Tremor Technologies, the insurtech with a technology-based programmatic insurance and reinsurance risk transfer marketplace, has announced the launch of Tremor Fetch™, a piece of functionality that will allow placement participants and capacity to follow the consensus market clearing price.

Tremor Fetch™ provides reinsurance firms and capacity providers participating in placements on Tremor’s marketplace platform with the ability to automatically follow the clearing price for layers of risk placed, meaning they can offer the capacity they want to at the clearing price found.

This is a really interesting addition to the Tremor risk transfer and reinsurance marketplace platform and its launch comes on the heels of new features including: Tremor X-Ray™, a user-friendly piece of functionality that allows reinsurance capacity and pricing to be filtered and analysed in real-time; as well as Tremor Blackboard™ real-time collaboration tool for remote and global teams to work together on their reinsurance placements; and Tremor’s launch of its Marketplace 2.0.

Why is Tremor Fetch interesting?

Because there are already reinsurance market participants that follow the lead price on placements, but with Tremor the price followed is the clearing price, the true market consensus for a layer of risk.

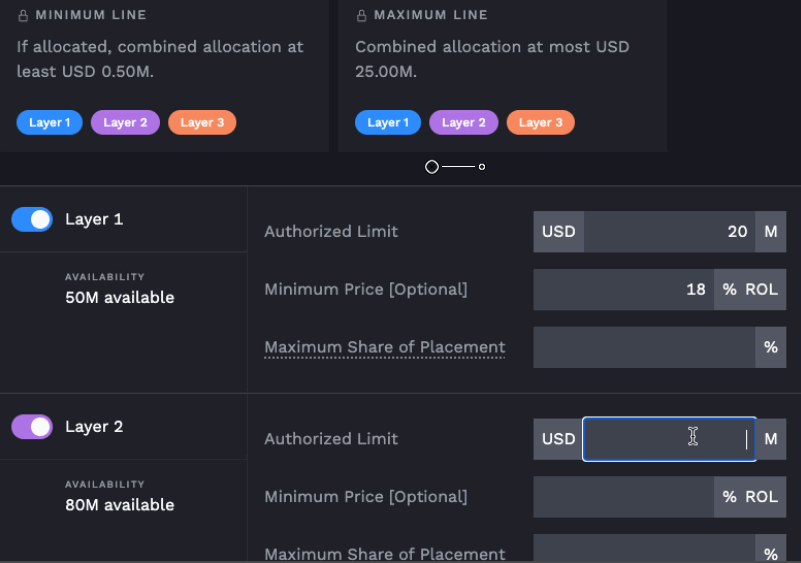

Tremor’s Fetch functionality allows reinsurance capital providers to authorise following capacity and automatically receive their line at the cedent’s chosen clearing price, subject to any pre-defined constraints.

Those capital providers using Fetch can make explicit their minimum price, as well as the maximum share they would be willing to receive.

Along with a suite of authorisation subjectivities, Tremor now offers close to 120 participating reinsurers “precise capacity authorization capabilities in a secure, online environment,” the company said.

“2021 has been an amazing year for Tremor both from a product adoption perspective and for the development of our product itself. Launching four major releases after deploying Panorama in February has been exciting to see and members of the Tremor marketplace really appreciate the continual addition of new capabilities to improve their buying and selling experience – in fact, many of our latest features have been developed in close partnership with insurers and reinsurers,” Sean Bourgeois, Tremor Founder & CEO commented.

This new feature is an excellent addition and useful functionality for those reinsurers and capacity providers who either don’t have the confidence to bid, or can’t do the full analysis themselves on a risk or reinsurance layer, and so would prefer to follow the market leaders.

Following lead markets is common in places like Lloyd’s, where smaller syndicates and capital providers often can’t lead and set the price discovery themselves.

This means they can always be sure they are signing onto programs at the best possible price, as the pricing is set based on true risk appetite and supply-related dynamics of the market, delivering a cleared price consensus.

Following the market consensus pricing should be preferable to putting out lines based on a single lead opinion, or an algorithm and this could also help ceding companies secure their capacity more easily if placing through Tremor’s platform.

This kind of consensus-based following market technology could also be of interest to large investors looking to allocate to reinsurance layers, or even ILS funds.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.