The biggest challenge to the market over the last 12 months has been the impact of loss creep from prior year events, while the threat of climate change is increasingly on the minds of industry participants, according to the results of our second global reinsurance market survey.

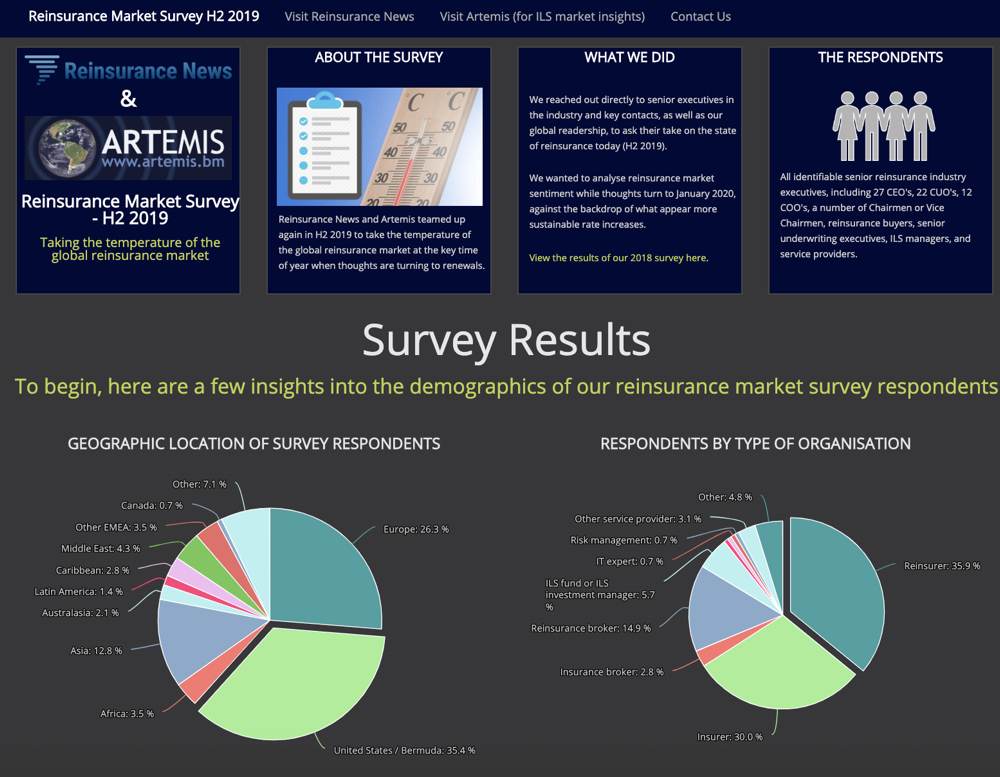

For the second year running, Artemis and sister-site, Reinsurance News collaborated to test the temperature of the global reinsurance market as it approaches the key January 2020 renewals.

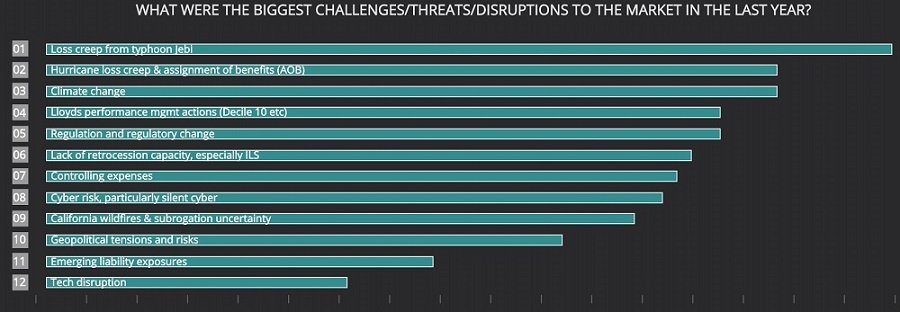

Published here, the results of our second reinsurance market survey reveals that respondents feel that the biggest challenge or threat to the marketplace over the last year has been loss creep from typhoon Jebi. This was followed by loss creep from hurricanes and AOB, which tied in second place with the threat of climate change.

Of the hundreds of identifiable responses to our survey, of which 72% of respondents either make or provide input to reinsurance buying decisions, loss creep was clearly seen as a significant disruptor.

Typhoon Jebi hit Japan in September, 2018 causing significant damages and devastation leading to economic losses of $20 billion, of which around $15 billion is expected to be covered re/insurance.

Initially, the re/insurance industry impact from Jebi was expected to be far lower than what it is today, but the complexity of the event and numerous factors resulted in significant loss creep that has continued through 2019, leading insurers, reinsurers, and insurance-linked securities (ILS) funds to increase reserves and up their loss estimates for the event.

For ILS funds, this has resulted in consistent monthly drags on returns, highlighted by the return metrics of ILS funds in July which while positive and more stable, averaging 0.42%, came in below average as a result of continued drag from loss creep.

While loss creep from Jebi topped the list of challenges and threats for survey respondents, hurricane loss creep and AOB issues were also noted as a significant challenge.

2018’s hurricane Michael was another event that resulted in significant loss creep for firms and came after the creep experienced from hurricane Irma in the prior year. In mid-October, it was reported that creep from Michael had increased to $7.2 billion, while 17,347 claims remained open, suggesting that further creep is on its way.

AOB abuse in Florida caused a real issue for the market and was expected to contribute to an increase in loss creep from hurricanes that hit the region. Reforms have been introduced that are designed to tackle the issue but this will take time to filter through and as such, AOB was a top challenge for industry participants.

Tied as the second most pressing challenge for the space over the last year with hurricane creep and AOB was climate change, which came in above Lloyd’s performance actions, regulation and regulatory change, a lack of retro, expenses, and cyber risk.

The influence of the changing climate on both the frequency and severity of extreme weather events is a hot topic of discussion across the risk transfer space.

In recent years, some of the strongest typhoons and hurricanes have formed over our oceans, while record levels of rainfall, extreme drought and truly staggering wildfire events have also occurred, all of which points to a new normal of more extreme and more frequent natural catastrophes.

Clearly, respondents to our global reinsurance market survey feel that climate change was a very significant challenge over the last year.

It’s worth noting the fourth most challenging issue for industry participants over the last year, which was the ongoing efforts at Lloyd’s to modernise and the market’s performance management actions.

Interestingly, more than 61% of survey respondents said that the Future at Lloyd’s Blueprint initiatives will not be enough to turn the market’s fortunes.

Towards the bottom of the list was the threat from California wildfires and subrogation uncertainty, followed by geopolitical tensions, emerging liability exposure, and tech disruption.

Following recent events, the industry is very aware of the negative impacts of loss creep and will likely be keeping a close eye on loss estimations and claims activity from the recent typhoon Hagibis.

The full results of our second global reinsurance market survey provide a useful test of the temperature of the industry, offering insight on market sentiment and expectations as we move towards the January 2020 reinsurance renewal season.

We hope our readers and other interested parties find the results enlightening and useful in making their strategic decisions for the renewal season ahead.

The full results of our latest survey are freely available from today and we’re happy to discuss them with any industry participants. We’re interested to hear your thoughts.

We’ll also be analysing the full reinsurance market survey results over the coming weeks on both Reinsurance News and Artemis.

Analyse the results of our global reinsurance market survey here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.