Tremor Technologies, the insurtech with a technology-based programmatic insurance and reinsurance risk transfer marketplace, has launched a new feature of its Panorama risk marketplace, offering clients SurveyorTM, which allows for multiple structures and perils to be priced and placed efficiently at the same time.

Already Tremor has placed $500 million of reinsurance limit within just 30 days using this new feature, across two placements.

Already Tremor has placed $500 million of reinsurance limit within just 30 days using this new feature, across two placements.

Panorama SurveyorTM allows protection buying insurance and reinsurance firms to explore in real time, the most competitive prices available for a variety of reinsurance or retrocession structures and perils.

It means that a protection buyer can request complete market pricing for multiple reinsurance structures simultaneously, so for example ultimate net loss, or indemnity capacity, alongside industry loss warranty (ILW) capacity.

In addition, Tremor’s Surveyor also allows multiple perils to be priced simultaneously as well.

Meaning that the protection buyer can then decide how much of each to buy and at what uniform price they want to settle at.

Two significant reinsurance placements totalling more than $500 million in limit have already been placed using Surveyor, Tremor explained.

“We believe that SurveyorTM is a game changer for reinsurance buyers, further enhancing the Panorama pricing and placing platform. With SurveyorTM, buyers do not need to have a final structure decided in advance or a firm position on critical perils before seeing the entire market of real prices – not rough estimations, the entire market. And it goes further – why make a binary decision when optimization tech like Tremor’s allows the buyer to blend?

“Why should insurers need to decide to include or exclude Cyber coverage from a reinsurance layer or an entire tower when they can buy 30% Cyber if the price is suitable? Panorama SurveyorTM delivers this power to buyers while allowing capacity providers to bid exactly as they want for what they want,” explained Sean Bourgeois, Tremor’s founder and CEO.

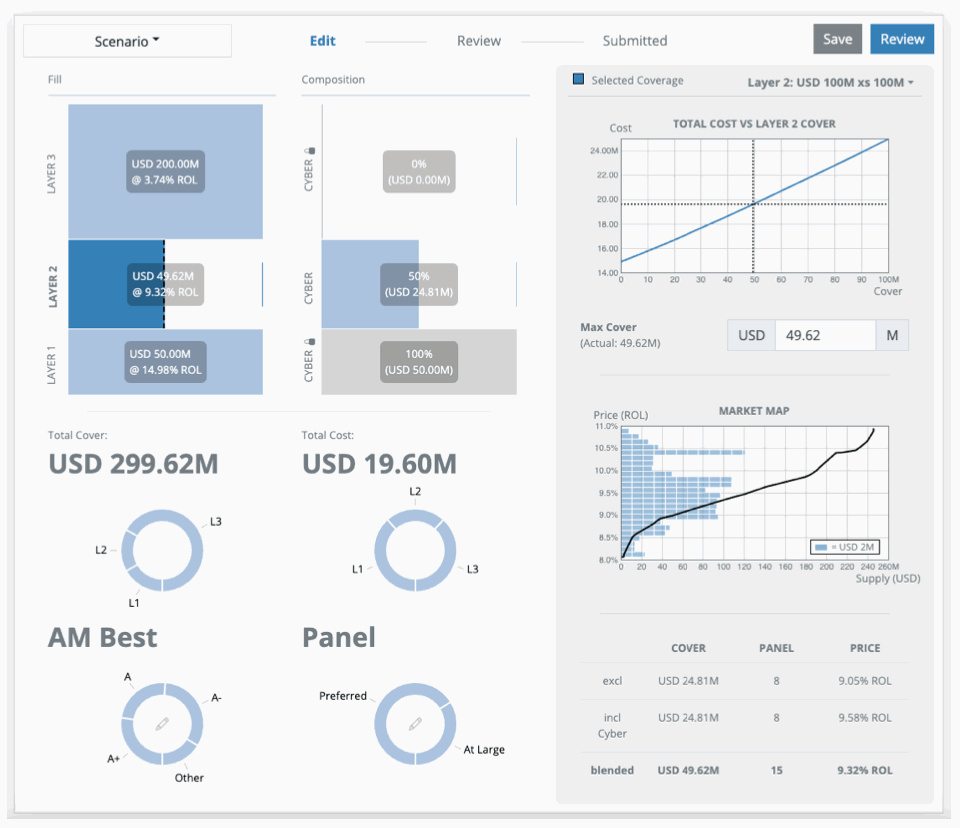

This is a very useful feature for reinsurance buyers and another example of an aspect of the reinsurance renewal placement process that technology can solve for much more rapidly and effectively than a human. A screenshot can be seen below.

With Tremor’s Surveyor tool, a reinsurance buyer can go to market seeking a certain level of capacity, but poll real, available pricing and risk appetite for that capacity across multiple structures, to try and get the best and most efficient execution that it can.

At the same time, the market’s pricing and risk appetite can also be polled for different perils and peril mixes, so for example you could include cyber, or exclude it, and compare the true pricing available.

All of this can happen extremely rapidly thanks to Tremor’s advanced auction-style marketplace technology, solving for the best reinsurance placement solutions for buyers in rapid, near real-time, based on capacity and pricing that is actually available.

These kinds of comparisons, of pricing and capacity availability and terns for a range of structures, peril inclusions (or exclusions), all while getting real, achievable pricing feedback and appetite from the reinsurers and ILS funds in the market, could take a broking team weeks to achieve. It certainly cannot happen as rapidly as technology can facilitate.

As Tremor continues to advance its technology, it has gone far beyond the typical features offered by placement software platforms, most of which do not actually have any true marketplace features, or access to real pricing and the ability to settle placements.

Tremor explained that it believes, “An efficient reinsurance market that perfectly matches risk to capital can only be achieved completely with the new market structure that Tremor has introduced powered by the optimization tools it has developed – and Panorama is proving this out as more and more cedents adopt the technology for their reinsurance purchases.”

Tremor recently announced that all of the major reinsurance brokers have now signed up to use its marketplace and has announced today that all of them have placed significant transactions in the last few quarters.

This adoption by reinsurance brokers is no surprise.

At first, brokers may have feared technology that places risk with capital, feeling that was a key piece of their value proposition to the market.

Which was misguided, as brokers’ true value proposition has never really been in this last-mile of the placement process, the efficient matching of risk and capital.

Rather it has always been in the rest of the reinsurance relationship, in helping design placements and structures, advising, consulting, modelling and managing the life-cycle of the relationship with protection buyers.

But increasingly brokers are now accepting that this last-mile of the placement of risk, or matching it efficiently with capital, is far better achieved using technology, in the vast majority of reinsurance or retrocession placements.

Tremor has had significant success in winning over the broking community, helped by its advanced technological approach to building tools that actually empower brokers, providing them with options to service their clients more effectively than ever before.

Tremor said that it is now on-track to triple its volumes placed in 2021, in what has been a particularly exciting year for the company.

For protection buyers, this is also exciting, as in just a few years of development Tremor has created a risk placement marketplace that is far more advanced than anything that has come before, or anything else on offer today.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.