Catastrophe bond market activity will remain busy through 2021, with an expectation that issuance could reach as much as $12 billion, so beating the record set this year, as the high number of maturing cat bonds are seen as likely to be renewed and more new sponsors may also be seen.

Our regular readers will already be aware of the records set in the catastrophe bond market during 2020, as we’ve been keeping them updated on this.

Our regular readers will already be aware of the records set in the catastrophe bond market during 2020, as we’ve been keeping them updated on this.

The catastrophe bond and related insurance-linked securities (ILS) market saw a record number of transactions in 2020, which drove issuance of pure 144A property catastrophe bonds above $10 billion for the first time ever and issuance of cat bonds and related ILS transactions has now surpassed $16 billion.

In fact, even before the end of 2020, issuance of property cat bonds (largely 144A) tracked by Artemis reached above $11 billion.

Analyse cat bond and ILS issuance data using our interactive charts.

We spoke with leading broker dealer firms and the capital market units of some reinsurance brokers, to get their views on what lies ahead for 2021.

The majority expect another very busy year, with the catastrophe bond market momentum seen through the final months of 2020 expected to carry on into a busy 2021.

The consensus is that issuance of 144A property catastrophe bonds could reach as high as $12 billion in 2021, with most broker dealers polled suggesting that at a minimum issuance in 2021 should almost match 2020’s records.

Paul Schultz, CEO of Aon Securities, the capital market and insurance-linked securities (ILS) specialist unit of insurance and reinsurance broker Aon, told us that his firms forecast for 2021 property cat bond issuance is $11 billion to $12 billion.

“We expect momentum established in 2020, capped off with a particularly strong 4Q, will carry over to 2021 and manifest itself not only in expiring deals, but new issuances as well,” Schultz told us.

In addition he further explained, “We expect fresh capital to support new issuances, as investors and ILS managers continue to support and prioritize cat bonds in the near term.”

Demand for the more liquid catastrophe bondm as an ILS or reinsurance linked investment structure, has clearly resurged after the pandemic as the important features of the ILS asset class, diversification and lack of correlation, were driven home.

This looks set to see significant support emerge for catastrophe bond issues, which should help broker dealers in getting towards their forecasts in 2021.

Cory Anger, Managing Director at GC Securities, a division of MMC Securities LLC and the capital market-focused relation to reinsurance brokerage Guy Carpenter, forecast up to $12 billion of issuance as well, for Rule 144A P&C focused catastrophe bonds.

“With more scheduled maturities occurring in 2021 relative to 2020 ($10.2B of 144A cat bonds in 2021, versus $9.013B of 144A cat bonds in 2020) coupled with the continuing challenges in the overall traditional reinsurance and retrocession marketplaces, we expect 2021 to be another strong year for 144A cat bonds issuance,” Anger told us.

“We expect most of the existing catastrophe bonds to renew as well as new activity from sponsors including corporates, insurers and reinsurers,” she continued. Saying that, “We expect to see 144A cat bond issuance in 2021 to be in the potential range of $11-12B.”

A number of additional factors could also promote further expansion of insurance-linked securities (ILS) and foster increased catastrophe bond issuance, Anger believes.

She explained that, “New SPV legislation in Hong Kong and Brazil as well as the recently announced Brexit deal are also conducive to the growth of the asset class.

“Additionally, we expect ILS capital to grow in 2021 given continued interest from sponsors in collateralized quota shares/sidecars, collateralized reinsurance and catastrophe bonds.”

We also spoke with representatives of Willis Re Securities, the ILS and capital markets focused unit of the reinsurance broking division of Willis Towers Watson.

Willis Re Securities had similarly positive forecasts for the ILS market and in particular catastrophe bonds, with continued momentum and growth expected.

Willis Re Securities told us that, “For 2021 we see a return to ILS AUM growth notwithstanding challenges like the potential for trapped capital from COVID-19.

“Q4 2020 market activity, the pipeline, and our recent survey all point to 2021 being a good year for cat bonds in particular.

“We could easily see issuance somewhere between flat and up 10% relative to 2020’s record-setting pace.”

Positive activity is expected across the market it seems, thanks to the robustness of catastrophe bonds and also their returns delivered in recent years despite challenges faced by the broader ILS marketplace.

“The cat bond forecast reflects both investor demand for more liquid and transparent investments as well as good relative performance for cat bonds the past few years. Given a heightened appreciation of risk from 2020, we also see good potential for new cat bond sponsors and perils to complement repeat sponsors in satiating this demand,” Willis Re Securities explained.

After the impressive year the catastrophe bond market has just experienced, it looks like 2021 could be equally as impressive and as a result investors in cat bond funds may also see a significant opportunity to capitalise on rising reinsurance pricing at this time.

Of course, a lot can happen during a year, as we’ve just seen with the pandemic in 2020 and the direction of travel and momentum can always change.

But right now, these positive forecasts suggest a very busy start to 2021 for the catastrophe bond and broader insurance-linked securities (ILS) market, further cementing third-party capital’s role within reinsurance and retrocession programs around the world.

Stay tuned to Artemis for news of every catastrophe bond and related ILS transaction that comes to market, as well as other structures including reinsurance sidecars.

You can view information on every catastrophe bond issued so far in 2020 and all prior years, totalling over 700 issues, in the Artemis Deal Directory.

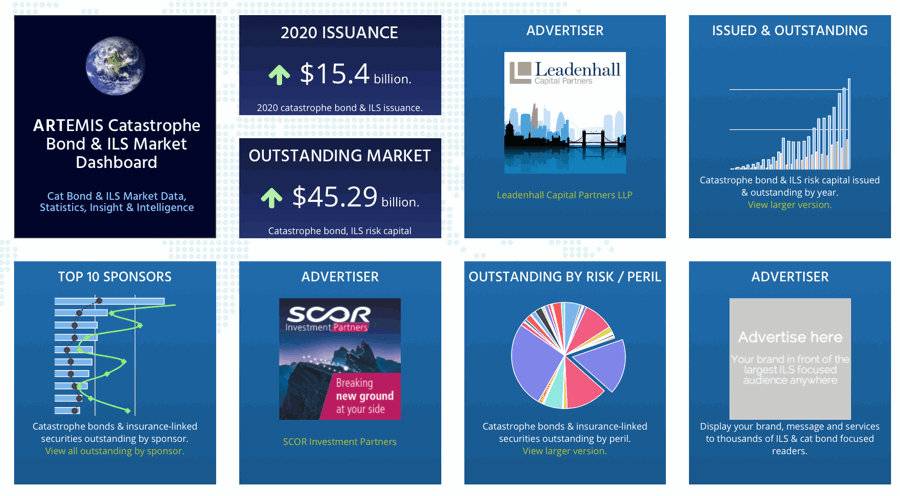

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.