Hurricane Helene privately insured losses estimated $8bn to $14bn by Moody’s RMS

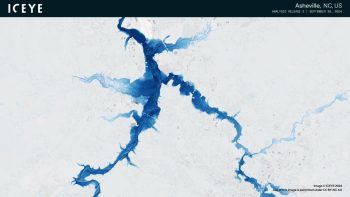

8th October 2024Moody’s RMS Event Response has said that it estimates private market insurance industry losses from hurricane Helene will be in a range from $8 billion to as much as $14 billion, one of the highest estimates seen so far.

Read the full article