Catastrophe bond funds in the UCITS format have reported a record start to the year, delivering almost 4% in returns on average in the first-quarter of 2023, according to the latest data from the Plenum CAT Bond UCITS Fund Indices.

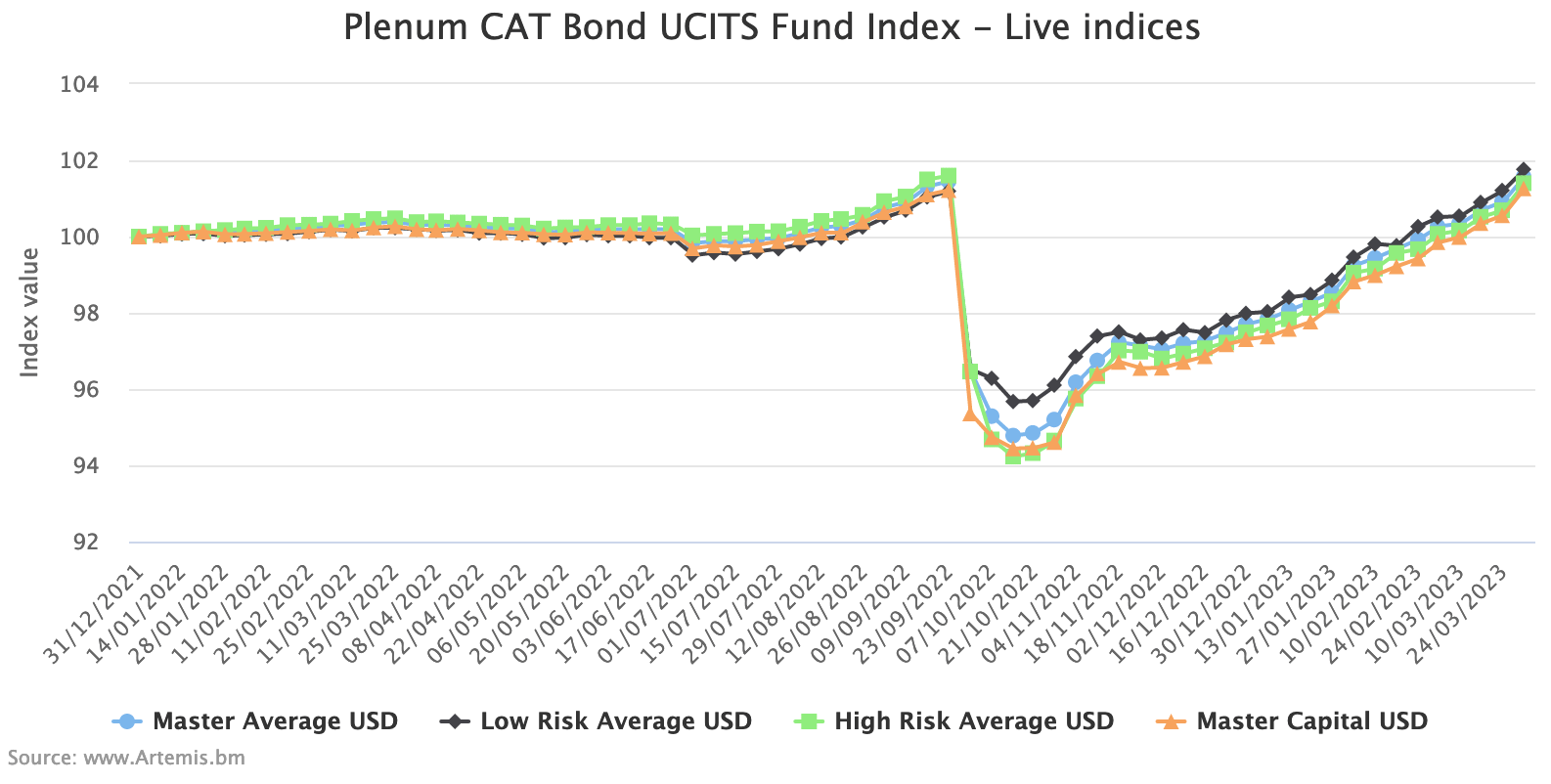

The Master Average cat bond Index return reached 3.95% for the first-quarter of 2023, while the lower-risk UCITS cat bond funds averaged 3.85%, higher-risk 4.01% and the Master Capital Index return was 4.06%.

