AIR Worldwide has estimated that insurance and reinsurance industry losses to onshore property resulting from the wind and storm surge impacts of Hurricane Ida will be between $17 billion and $25 billion.

This estimate from AIR compares to CoreLogic’s industry loss range of $14 billion to $21 billion, and Karen Clark & Company’s re/insured loss estimate of close to $18 billion.

This estimate from AIR compares to CoreLogic’s industry loss range of $14 billion to $21 billion, and Karen Clark & Company’s re/insured loss estimate of close to $18 billion.

The catastrophe risk modeller’s insured loss estimate includes physical damage to property (residential, commercial, industrial and auto), both structures and their contents from winds, wind-borne debris, storm surge, and the impact of demand surge. But does not include hurricane precipitation-induced flood losses.

It also appears that AIR’s range doesn’t include any allowance for offshore energy and marine related losses in the Gulf of Mexico.

Furthermore, it’s become clear that storm Ida’s track has dumped intense rainfall on parts of the northeast of the country, with record flooding seen in parts of New York and New Jersey. So, it’s safe to assume these figures will trend upwards.

At the same time, the up to $25 billion estimate does reflect an adjustment to account for increased material and other repair costs in the current construction market, explains AIR.

AIR and Xactware, a sister company of Verisk, explain that materials costs have risen pretty significantly over the past 12 months from supply chain disruption in the construction market. The pair explain that while these costs have fallen since their peak in July when they came in 80% above September of last year, they still remain roughly 30% higher, while repair costs are up significantly.

“Reconstruction costs are more expensive today than they were a year ago. The increase in the total reconstruction cost index means that costs are higher on average nationally; this affects the low- as well as the high-severity events,” says AIR.

The cost of diesel fuel adds yet another source of uncertainty, says AIR. The cost of diesel has been impacted by the closing of refineries due to hurricane Ida, which would be used to transport materials.

“While some of these facilities were undamaged, the uncertainty around the timing of the restoration of the power grid and lack of electricity in the meantime is going to keep some of them from coming back online and contributing to the diesel fuel supply,” explains the firm.

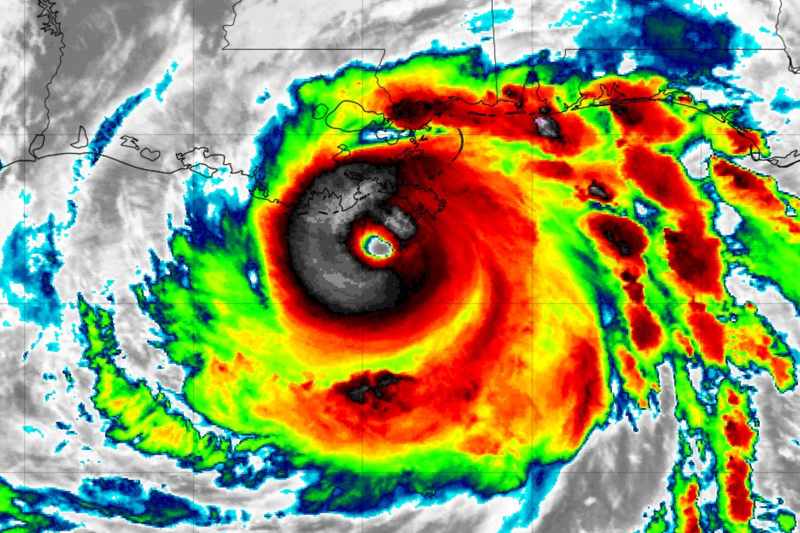

The risk modeller states that the storm surge produced by Ida was in line with expectations and “generally not as severe as Katrina’s”. Although, some parts of southeastern Louisiana, where Ida made two landfalls as a Category 4 hurricane, experienced severe storm surge owing to a lack of protection.

AIR also warns of the potential for hurricane Ida’s tail to extend as analysis by a sister company in the Verisk family, Wood Mackenzie, finds that Ida has had a substantial impact on Louisiana refinery operations and Gulf of Mexico production, which has led to “a historic U.S. crude supply chain issue.”

The company notes that utility disruptions driven by a lack of power, mobile data services, and water, could ultimately push out the tail of Ida when it comes to claims reporting.

Also read:

– Ida remnant flood damage to add double-digit billions to storm costs: Aon.

– NFIP cat bonds & reinsurance in focus as Ida’s remnants flood New York.

– FedNat expects reinsurance recoveries for hurricane Ida.

– Hurricane Ida insurance market loss could reach $21bn: CoreLogic.

– Hurricane Ida insured losses close to $18 billion: KCC.

– Hurricane Ida will add momentum to reinsurance pricing: AM Best.

– The catastrophe bonds marked down on hurricane Ida threat.

– Hurricane Ida loss puts some aggregate covers at-risk: Fitch.

– Hurricane Ida to hit quota shares & excess-of-loss reinsurance: Moody’s.

– Hurricane Ida losses to fall more to reinsurance, but renewals influence low.

– Hurricane Ida data suggests $15bn to $25bn industry loss: Twelve Capital.

– Hurricane Ida insured losses expected in the double-digit billions.

– Hurricane Ida cat bond fund impact minor on latest track: Plenum.

– Hurricane Ida hits Cat 4, landfall location key to ILS market impact.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.