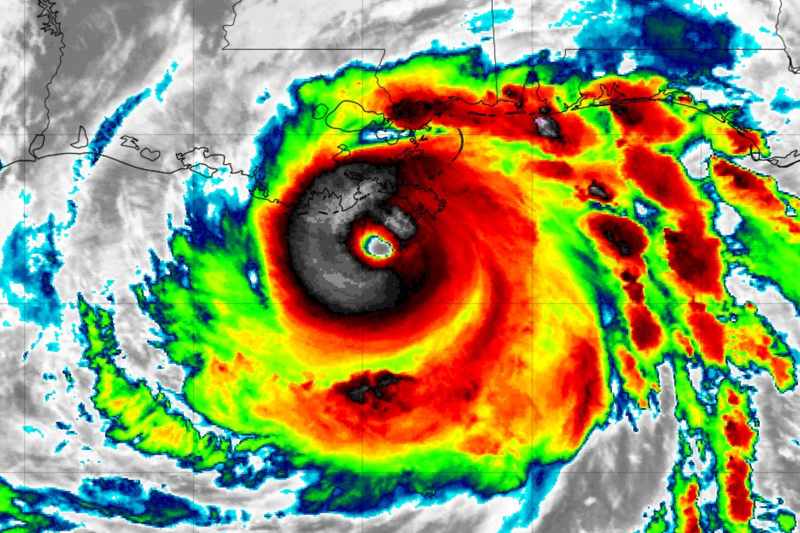

Hurricane Ida made landfall as a strong Category 4 storm with sustained winds of 150 mph yesterday in Louisiana, close to Port Fourchon. Market sources suggest an insurance and reinsurance industry loss into the double-digit billions of dollars is likely, with $15 billion to $20 billion (perhaps a little higher) seen as a reasonable area to expect loss estimates to converge, at this early stage.

We were covering hurricane Ida’s approach to Louisiana yesterday, read our thoughts on the possible impacts as hurricane Ida rapidly intensified and made landfall here.

We were covering hurricane Ida’s approach to Louisiana yesterday, read our thoughts on the possible impacts as hurricane Ida rapidly intensified and made landfall here.

Also from yesterday, read our article on possible catastrophe bond market impacts, as Plenum Investments said it anticipated a minor hit to its cat bond funds based on hurricane Ida’s forecast path.

As hurricane Ida approached, the industry’s expectations of loss rose with the wind speeds, as the storm rapidly intensified, with its wind speeds rising more than 65 mph in just 24 hours.

Ida crashed ashore close to the energy hub of Port Fourchon, then tracked north west with strong winds impacting New Orleans on the eastern side.

Damage reports suggest extensive impacts along the coast and through towns close to hurricane Ida’s center and strongest winds.

Hurricane Ida may have exacerbated the situation by slowing considerably after making landfall. After rapidly intensifying, it now seems Ida has been particularly slow to weaken, which will have resulted in an expanded hazard footprint for the models to deal with, potentially increasing the loss potential of the storm.

In fact the hurricane maintained its Category 4 strength for some hours after its initial landfall, as the topography and swamps of southern Louisiana continued to fuel the storm.

Hurricane Ida’s strongest winds passed a little to the west of New Orleans it now seems, saving the city from the worst possible wind damage impacts.

But still, New Orleans has experienced extensive damage to properties, early reports suggest, while close to a million homes across Louisiana are now without power.

Overall, the recovery from hurricane Ida is set to be challenging and so too is the insurance and reinsurance industry’s claims process, as the widespread area impacted, power outages and now continuing torrential rains are all going to complicate the matter.

New Orleans has lost power completely after a major transmission line was damaged by hurricane Ida and it’s thoughts some areas could be without power for days or even weeks, raising the prospects of mold related issues and other concerns for property insurance claims.

Ida is still a hurricane at this time as it passes north, so damage and impacts continue to affect Louisiana.

Now, the main threat seems to be some wind damage to structures and then water damage from torrential rains and also river flooding.

Given hurricane Ida’s slow passage inland, the rainfall threat has proved worse than originally thought.

In addition, there are reports of levee failures in some areas of the state, which may bring additional flooding to certain Parishes.

Hurricane Ida is set to be a very challenging storm to estimate an industry loss for. The expanse of land affected by strong Category 4 winds has been significant, while impacts continue and water-related losses are likely for hours to come.

Throw in the power-outages and threat of prolonged loss of power to New Orleans and it’s clear insurers and their adjusters will have a very challenging time ahead.

Not to mention the added challenge of an ongoing pandemic as well. PCS highlighted that Louisiana is one of the states with a particularly high PCS Covicane score.

So the insurance and reinsurance market should anticipate a challenging claims environment, potentially a prolonged claims process and the situation is also set up for challenges to emerge further down the line with loss amplification, claims inflation and loss creep.

All of which will make it challenging for insurance-linked securities (ILS) fund managers to estimate the impacts to their portfolios as well, as some positions may be in a state of some uncertainty (are they loss affected or not?) for some weeks to come.

Our sources late on Sunday were all pointing to a consensus expectation of an insurance, reinsurance and ILS market loss above US $10 billion.

Some on late Sunday evening were suggesting the industry loss from hurricane Ida will be above $15 billion or even $20 billion, with top-end estimates seemingly coming out around the $25 billion mark, or a little over.

These are modelled estimates, of course and reflect the uncertainty related to this hurricane, which despite its major status is not going to be a clear-cut case for loss estimation purposes.

As a result, expecting an industry loss of above $10 billion appears assured, but above $20 billion is less certain at this still early stage, with the hurricane still churning over land.

So soon after a major landfall it is always extremely challenging to accurately estimate an industry loss. Even the early modelled loss numbers from catastrophe risk modelling specialists, which may begin to emerge later today, will need to be taken with a pinch of salt.

Recent years have shown how loss amplification can elevate an insurance and reinsurance industry loss total, so it’s far too early to have anything accurate to share.

But double-digit billions seems the right level to begin with, suggesting definite impacts for the reinsurance and ILS fund market.

As we explained yesterday, the precise track of hurricane Ida is key in defining the possible impacts, with how close significant winds came to New Orleans the most important factor.

Hurricane Ida’s track did shift slightly east through Sunday, bringing the stronger winds closer to the metropolitan area.

Andrew Siffert, Senior Meteorologist at insurance and reinsurance broker BMS Group provided a bit of clarity in his latest update.

Siffert wrote, “Given the slight eastward track shift closer to New Orleans and the overall stronger intensity of Ida at landfall, which could be a Category 5 and most certainly the strongest of Category 4 hurricanes, the insured losses will now likely exceed $10 billion, if not more, as the damage will grow exponentially depending on the wind speeds experienced in New Orleans.”

“In some regards, this might be like the wind swath of Hurricane Charley in 2004, which had a very narrow damage swath. Like the wind swath, the highest of the storm surge will be narrow due to the lower integrated kinetic energy of Ida. However, a lot of reliance efforts such as levees and pumps are critical to keeping a large amount of exposure free from water damage. This will need to be watched carefully as Ida makes landfall,” Siffert added.

However, the levees have largely held and New Orleans seemed to avoid the very worst of the winds, so perhaps the top-end estimates of more than $20 billion plus are too aggressive. Time will tell.

We’ll continue to update you as new data points are shared by the industry and as any more information comes to light.

Also read:

– Hurricane Ida data suggests $15bn to $25bn industry loss: Twelve Capital.

– Hurricane Ida cat bond fund impact minor on latest track: Plenum.

– Hurricane Ida hits Cat 4, landfall location key to ILS market impact.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.