A number of catastrophe bonds have been marked down in end of month secondary market pricing sheets, with some of the anticipated names suffering declines of between 25% and 35% in value.

After hurricane Ida’s devastating landfall with 150 mph winds in Louisiana on Sunday it was always anticipated that there would be a mark-to-market reaction in catastrophe bonds.

After hurricane Ida’s devastating landfall with 150 mph winds in Louisiana on Sunday it was always anticipated that there would be a mark-to-market reaction in catastrophe bonds.

The majority of insurance-linked securities (ILS) fund managers seem relatively comfortable that cat bond losses will be largely mark-to-market from the hurricane, as long as the industry loss remains in the current estimated range of around $15 billion to as high as $25 billion.

But there are some catastrophe bonds that are considered particularly exposed, where there is the potential for actual losses, should the insurance and reinsurance market’s bill from hurricane Ida rise higher than expected.

At this stage though, these are all mark-to-market reductions in value of catastrophe bond positions, with no actual losses seen at this time.

Unsurprisingly, when the cat bond broker pricing sheets were sent out last night to mark positions for the end of August, the largest price changes were seen in catastrophe bonds sponsored by Louisiana Citizens Property Insurance Corporation.

The residual market coastal insurer for the state of Louisiana is likely to take a significant loss from hurricane Ida, with its reinsurance program likely to absorb at least some of that.

Louisiana Citizens Property Insurance Corporation has been sourcing reinsurance from the capital markets using catastrophe bonds since 2021 and right now has two transactions and three tranches of cat bond notes at-risk, all of which cover it against Louisiana hurricane losses of a certain magnitude.

Louisiana Citizens $60 million Catahoula Re Pte. Ltd. (Series 2020-1) catastrophe bond provides reinsurance cover against named storms and severe thunderstorms, as too does the $125 million and more recently issued Pelican IV Re Ltd. (Series 2021-1).

Louisiana Citizens $60 million Catahoula Re Pte. Ltd. (Series 2020-1) catastrophe bond provides reinsurance cover against named storms and severe thunderstorms, as too does the $125 million and more recently issued Pelican IV Re Ltd. (Series 2021-1).

The Pelican IV 2021-1 cat bond features two tranches, a $75 million Class A per-occurrence tranche of notes and a $50 milion Class B annual aggregate tranche.

All three outstanding tranches of notes from the Catahoula Re and Pelican IV Re cat bonds have been marked down, with reductions ranging from 25% to as much as 35%, or a little more, depending on the broker pricing sheet you look at.

All of these tranches inure to stated reinsurance protection that Louisiana Citizens has in-force, meaning traditional reinsurance covers have to be eroded before these cat bonds would attach.

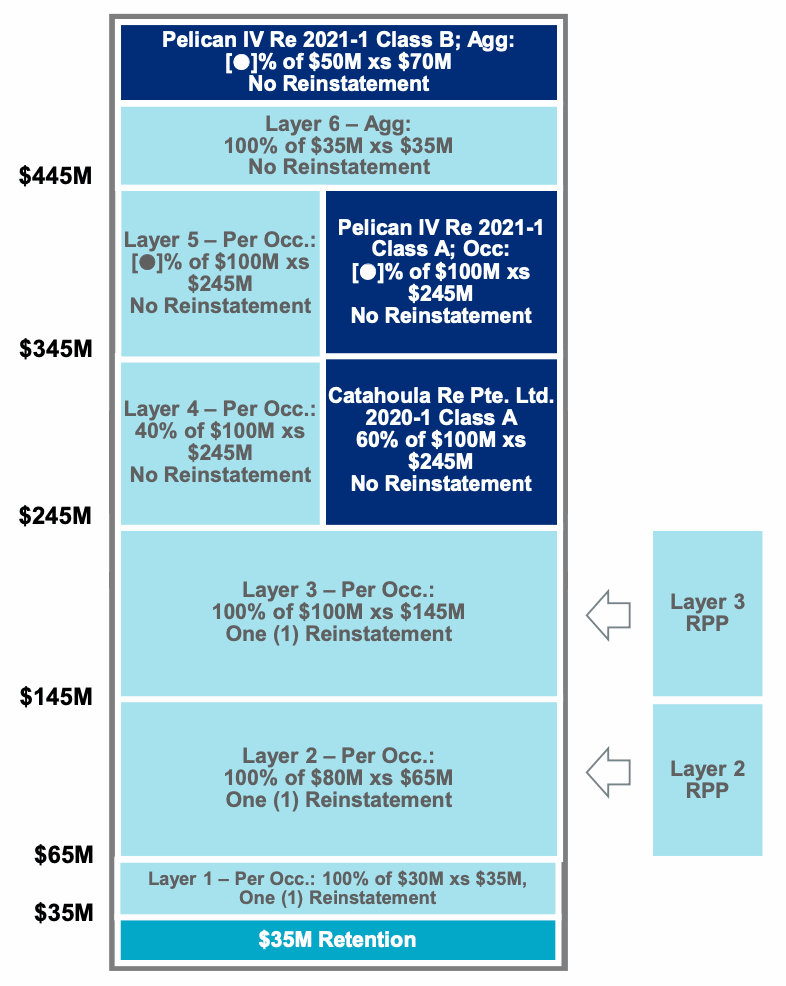

A source shared the image seen above and to the right with us, which shows how the Louisiana Citizens reinsurance tower was expected to look after the issuance of the most recent Pelican cat bond was completed.

