Two outstanding per-occurrence catastrophe bond tranches sponsored by Louisiana Citizens Property Insurance Corporation have been marked down much further on some broker pricing sheets in the last week, with secondary market bid pricing now implying a market expectation of a significant loss of principal.

Secondary cat bond broker pricing sheets show that both the $60 million, single tranche and per-occurrence coverage Catahoula Re Pte. Ltd. (Series 2020-1) catastrophe bond and the $75 million per-occurrence tranche of the dual-tranche $125 million Pelican IV Re Ltd. (Series 2021-1) cat bond have been marked down much further in the past week.

These two tranches were already marked down based on their exposure to hurricane Ida, marked at around the 70 to 80 cents on the dollar point a week ago, implying 20% to 30% of principal losses were possible .

But in the latest cat bond pricing sheets we’ve seen, the pricing has fallen much further, with these two tranches marked down to between 10 and 20 cents on the dollar, implying the market expects an 80% or greater loss of principal for each of the tranches.

It seems likely some information has been reported by Louisiana Citizens in the last week, to aid investors in marking their cat bonds for possible losses.

Industry loss estimates have continued to rise, now aggregating around the $25 billion to $35 billion mark.

As we explained a fortnight ago, information we’ve seen suggests that Louisiana Citizens will benefit from significant reinsurance recoveries, with the size of its loss estimated as likely to be above $300 million and perhaps as high as $400 million.

As we explained a fortnight ago, information we’ve seen suggests that Louisiana Citizens will benefit from significant reinsurance recoveries, with the size of its loss estimated as likely to be above $300 million and perhaps as high as $400 million.

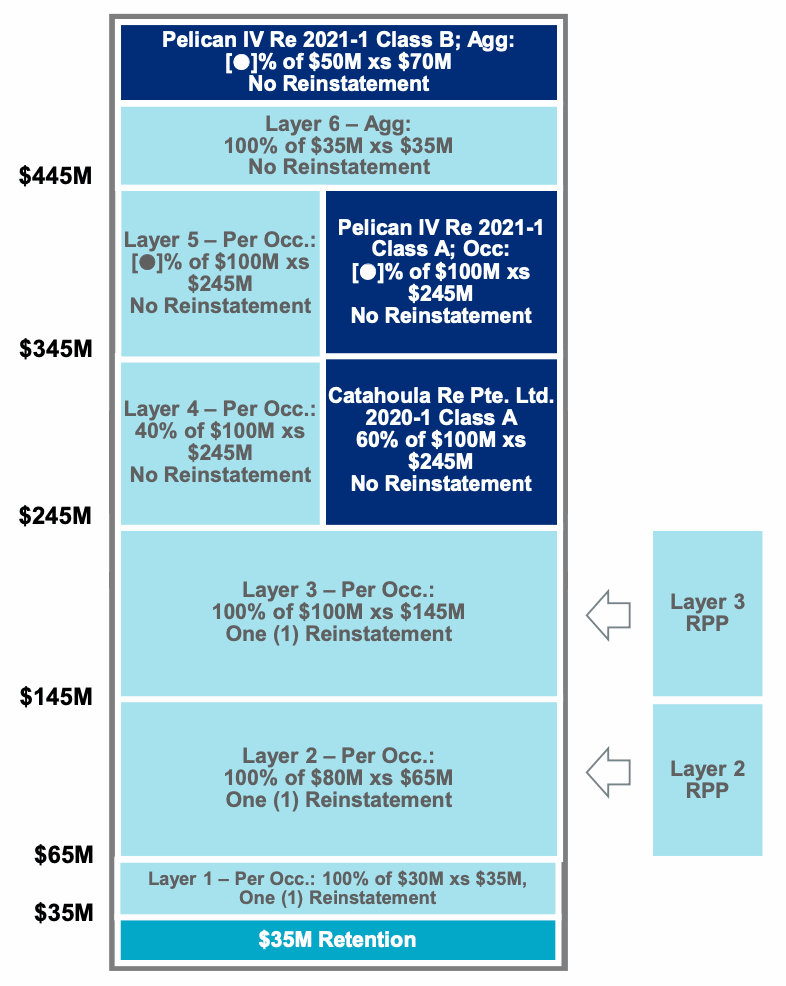

A loss of that magnitude would eat well into Louisiana Citizens multi-layered reinsurance tower, with these two per-occurrence catastrophe bond tranches likely to face losses as a result.

As you can see on the right, the Catahoula Re cat bond sits lowest down in the Louisiana Citizens reinsurance tower and if the residual market insurers’ ground-up loss from hurricane Ida stretches to $345 million then investors in this cat bond will face a total loss.

Sitting above that is the Pelican IV Re 2021-1 Class A occurrence tranche, which would attach once the Catahoula Re cat bond’s reinsurance coverage is exhausted.

Given these tranches are both now marked down significantly, it implies the market expects losses from both, which would mean the market anticipates the Catahoula Re bond being a total loss, even though it is still priced at around 10 cents on the dollar.

Louisiana Citizens other outstanding cat bond tranche, the $50 million aggregate layer from the Pelican IV Re 2021-1 issuance, is also marked down, but only slightly to reflect a significant single event as having occurred.

At this stage it seems unlikely later hurricane Nicholas, that also impacted Louisiana, will erode this bond too much further.

Other exposed catastrophe bond have not seen their secondary pricing move significantly in the last week, with Louisiana Citizens bonds the only ones to experience steep declines on some broker sheets.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.