Hurricane Ida loss creep wipes out another Louisiana Citizens cat bond

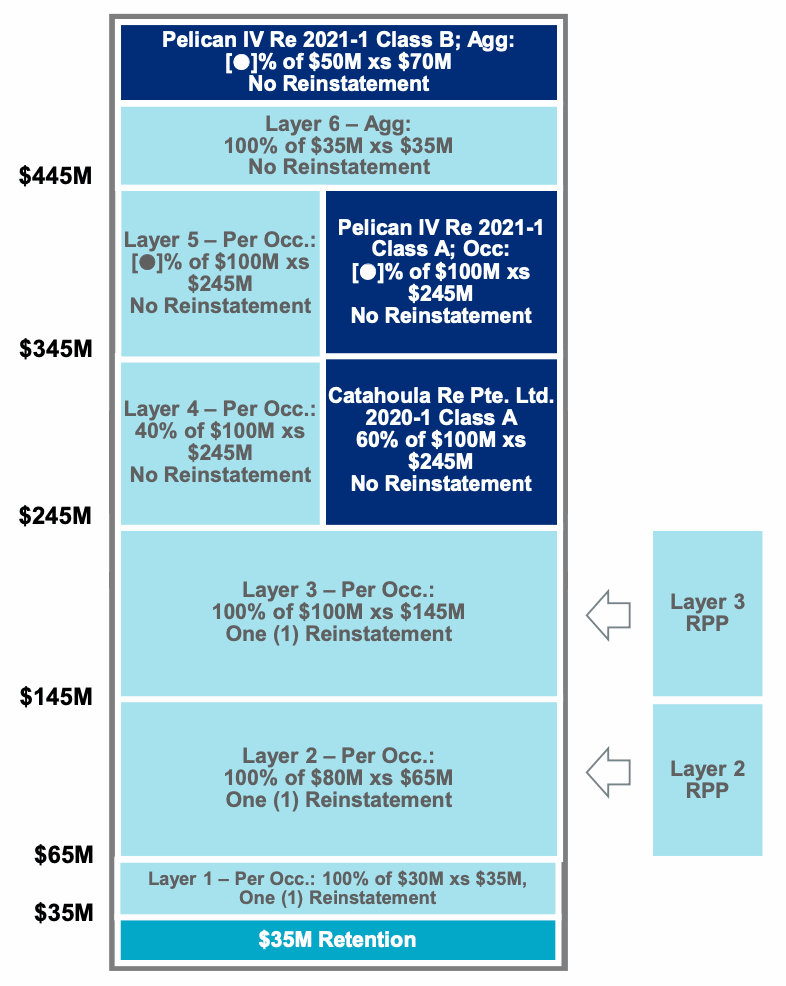

22nd August 2022Additional loss creep from 2021’s hurricane Ida has now eroded another layer of Louisiana Citizens’ catastrophe bond backed reinsurance protection, with the $50 million Class B notes of the residual market insurers’ Pelican IV Re Ltd. (Series 2021-1) cat bond set to pay out all of their principal in a reinsurance recovery.

Read the full article