We can’t confirm this is precisely how it looked when hurricane Ida struck, but it was likely similar and shows that there is roughly $35 million of retention and $210 million of traditional reinsurance to be eroded before the catastrophe bonds are impacted by losses.

For comparison, Louisiana Citizens loss from 2020’s hurricane Laura, a roughly $12-$15 billion industry loss, resulted in an estimated $65 million of claims (as of Jan 2021).

So even if hurricane Ida’s insurance and reinsurance market loss settles towards the upper-end of estimates, above $20 billion, it’s possible Louisiana Citizens still won’t need to call on its cat bond coverage.

Which suggests that, for now, these markdowns of the Louisiana Citizens cat bonds are purely mark-to-market and some recovery is likely if hurricane Ida’s loss settles towards the middle of estimates.

The one outlier here is the aggregate tranche of the Pelican Re IV deal, as that remains exposed to any other named storms this season, as well as severe thunderstorms and could have taken some deductible erosion from other events already this risk period.

Another catastrophe bond sponsor that is in-focus for hurricane Ida is Safepoint Insurance Company, who’s $40 million Manatee Re III Pte. Ltd. (Series 2019-1) catastrophe bond has also been marked down quite heavily.

The Manatee Re III cat bond is split into two $20 million tranches of notes, both of which provide Safepoint with per-occurrence reinsurance protection and cover hurricane risks in Louisiana.

The two tranches have been marked down between 15% and 20% each, depending on the broker pricing sheets you look at.

Again, these for now seem like mark-to-market price reductions, which have a good chance of being recovered unless losses from hurricane Ida escalated significantly to the top-end of industry estimates or higher. But of course it is hard to tell, not knowing the state of inuring reinsurance layers and whether any are already eroded.

As hurricane Ida rushed towards landfall it became clear the storm was carrying a lot of tropical moisture and that rainfall levels would be extremely high. Ida then slowed on landfall and stalled for quite some time across Louisiana and then continued to soak US states as it moved northeast. This continues to be the case, with torrential rains reported along Ida’s track.

As a result, the catastrophe bond market has marked down all of the outstanding FloodSmart Re catastrophe bond tranches, that provide FEMA’s National Flood Insurance Program (NFIP) with reinsurance protection.

There are $1.275 billion of FloodSmart Re catastrophe bonds still in-force, across the $300 million FloodSmart Re Ltd. (Series 2019-1), the $400 million FloodSmart Re Ltd. (Series 2020-1) and most recent and largest $575 million FloodSmart Re Ltd. (Series 2021-1) cat bond issues.

We’ve seen these marked down by anything from a few percent to 12%, with 8% to 10% seemingly the main range of price reductions seen.

Again, these are mark-to-market price reductions, designed to factor in an elevated level of risk to these bonds, as the fallout from hurricane Ida is calculated.

At this time it seems unlikely any of the FloodSmart Re catastrophe bonds could be triggered by hurricane Ida losses, as none were triggered by 2017’s hurricane Harvey, which was the NFIP’s biggest ever loss event. Right now it doesn’t seem that Ida will be as severe as that for flood insurance losses, although still clearly a major event and perhaps one that could cause losses on the NFIP’s traditional reinsurance program.

These are the main catastrophe bonds seen as having exposure to hurricane Ida, albeit largely just on a mark-to-market basis at this time.

We expect much of the price declines will be recovered across these cat bonds, unless the industry loss from hurricane Ida worsens considerably and ends up higher than most in the industry currently anticipate.

There are some other cat bonds that have been marked down, all seemingly also related to hurricane Ida, with these additional markdowns largely in the Residential Re cat bonds sponsored by USAA and some aggregate retrocession deals.

For USAA, the particularly risky Class 1 notes from its Residential Reinsurance 2020 Limited (Series 2020-2) have been marked down between 5% and 10% it seems, while another riskier per-occurrence tranche from its Residential Reinsurance 2017 Limited (Series 2017-2) cat bond have been marked down by low single-digits.

Other than that the changes in cat bond prices seem mostly small, in low single-digit percentages, and applied largely to multi-peril aggregate reinsurance and retro deals, likely influenced by hurricane Ida as well.

At this still very early stage after hurricane Ida’s landfall it is very challenging to predict whether any of these price declines to exposed catastrophe bonds could stick, or worsen.

Right now, based on where industry loss estimates sit, these all seem mark-to-market in nature and largely recoverable as the loss situation clears up.

However, it’s very hard to know how big a loss Louisiana Citizens could face, given its concentration of exposures on the coast where Ida hit particularly hard. It’s also hard to know at this stage how an insurer like Safepoint may have been affected, or how big a loss the NFIP may face.

So these cat bond positions could remain marked down for some weeks before recoveries are made, while any escalation in losses from Ida as claims flow in could result in additional markdowns as well.

Cat bond fund managers will reflect these markdowns in their NAV’s for August, but some recovery is then possible when September NAV’s are reported.

Also read:

– Hurricane Ida loss puts some aggregate covers at-risk: Fitch.

– Hurricane Ida to hit quota shares & excess-of-loss reinsurance: Moody’s.

– Hurricane Ida losses to fall more to reinsurance, but renewals influence low.

– Hurricane Ida data suggests $15bn to $25bn industry loss: Twelve Capital.

– Hurricane Ida insured losses expected in the double-digit billions.

– Hurricane Ida cat bond fund impact minor on latest track: Plenum.

– Hurricane Ida hits Cat 4, landfall location key to ILS market impact.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.