Tremor Technologies, the insurtech with a technology-based programmatic insurance and reinsurance risk transfer marketplace, has announced the launch of Marketplace 2.0, a new iteration of its software that has been redesigned with risk transfer users in mind.

Tremor said that its team have been hard at work in recent months refreshing the user experience for buyers and sellers of reinsurance protection, resulting in this update to its marketplace.

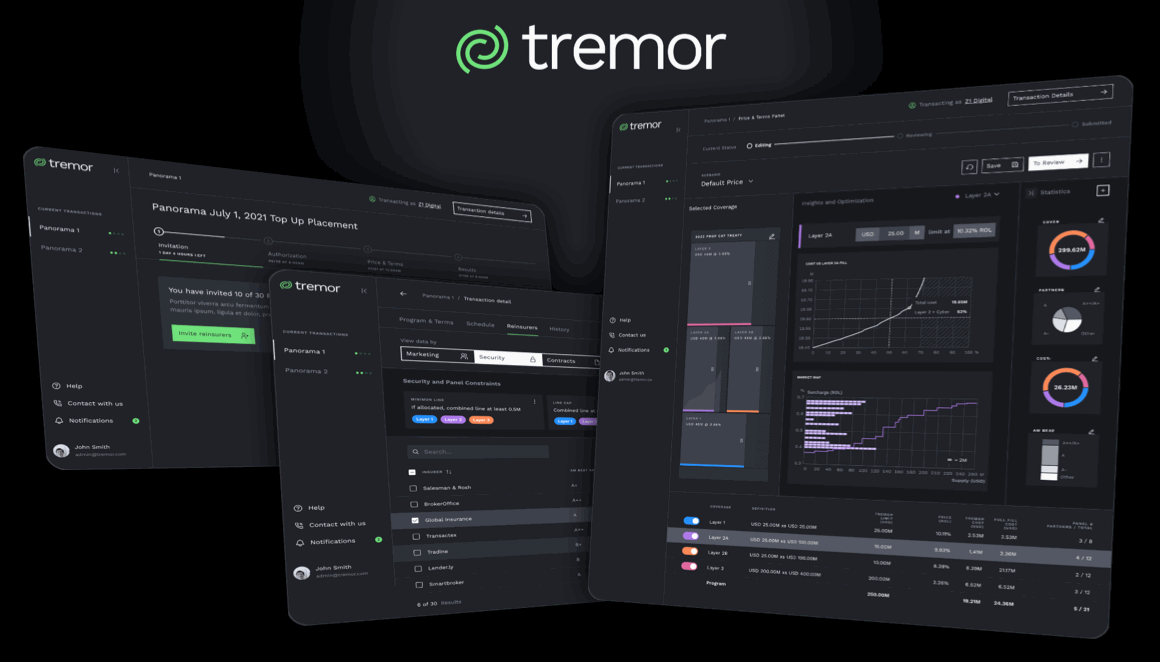

As of today, users will be able to access Tremor Marketplace 2.0 and will also see a new logo and “dark-mode” brand experience.

“Bringing modern risk transfer capabilities to the reinsurance marketplace by optimally matching risk to capital using modern trading technologies has been our focus from day one. Today, we are very pleased to announce the latest design iteration of our market leading platform, Marketplace 2.0.

“Buyers and sellers of reinsurance will now experience a State of the Art user experience on par with the most advanced and sophisticated capital market trading platforms in the world, further separating Tremor from the pack as the de facto reinsurtech market leader,” explained Sean Bourgeois, Founder & CEO of Tremor.

Tremor’s team has spent several quarters meticulously undertaking user experience design work, to implement and integrate improvements and enhancements to user interaction, while giving its software a modernised look and feel.

Tremor said that it believes its Marketplace 2.0 competes on par with the best online trading marketplaces in the world.

The new design has been created with user needs in mind, while the underlying technology remains Tremor’s market-leading price discovery and allocation capabilities.

The company believes the trading experience will now be even easier to use for both reinsurance protection buyers and sellers, making it even simpler to benefit from the efficiencies of a programmatic marketplace for risk placement and transfer.

Tremor is on-track to triple its client count and volumes in 2021.

The company has been adding to capacity all through this year, while executing placements for its client base and bringing risk to reinsurance capital providers.

Recently the company said capacity available through its marketplace surpassed $500 billion, or over 95% of global reinsurance, while it can also offer clients access to two-thirds of Lloyd’s market capacity and has all the major reinsurance brokers signed up.

On top of that the company has also added new placement functionality in 2021 as well, not least the ability to allow multiple insurance or reinsurance structures and perils to be priced and placed efficiently at the same time.

“Launching Marketplace 2.0 in time for the 1/1 renewal season is perfectly timed to cap the firm’s best year yet,” the company explained.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.