The resurging incidence of cases of COVID-19 across areas of the United States could add pressure to catastrophe insurance and reinsurance market claim processes and amounts, so PCS has undertaken some research on hurricane events to show where the threat is greatest.

As our sister publication Reinsurance News explained recently, PCS had warned that a pandemic resurgence could have significant implications for catastrophe claims in the most vulnerable areas of the US.

As our sister publication Reinsurance News explained recently, PCS had warned that a pandemic resurgence could have significant implications for catastrophe claims in the most vulnerable areas of the US.

Now, PCS, a Verisk business, has undertaken research to analyse how rising pandemic threats could affect the states most exposed to catastrophe risks, particularly hurricanes.

With hurricane season upon us, the increasing threat of COVID-19 pandemic related disruption at the same time, suggests claims processes may be challenged and claims themselves could be elevated, or inflated, as a result.

Of course, the same thinking applies to all major catastrophe events. If they occur in an area where the pandemic is creating increasing pressures, then there is an elevated risk that claims could be inflated as a result.

PCS’ research suggests that, “Tropical storm and COVID-19 risks clearly are converging in several key states.”

Summarising the issue by saying that, “Historical storm activity and vaccination rates suggest that tropical storm-prone states could fall victim to a major weather event that could also increase COVID-19 transmission, as a result of a catastrophe bringing large numbers of unvaccinated people into close proximity.”

PCS developed a tool for analysing the risk of tropical storm and COVID-19 clash risk, using historical storm activity and recent COVID-19 incidence rates, to demonstrate that the situation may be riskier than it looks, with ramifications for insurance and reinsurance markets.

“A major hurricane affecting states with elevated COVID-19 risks could exacerbate both the industrywide insured loss associated with such a catastrophe and the further transmission of the virus, resulting in a situation where each threat feeds off the other,” PCS believes.

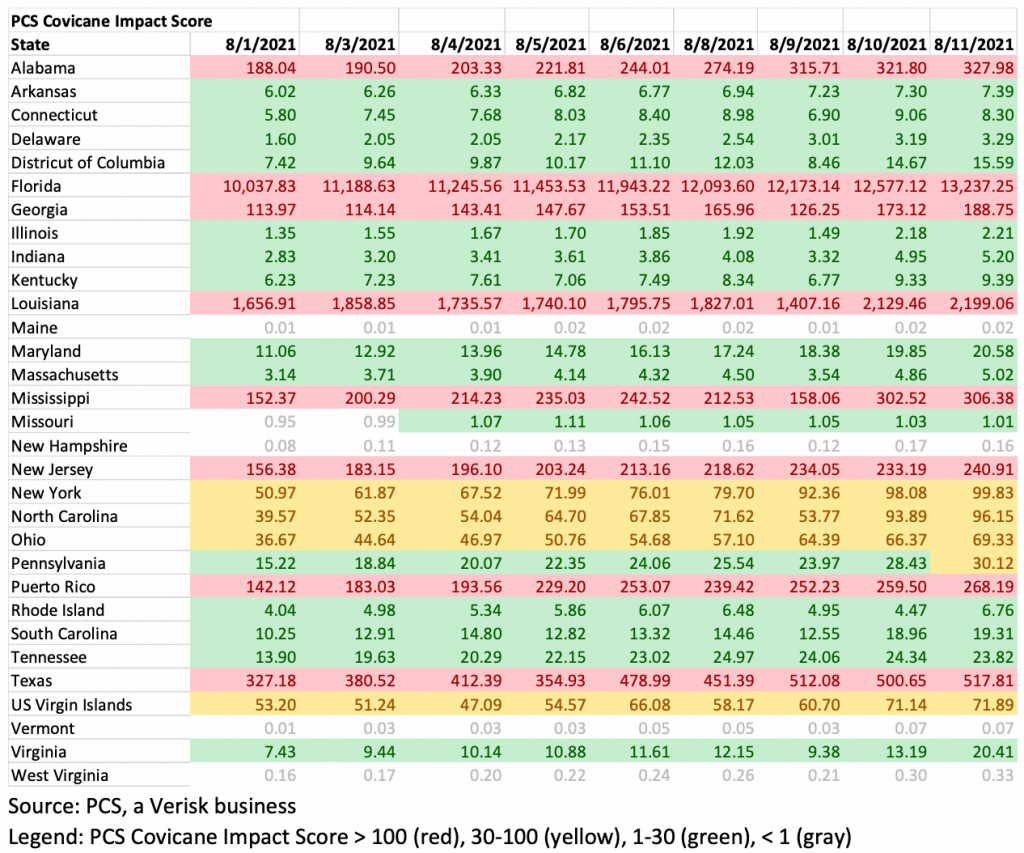

PCS’ Covicane Score uses data on large event frequency and aggregate claims, the rate of full vaccination, population density, as well as new COVID-19 cases reported in the last seven days, to provide a composite view of state vulnerability to this clash risk.

“States that have a history of getting hit hard by big hurricanes where vaccination rates are low and new cases are high, essentially, are at disproportionate risk of increased transmission and post-event reconstruction time and expense,” PCS explained.

A PCS Covicane Score starts at zero and can increase to a level ultimately constrained by population size and density, to reflect the chances of clash risk emerging should a challenging catastrophe event occur that results in population placement and so have the potential to elevate pandemic risks right in the middle of catastrophe response and recovery, with obvious ramifications.

One of the main threats is that the claims lifecycle becomes elongated and claims filing and closure are delayed, with implications for the rate of inflation.

The reinsurance and insurance-linked securities (ILS) market are all too familiar with hurricane claims inflation and loss creep. PCS believes that the pandemic could become a factor here, if a major catastrophe struck an area with high growth rates of COVID-19.

Alongside the chances of claims inflation, there is also the availability of talent, particularly adjusters, talent in terms of contractors and repair professionals, and labour for claims identification, verification, quantification and recovery or repair.

These inflationary factors, related to the availability of people, have been seen in the past with major hurricanes such as the 2017 seasons Harvey, Irma and Maria.

Add in rising COVID cases in an area where vaccination rates are low and it’s easy to see how this problem could be exacerbated.

On top of this, supply chains are another factor, as the pandemic incidence and vaccination rate would have a bearing on the ability of supply chains to keep moving after a major catastrophe event, which could result in shortages and prolonged repair processes, also with ramifications for claims amounts as well.

There are factors here that could drive higher insured losses, as supplemental amounts are added, as well as lengthening the claims process.

“An elongated claim lifecycle increases the potential for higher insured losses,” PCS warns, adding that “Preparation now can increase claimant satisfaction after a major event while also protecting insurer capital.”

Unsurprisingly, south-east and southern US states where COVID-19 rates have always been highest over the last few months and where vaccination rates are low to middling, are the states that see the highest PCS Covicane Score, given their exposure to tropical storms is also higher.

Florida fares worst, with a particularly high PCS Covicane Score, followed by Louisiana, Texas, Alabama, Mississippi, Georgia and Puerto Rico. But New Jersey is next, showing that there is a clash risk even with storm events further north, a Sandy repeat for example.

As a result, these are the states deemed to have the highest risk of a COVID-19 – hurricane related clash risk, should a major event occur. You can see the full scoring below, by week of COVID-19 rate data.

.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.