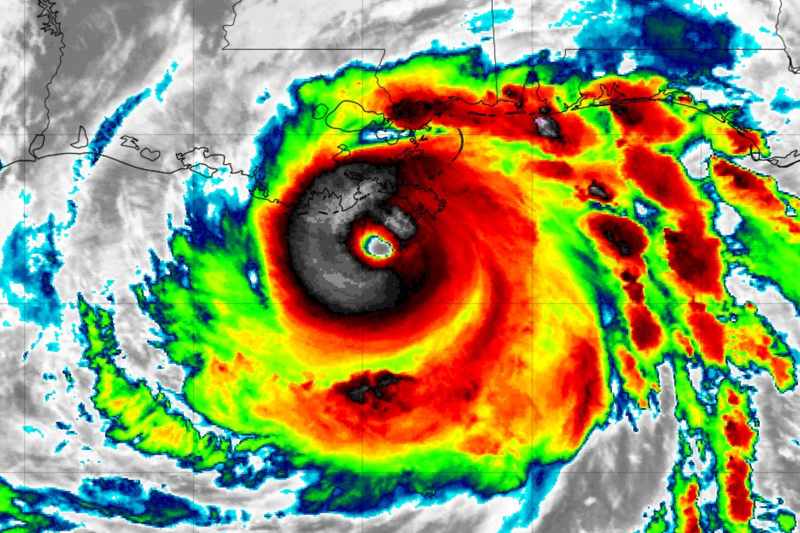

FloodSmart Re cat bond trades down on hurricane Ian storm surge fears

27th September 2022So far, major hurricane Ian’s approach to the west coast of Florida and the Tampa Bay region has not stimulated a significant amount of catastrophe bond trading, with the secondary market relatively quiet. Except for one telling trade that shows investor nerves over potential storm surge impacts are rising.

Read the full article