Rates in the U.S. commercial P&C sector declined by an average of 1% in September, the fourth month in a row that a -1% rate movement has been recorded, suggesting the market is at a “standoff,” according to Richard Kerr, Chief Executive Officer (CEO) of MarketScout.

“The market is locked into an average rate reduction of minus 1 percent. It seems to be a standoff. Insurers are determined to force rate increases while insureds are pitting agents and brokers against each other so they will squeeze their assigned insurers for the best pricing.

“This forced competition helps buyers get the best deal the market has to offer,” said Kerr.

MarketScout’s commercial P&C insurance barometer shows that an overall 1% decline in September has maintained the trend that began in June 2016, emphasising that while insurers are tired of cutting rates clients are pushing for the best possible price.

Analysts at Keefe, Bruyette & Woods (KBW) have also commented on rate movements in the sector during September 2016, noting that the 1% decline is in line with recent months’ decreases, at represents a flat year-on-year change in commercial rate trends.

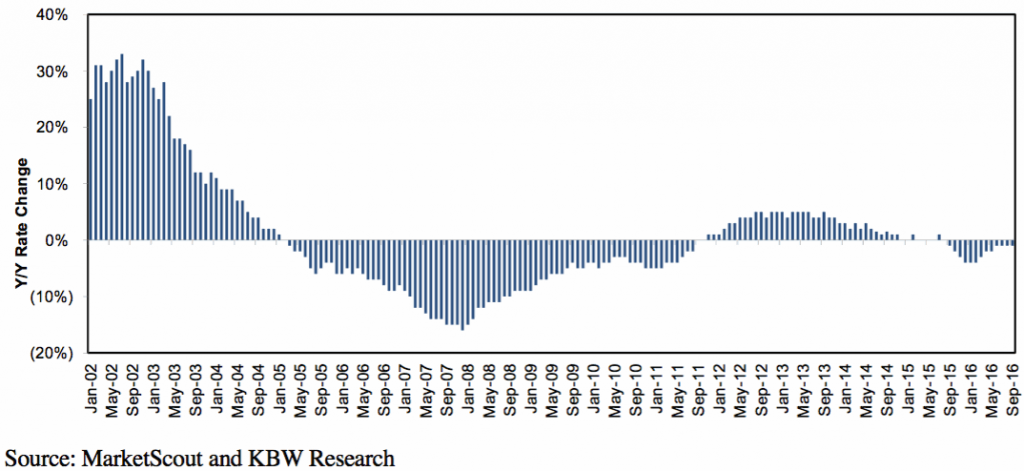

The chart below, provided by KBW, shows that rate movements turned negative in September 2015, and have slowed since February 2016 but still remain negative.

Commercial Insurance Rate Barometer – 1/2002 to 9/2016

The insurance and reinsurance sector remains challenging and the softening landscape continues to limit profitability. At the same time, the persistent flow of alternative reinsurance capital in the global reinsurance industry is adding pressure to business lines, particularly property rates.

But insurers appear to be showing discipline, maintaining the slowdown in rate declines that began in June as they look to resist any further rate deterioration.

MarketScout’s barometer also provides a breakdown of rate movements in the U.S. commercial P&C space by account size, which reveals that small (up to $25,000), medium ($25,001 – $250,000), and jumbo (over $1 million) sized accounts showed no change from the previous month. Declining by an average of 1%, 1%, and 2%, respectively.

However, large ($250,001 – $1 million) sized accounts did report a change in the month, declining by an average of 1%, compared with a 2% decline in August.

By coverage class, MarketScout reveals that during September rate movements for commercial property, business interruption, BOP, general liability, D&O liability, fiduciary, and surety lines all remained flat.

While inland marine, umbrella/excess and workers’ compensation declined by an average of 1% in the month. Professional liability, EPLI and crime increased by 1% during September, and commercial auto actually increased by 3% during the period, the most significant rate increase of any coverage class.

With commercial P&C rates continue to decline month after month, MarketScout analysis reveals that personal lines’ rates actually increased by an average of 2% in September. All homeowners’ rates were up by an average of 2% during the month, explains MarketScout, while automobile rate also increased by 2%, and personal article rates remained flat.

“Personal lines insurers are nervously watching Hurricane Matthew as of the publish date of this barometer.

“The current track of the storm could impact almost all personal lines insurers from Florida to North Carolina. Rate adjustments in these coastal states are very likely if Hurricane Matthew follows the projected path,” said Kerr.

As it turns out though, the impact of hurricane Matthew is not expected to be so costly to insurance or reinsurance capital that it will be sufficient to cause any further move in rates.

Also read:

– Another month of 1% average commercial P&C rate declines in August.

– Commercial P&C rates down 3.9% in Q2, buyers market remains: CIAB.

– Insurers push for end to commercial P&C rate decline, 1% down in July.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.