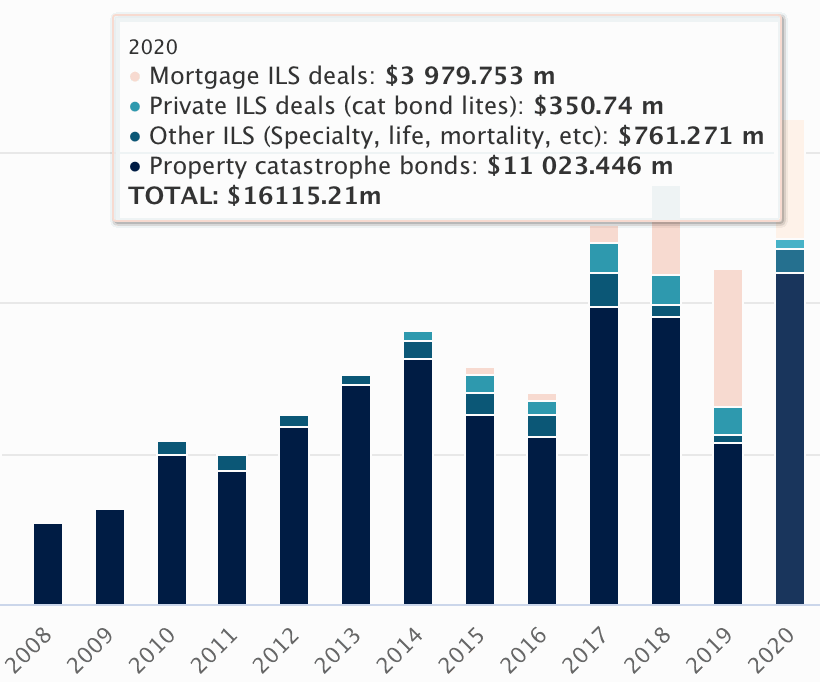

The catastrophe bond and related insurance-linked securities (ILS) is set to pass another milestone this week, as Artemis’ data on the cat bond and ILS marketplace will count over $16 billion of annual issuance for the very first time in 2020.

Within our Artemis Deal Directory, the most extensive publicly available source of information on catastrophe bonds and other similar insurance-linked securities (ILS), 2020 issuance is set to reach an incredible over $16.1 billion including the latest deals that settle today and tomorrow.

We’ve updated our charts today to reflect this new milestone and perhaps even more impressive than the $16 billion overall marker being hit in 2020, is the fact that now pure 144A catastrophe bond issuance has surpassed $11 billion for the first time ever.

Analyse cat bond and ILS issuance data using our interactive charts.

2020 has seen numerous records broken and it’s only one week since issuance of pure largely 144A catastrophe bonds surpassed $10 billion for the first time.

But issuance has been rapid in recent weeks, helping pure and broadly marketed cat bonds pass the $11 billion market as well, with now almost $1.9 billion of 144A cat bond issuance completed in December alone, as of tomorrow.

The $16.1 billion of overall cat bond and related ILS issuance seen in 2020 now breaks down as follows: the $11 billion of broadly syndicated, largely 144A property catastrophe bonds (as of tomorrow); just over $761 million of other line of business cat bonds (specialty, mortality, life/health); almost $351 million of private cat bonds (or cat bond lites); and close to $3.98 billion or mortgage ILS transactions.

Analyse cat bond and ILS issuance data using our interactive charts.

The previous annual record for catastrophe bond and related ILS issuance tracked by Artemis was $13.86 billion, set in 2018. There’s still one more mortgage ILS deal to come before the end of the year, as well as a possibility of some cat bond lites as the year draws to a close.

But 2020 will go down in history as the year catastrophe bonds, as well as fully securitized insurance-linked securities (ILS) in cat bond structure, demonstrated their resilience to extreme financial market challenges, their ability to provide continuity to ceding companies looking for reinsurance and retrocession, plus the ILS market as a whole demonstrated its ability to respond to investor demand for access to reinsurance linked returns.

As well as annual catastrophe bond and related ILS issuance reaching a new record annual high in 2020, as recorded by Artemis, so too has the amount of risk capital outstanding in the ILS market.

This has now exceeded $46 billion for the first time ever, as of this week, the highest figure seen since we began tracking this marketplace in the late 1990’s.

As you can see from our charts, the ILS market, in terms of catastrophe bond and related ILS risk capital outstanding, has grown strongly in 2020.

It’s particularly encouraging that a lot of this growth has come from the ability of pure 144A cat bond market issuance to far exceed maturities this year.

We’re still hearing bullish reports from brokers for 2021 and expect double-digit billion issuance to be targeted, across pure cat bonds and specialty, life/health/mortality cat bond deals.

Stay tuned to Artemis for news of every catastrophe bond and related ILS transaction that comes to market, as well as other structures including reinsurance sidecars.

You can view information on every catastrophe bond issued so far in 2020 and all prior years, totalling over 700 issues, in the Artemis Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.