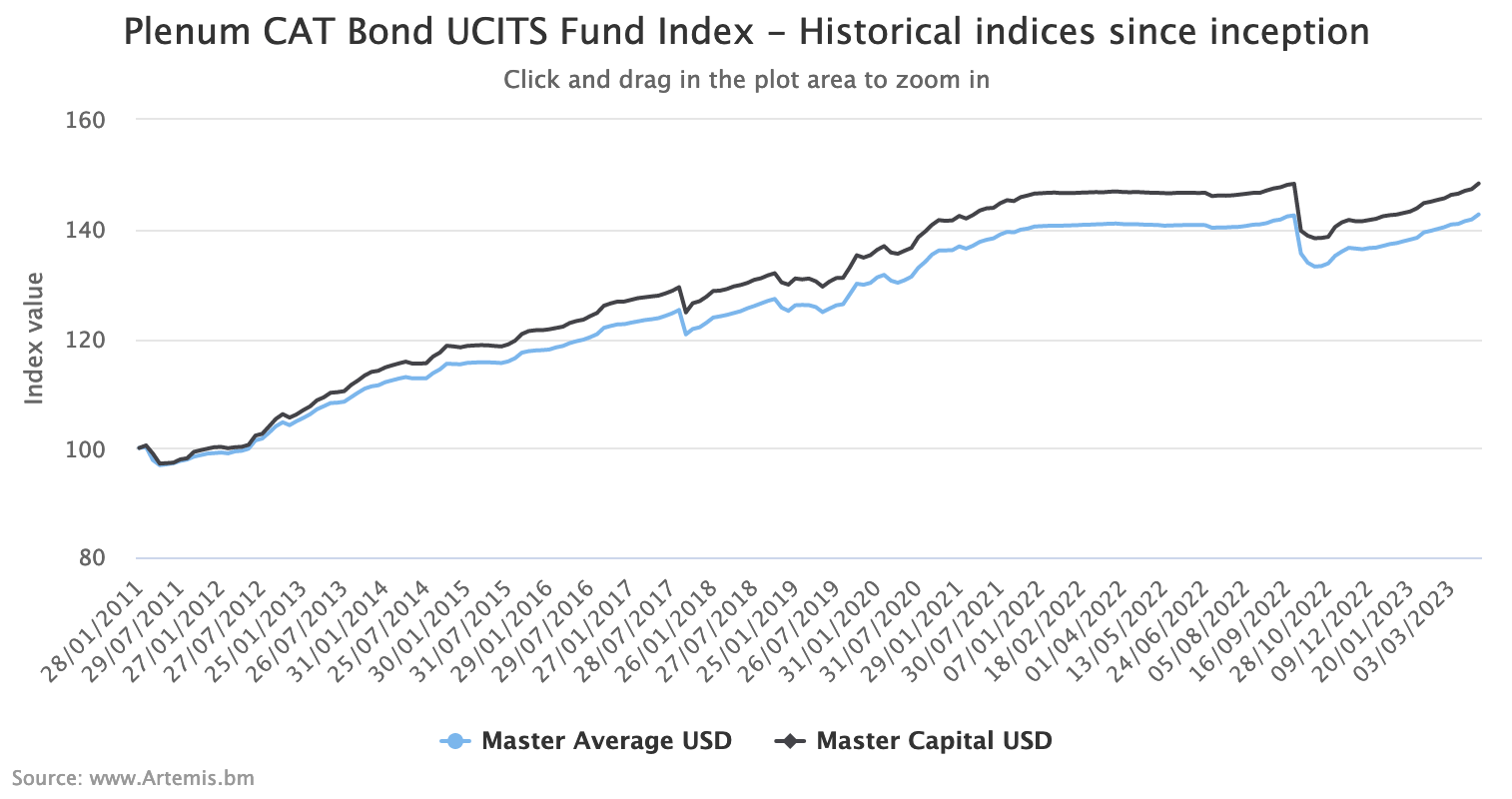

It’s a very impressive start to the year for catastrophe bond fund returns, far eclipsing any previous first-quarter recorded by this UCITS cat bond fund index, which tracks cat bond fund performance data back to 2011.

As we reported recently, the lower-risk cohort of UCITS catastrophe bond funds had recovered back to a level last seen before hurricane Ian recently.

Now, the Master Average and Master Capital Indices of UCITS cat bond funds has also achieved this, while the higher-risk cohort of cat bond fund strategies is very close to surpassing the level seen prior to hurricane Ian, a testament to the cat bond market recovery following that major insurance and reinsurance market loss event.

Since hurricane Ian, which is really a half-year performance for these Indices, the Master Average UCITS cat bond fund Index has now returned 5.28%, while the Master Capital UCITS cat bond fund Index is now up by 6.19% since the end of September 2022.

That’s a very strong half-year performance for cat bond funds and while a significant proportion of this was from recoveries in value of positions that got heavily marked down after hurricane Ian, on a go-forward basis the higher spreads of new issues should begin to deliver an equally impressive return for the months to come.

Overall, the Plenum CAT Bond UCITS Fund Indices are now back at an all-time high, having recovered back to the levels last seen prior to Ian.

Over a rolling-12 months period to the end of Q1 2023, the Master Average UCITS cat bond fund Index is now up 1.26%, but it is the lower-risk UCITS cat bond fund strategies that have performed the best, with that Index up an impressive 1.57% for the last 12-months, despite the spread widening seen in 2022 and the impact of hurricane Ian. A very impressive performance.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Analyse interactive charts for this UCITS catastrophe bond fund index.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.