Our readers forecast more than $12 billion of catastrophe bond issuance in 2021, which would see the market setting a new record. But in terms of which area of insurance-linked securities (ILS) is likely to grow fastest, the collateralized reinsurance market is forecast to outpace cat bond market growth this year.

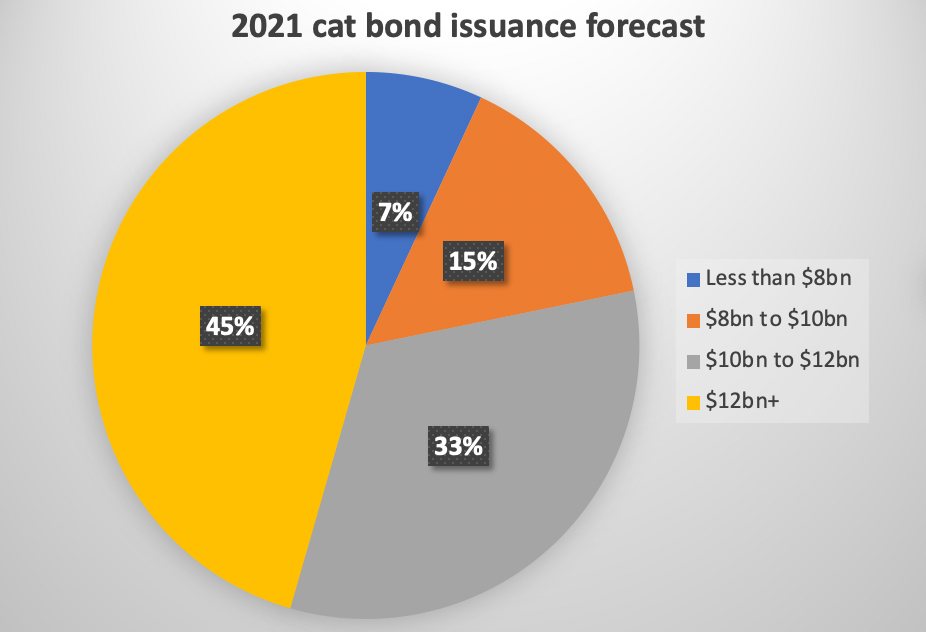

We surveyed our readers this week, asking for their opinions as to how much catastrophe bond issuance we are likely to see in 2021.

We asked for a forecast based on 144A cat bond issuance only, so including property catastrophe bonds, life & health or mortality cat bonds, plus any specialty lines cat bonds, issued during this year.

Our readers were split, but the largest percentage of respondents opted for catastrophe bond issuance to reach above $12 billion in 2021, which is close to the forecasts of the leading broker-dealers who told us to expect something between 2020’s issuance level and the $12 billion mark for pure property cat bonds.

45% of our readers, who responded to the poll, said that they believe cat bond issuance will exceed $12 billion in 2021.

33% of respondents forecast between $10 billion and $12 billion, while the remaining 22% opted for less than $10 billion of cat bond issuance in 2021.

While the catastrophe bond market looks primed for another very busy year in 2021, following a record-breaking 2020, that’s not to say it will be the segment of the insurance-linked securities (ILS) market that grows the fastest this year.

Over the last few years, the other and larger side of the ILS market, where collateralized reinsurance and private ILS deals sit, also including transactions and structures as industry loss warrants (ILWs) and sidecars, has been seen to shrink.

The reasons for this have been varied, from the major hurricane losses of 2017, the social inflation and loss creep that followed, the wildfire losses of recent years and also uncertainty over the potential impacts of the COVID-19 pandemic, the collateralized reinsurance and private ILS market has faced a more challenging time than pure catastrophe bonds over the last few years.

But, as we explained recently, inflows to ILS fund managers are recovering now and while cat bond funds have been beneficiaries of this increasing investor interest, so too are private ILS funds and collateralized reinsurance specialists.

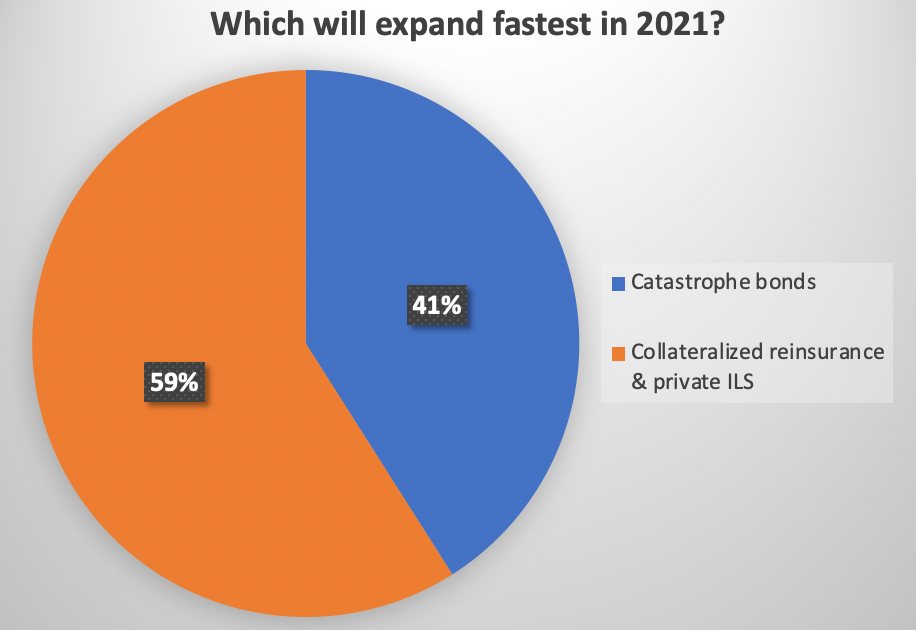

So, with that in mind, we also asked our readers which side of the ILS market should be expected to grow the most in 2021, cat bonds or collateralized reinsurance and private ILS?

59% of our readers that responded to the poll said that they expect the collateralized reinsurance and private ILS segment of the market to grow the most in 2021, compared to 41% who opted for catastrophe bonds.

The results point to confidence across the market that the challenges of recent years faced by some collateralized reinsurance strategies are increasingly being put behind them.

They also reflect what’s being seen in terms of fund raising and also new launched in the ILS market as well.

Put together, these two data points suggest the insurance-linked securities (ILS) market is confident of another strong year in 2021, major catastrophe loss events allowing of course.

They also tie in with investor trends as well, where appetite to deploy capital into the ILS market is currently seen to be reaching higher levels.

In just the last fortnight, we’ve spoken directly with a number of pension funds and sovereign wealth investors who aren’t yet deployed in ILS. Between them, these new investors, have an ambition to deploy billions of dollars into the ILS space, if the opportunity presents itself.

These new investors to ILS seem to be becoming more abundant again right now, we’re hearing from increasing numbers. While at the same time we’re also hearing from some already invested institutions who feel that now is the time to upsize allocations to ILS strategies, again opportunity allowing.

All of which points to growing confidence in ILS.

Both within the market and within an expanding investor base. While these forecasts from our readers also suggest that the ILS market is moving beyond the difficult few years it’s faced and is primed for another period of growth.

Analyse catastrophe bond and ILS market issuance using our range of charts and visualisations.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.