Reducing or controlling exposure to catastrophe risks is seen as the most important driver of reinsurance buying decisions for the January 2022 renewal season, according to hundreds of respondents to our recent market survey.

We undertook our latest global reinsurance market survey alongside sister publication Reinsurance News during the third-quarter, analysing market opinion at a key time of year.

By reaching out to our combined readership of more than 200,000 per-month, through September and into October, we got a sense for how the sector is feeling ahead of the important January 2022 reinsurance renewals.

Our H2 2021 reinsurance market survey is based on responses from hundreds of identifiable market participants, many in the C-Suite and more than 70% of which provide input or directly make reinsurance buying decisions.

The full results are available online for free and you can analyse the data from responses here.

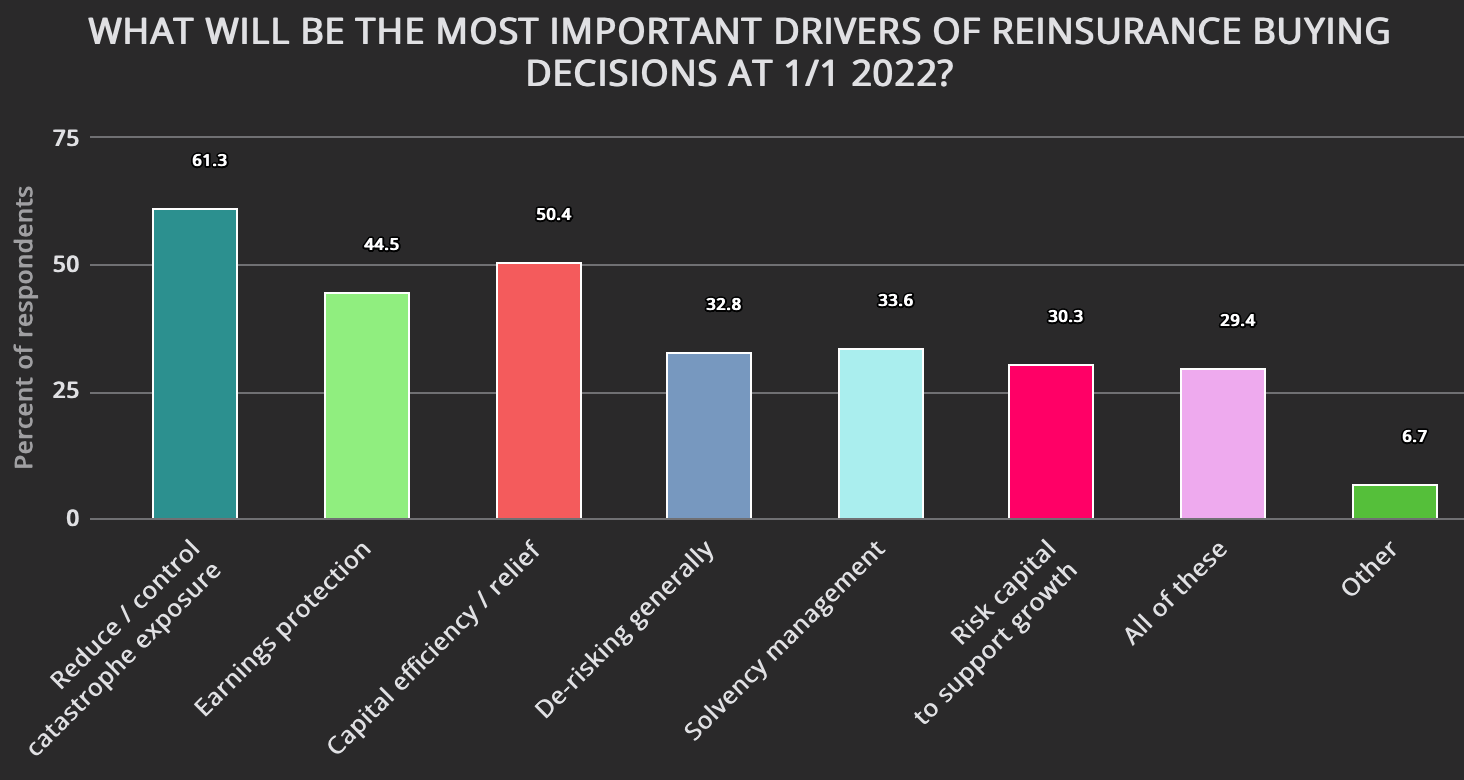

We asked our readers to tell us what they felt the most important drivers of reinsurance buying would be at the 1/1 2022 renewals.

Unsurprisingly perhaps, given 2021 was another year of major catastrophe losses, overlaid with growing concerns about secondary perils and increasing uncertainty over climate related risks, the top answer is focused on de-risking and better managing catastrophe exposures.

Over 61% of our respondents said that reducing and controlling catastrophe exposure is the most important driver of reinsurance buying decisions for the January 2022 renewals.

This is reflected in our discussions with industry participants, many of whom are increasing their focus on de-risking portfolios of catastrophe risk and moderating their catastrophe risk appetites around this renewal season.

Reports suggest these efforts are going to be quite significant for some, with a number of players accelerating their pull-back from some peak catastrophe zones and set to write less secondary peril exposure as well.

While others are doubling-down on their focus on named perils, to try and make portfolios of catastrophe risk more predictable.

At the same time, there are increasing efforts to leverage third-party capital as a way to better manager property catastrophe exposures, sharing more of the risk or shifting it onto third-party balance-sheets, it appears, alongside which rising use of instruments such as catastrophe bonds also speak to a rising cat risk phobia in some quarters of the industry.

The second most important driver of reinsurance buying at the upcoming renewals is expected to be capital efficiency or relief, as over 50% of respondents placed this as the critical factor for their renewal ambitions.

After that, earnings protection came third, followed by managing solvency levels.

With the reinsurance renewals still seen to be running late, it’s not certain every buyer will achieve its goals this year, as a last minute rush for capacity could result in some disappointment.

Reinsurance renewal pricing still remains on track for increases at January 1st 2022, but how much by continues to be very uncertain at this time, sources tell us.

The full results of our second global reinsurance market survey provide a useful test of the temperature of the industry, offering insight on market sentiment and expectations as we move towards the January 2022 reinsurance renewal season.

We hope our readers and other interested parties find the results enlightening and useful in making their strategic decisions for the renewal season ahead.

The full results of our latest survey are freely available from today and we’re happy to discuss them with any industry participants. We’re interested to hear your thoughts.

We’ll also be analysing the full reinsurance market survey results over the coming weeks on both Reinsurance News and Artemis.

Analyse the results of our global reinsurance market survey here.

Also read:

– Global reinsurance market survey points to increased buying at 1/1.

– Market anticipates broad firming at Jan 2022 reinsurance renewals: Survey.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.