AI-improved risk modelling can streamline catastrophe bond transactions: World Bank

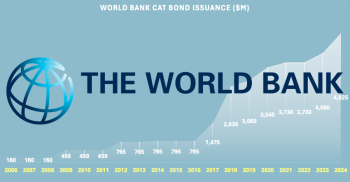

23rd October 2024According to executives at the World Bank, artificial intelligence (AI) based improvements to catastrophe risk modelling could in future allow more transactions to be brought to the catastrophe bond market, with less lead time and potentially wider investor acceptance.

Read the full article