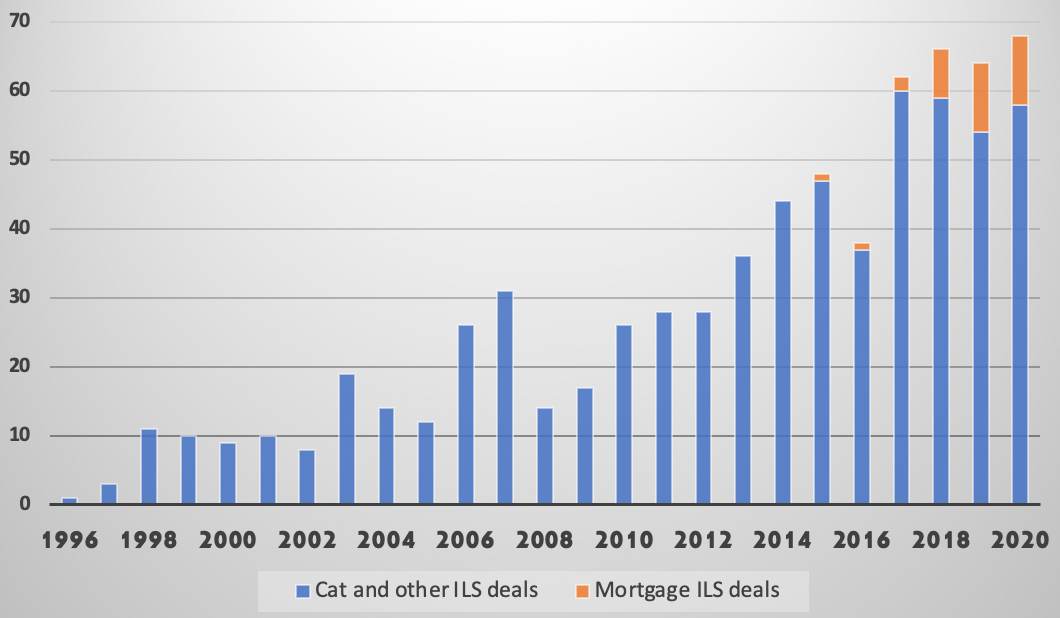

The market for catastrophe bonds and related insurance-linked securities (ILS) has already broken the annual record for number of deals issued in 2020, as this year remains on-track to break the record for the dollar-amount issued as well.

Within our Artemis Deal Directory, which is the most extensive source of information on catastrophe bonds and other similar insurance-linked securities (ILS) with over 700 transactions now listed, so far in 2020 we have recorded information on 68 deal issuances, breaking the previous annual record set in 2018.

Three catastrophe bond transactions in our Deal Directory are yet to settle as well, meaning the total will rise to 71 at least by the end of November.

As of today, 58 of the catastrophe bond and related ILS transactions issued so far in 2020 and listed in our Deal Directory feature property catastrophe, specialty, mortality and life insurance or reinsurance related exposures, while the other 10 are mortgage ILS deals.

The annual record for the number of property catastrophe, specialty, mortality and life bonds issued actually stands a little higher at 60, set in 2017.

But the three transactions still marketing are all property catastrophe bonds, meaning that by the end of November the market will have set the record excluding the mortgage ILS activity as well.

In terms of the dollar value of catastrophe bonds and related ILS issued and listed in our Deal Directory, the total for 2020 stands at almost $13.5 billion, which is closing fast on the 2018 record of almost $13.9 billion and this will be broken soon as well.

Excluding all mortgage ILS issuance though, which has become an increasing component of the overall marketplace as mortgage insurers look to the capital markets for reinsurance capacity, issuance still remains some way below the 2017 record of almost $12 billion.

But with most of November and the whole month of December still to run, while catastrophe bonds look like a very attractive reinsurance and retrocession alternative in 2020, there is every chance that we see that record broken as well and this year could break most records in the market if issuance continues apace and all the pipeline targeted issues get launched and completed before December 31st.

You can view information on every catastrophe bond issued so far in 2020 and all prior years in the Artemis Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

Keep up-to-date with the make-up of the catastrophe bond and ILS market using the Artemis Catastrophe Bond & ILS Market Dashboard, designed to be a simple and effective tool providing key data and statistics on every transaction (there are 700+) contained in our catastrophe bond & ILS Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.