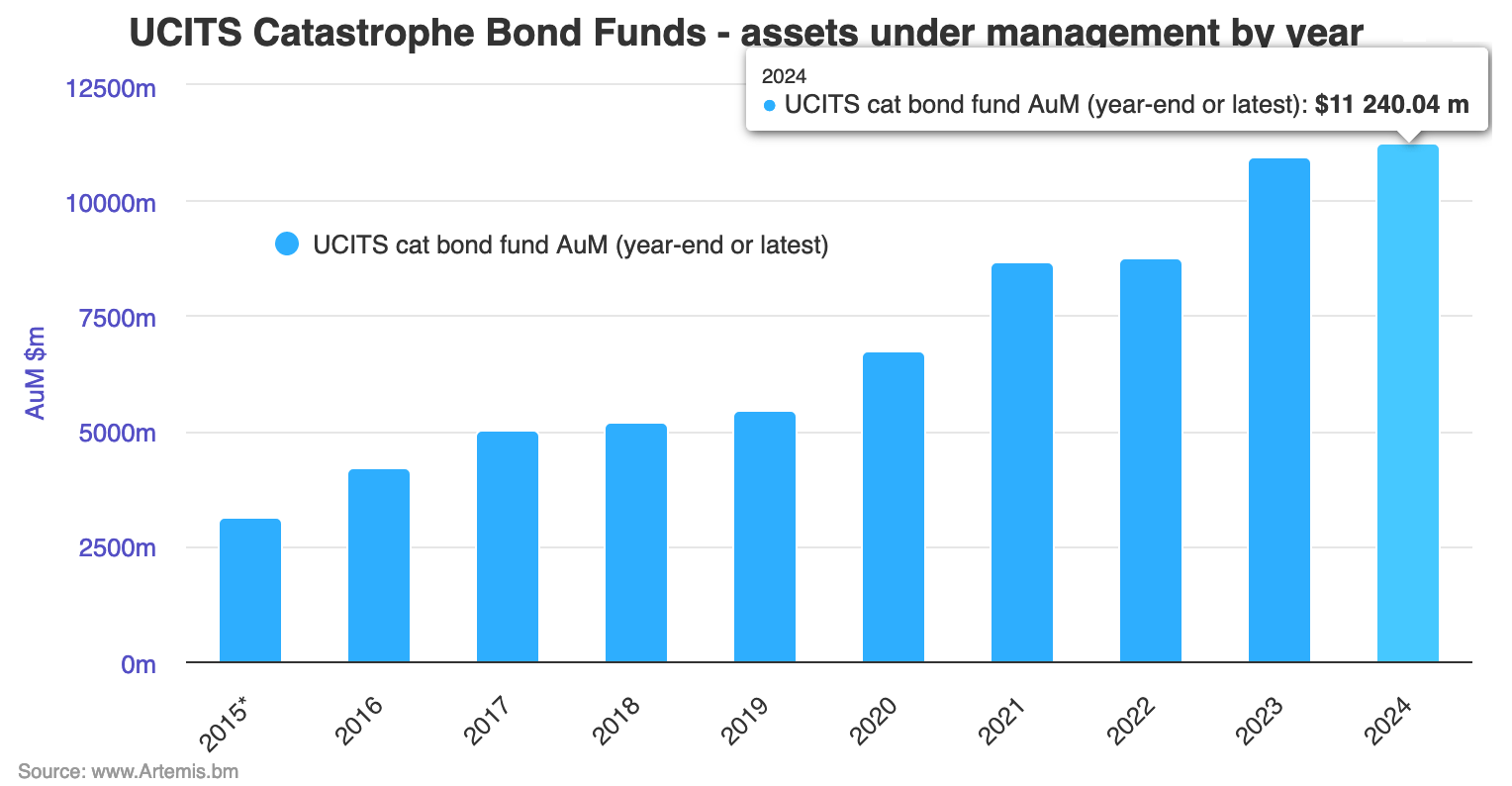

Catastrophe bond funds in the UCITS format have continued to experience growth as a group in early 2024, ending February with $11.24 billion in combined assets under management (AUM), while two UCITS cat bond funds have surpassed the $3 billion milestone this year.

UCITS catastrophe bond funds as a group expanded their asset bases by 25% through calendar year 2023, adding an impressive 10.5% just in the fourth-quarter of last year. That took their combined AUM to almost $11 billion at December 31st.

Now, just two months into 2024, the $11 billion milestone has been surpassed, as UCITS cat bond funds as a group added 2.72% to their assets so far this year, to end February at a new high of just over $11.24 billion.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Perhaps the biggest story of the first two months of 2024, is the fact two of the insurance-linked securities (ILS) investment managers with UCITS cat bond fund strategies, have surpassed $3 billion in assets for their funds in 2024.

The Twelve Cat Bond Fund surpassed $3 billion in January, so becomes the first UCITS cat bond fund manager with a strategy of that size.

By the end of February, the Twelve UCITS cat bond fund strategy had reached almost $3.06 billion, having added 5% in assets since the end of 2023.

The Schroder GAIA Cat Bond Fund actually shrank slightly in January, but then reported the addition of almost $240 million in assets just in February 2024, which took it to almost $3.02 billion by the end of the month, making it the second largest UCITS cat bond fund and only the second to ever surpass $3 billion in AUM.

Conversely, the GAM Star Cat Bond Fund, which is managed by Fermat Capital Management but offered by asset manager GAM, shrank by 8% over the first two months of 2024, falling to $2.52 billion in AUM at the end of February, now well down on the $2.85 billion high it had reached last June.

One particularly notable mover in 2024, is the Credit Suisse (Lux) Cat Bond Fund, which has added an impressive $245.8% in assets this year, to reach almost $119 million.

While that’s small by comparison to the three major UCITS cat bond funds, for the Credit Suisse strategy this is a significant increase for the strategy, taking it back to an AUM level not seen since 2019.

In 2024 so far, strong growth was also experienced by some other cat bond fund managers, such as the HSZ Group Maneki cat bond fund which added 16%, the AXA Investment Managers Wave cat bond fund which added 12% and the Leadenhall Capital Partners UCITS ILS Fund which added 12% in assets so far this year as well.

It’s an overall strong start to the year for UCITS catastrophe bond funds, although with evidence of some churn at GAM.

With catastrophe bond issuance racing away so far this year and the first-quarter now on-track to break records for new cat bonds in dollar value terms, the asset managers offering UCITS cat bond fund strategies should have ample opportunity to deploy new assets as they are raised, suggesting further growth for this sector is likely this year.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.