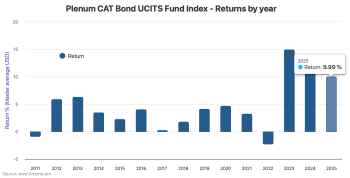

Ambassador mutual fund surpasses $700m in cat bond and ILW assets

12th January 2026The Ambassador catastrophe bond focused US mutual fund strategy operated by Embassy Asset Management has grown its total insurance-linked securities (ILS) assets under management to more than US $700 million or the first time, while the strategy delivered an 11.61% return for the last year of record.

Read the full article