We need to use the power of the capital market for innovation: Henchoz at PwC event

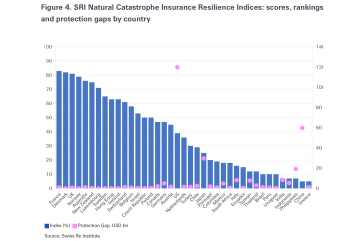

8th September 2025Jean-Jacques Henchoz, Chairman of the Board of BMS Group and former CEO of Hannover Re, gave an impassioned plea for the reinsurance industry today to make inroads into narrowing protection gaps, seeing innovation, technology and a culture of experimentation as key, while the capital markets are a vital tool to achieve this.

Read the full article