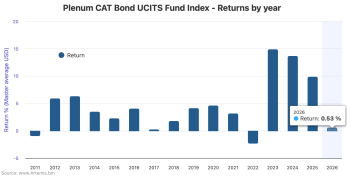

Cat bond funds start 2026 with 0.53% average January return: Plenum UCITS Index

9th February 2026Catastrophe bond fund strategies in the UCITS format have started 2026 positively, delivering an average return of 0.53% for January, according to the Plenum CAT Bond UCITS Fund Indices.

Read the full article