Estimates for insurance and reinsurance market losses from recent hurricane Ida are rising with the inclusion of damages from the storms remnants that occurred further north, according to analysts at Goldman Sachs.

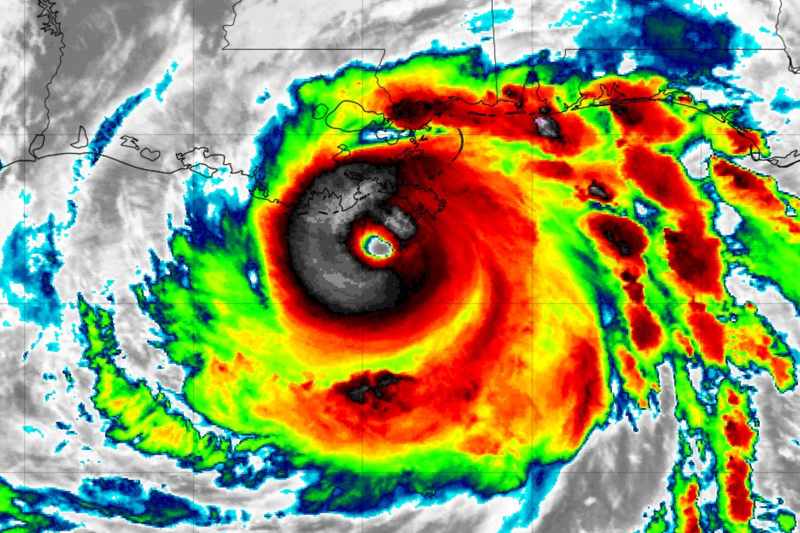

Right after hurricane Ida slammed into Louisiana as a major Category 4 storm with 150 mph winds, loss estimates ranged from $15 billion to as much as $25 billion.

Right after hurricane Ida slammed into Louisiana as a major Category 4 storm with 150 mph winds, loss estimates ranged from $15 billion to as much as $25 billion.

Later updates suggested something nearer to $18 billion to $20 billion, then above $20 billion as possible.

But now, Goldman Sachs equity analyst team say that industry modelled estimates are moving higher, towards the $30 billion to as much as $40 billion range.

It’s important to note here than the analysts do not divulge the sources of these higher modelled loss estimates for hurricane Ida and it’s possible these are not official and have been sourced from some of the companies under the teams coverage.

Updates: RMS later said that the Gulf region insured losses would be from $25bn to $35bn, while CoreLogic said insured losses from the flooding due to hurricane Ida’s remnants in the northeastern states of the US will range from $5 billion to as much as $8 billion.

These two new estimates clearly suggest the total insurance market losses, including losses to the NFIP, are likely to be in the $30bn to $40bn range, as Goldman’s analysts expect.

However, it does align with what we’ve been hearing in general, that expectations have risen and the market anticipates a higher insurance and reinsurance market loss than it had originally, pointing to the upper-end of earlier estimates.

After factoring in the damages further north from hurricane Ida’s remnants, thee analysts say that, “The latest catastrophe risk modeling pointing to an insured loss of $15bn to $40bn, with the top end surpassing the losses caused by Irma & Harvey (c.$33bn) in 2017.”

Adding that, “While the catastrophe estimates provide a wide range of potential losses, we see loss estimates higher than the initial $15bn and now more towards $30bn to $40bn range.”

There is a lot of uncertainty still, not least in where losses fall, in terms of wind versus water damages and how much of the ultimate bill will fall to the National Flood Insurance Program.

Other complications include the challenges in estimating damages so soon after a catastrophe event with a particularly broad hazard footprint, as well as how factors related to demand-surge could play into the ultimate recovery and claims costs.

Goldman Sachs analyst team explained, “We acknowledge the difficulty in estimating the total losses at an early stage as satellite images are unable to gauge the water damage caused to houses and the post storm damages like mold that will add to the claims amount as the water recedes.

“Furthermore, the COVID-related surge in prices of building materials (cement, lumber etc) will also add to the claims, although claims inflation is normal in the aftermath of a major hurricane and included in estimates.”

Because of the magnitude of losses the analysts expect the industry to face from hurricane Ida, they believe that reinsurance capital will take a significant share.

“We expect reinsurers to be more materially impacted by losses incurred from Hurricane Ida than primary insurers, as reinsurers tend to take on a greater market share of large loss events and US insurers tend to be heavy utilisers of reinsurance,” Goldman Sachs analysts wrote.

Our industry sources continue to work with the $15 billion to $25 billion range, but the majority have moved up that banding into the $20 billion and above region.

That’s based on the private insurance and reinsurance market loss, so not factoring in all of the NFIP impacts and losses.

It’s possible Goldman Sachs analyst team are including the NFIP’s losses in their estimation.

But accuracy of any estimates aside, what this does drive home is the fact that industry losses are set to be much higher than initially feared, while the complexity of the hurricane Ida claims process has likely increases for the industry as well.

AIR Worldwide’s estimate of late last week was for $17 billion to $25 billion of losses and that explicitly excluded any flood losses and the damage seen due to Ida’s remnants further north.

So, on that basis, it is definitely the case that we’re looking at something closer to $20 billion or higher. But how much higher is now the question the industry is grappling with, as it looks to identify where losses will fall and at what magnitude.

Also read:

– Hurricane Ida insured wind & storm surge losses seen at up to $25bn by AIR.

– Ida remnant flood damage to add double-digit billions to storm costs: Aon.

– NFIP cat bonds & reinsurance in focus as Ida’s remnants flood New York.

– FedNat expects reinsurance recoveries for hurricane Ida.

– Hurricane Ida insurance market loss could reach $21bn: CoreLogic.

– Hurricane Ida insured losses close to $18 billion: KCC.

– Hurricane Ida will add momentum to reinsurance pricing: AM Best.

– The catastrophe bonds marked down on hurricane Ida threat.

– Hurricane Ida loss puts some aggregate covers at-risk: Fitch.

– Hurricane Ida to hit quota shares & excess-of-loss reinsurance: Moody’s.

– Hurricane Ida losses to fall more to reinsurance, but renewals influence low.

– Hurricane Ida data suggests $15bn to $25bn industry loss: Twelve Capital.

– Hurricane Ida insured losses expected in the double-digit billions.

– Hurricane Ida cat bond fund impact minor on latest track: Plenum.

– Hurricane Ida hits Cat 4, landfall location key to ILS market impact.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.