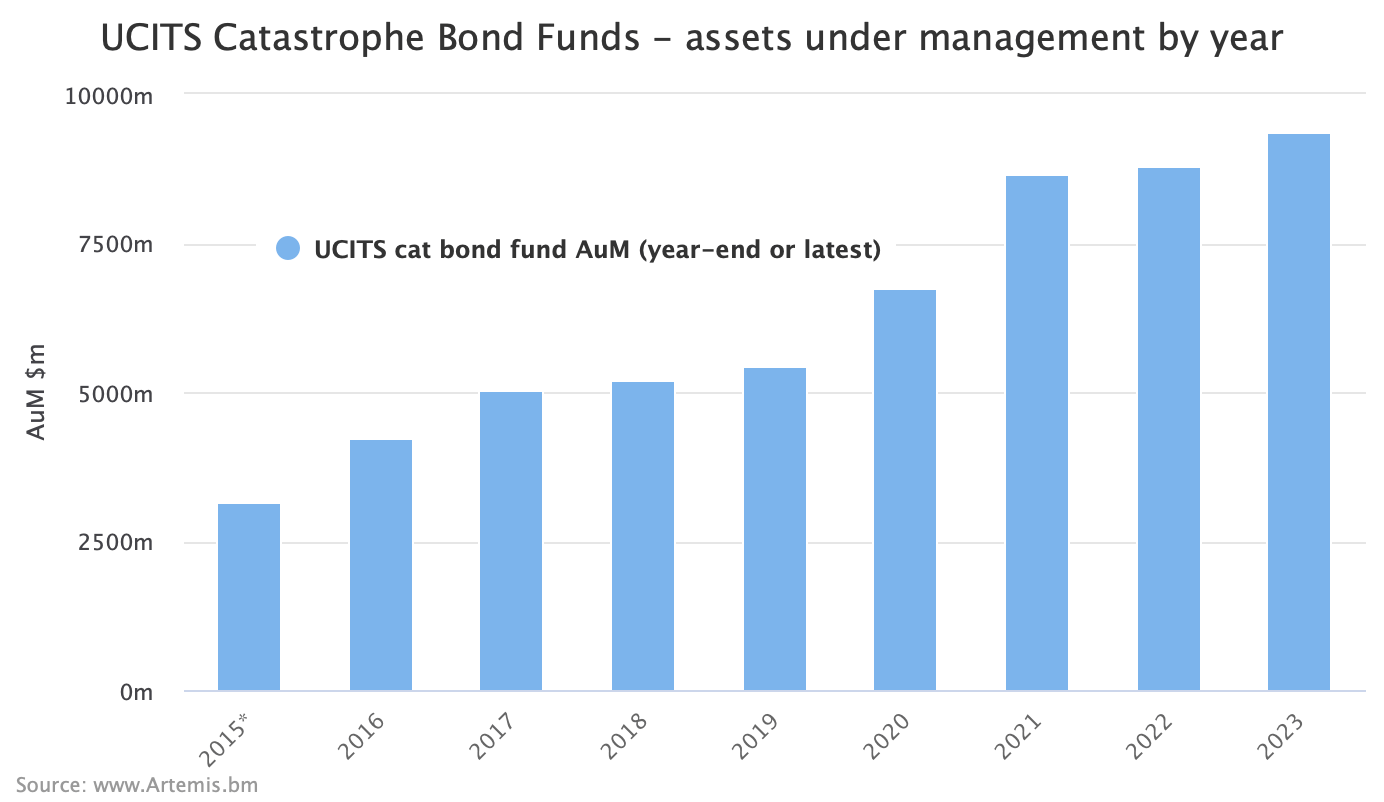

Inflows to the catastrophe bond market and recoveries in values of certain cat bond positions through the first-quarter of 2023, have driven the combined assets under management of the main UCITS cat bond fund strategies 7% higher to a new record of $9.37 billion.

The overall assets under management (AuM) of the main UCITS catastrophe bond funds rose by more than $590 million during the first-quarter of 2023.

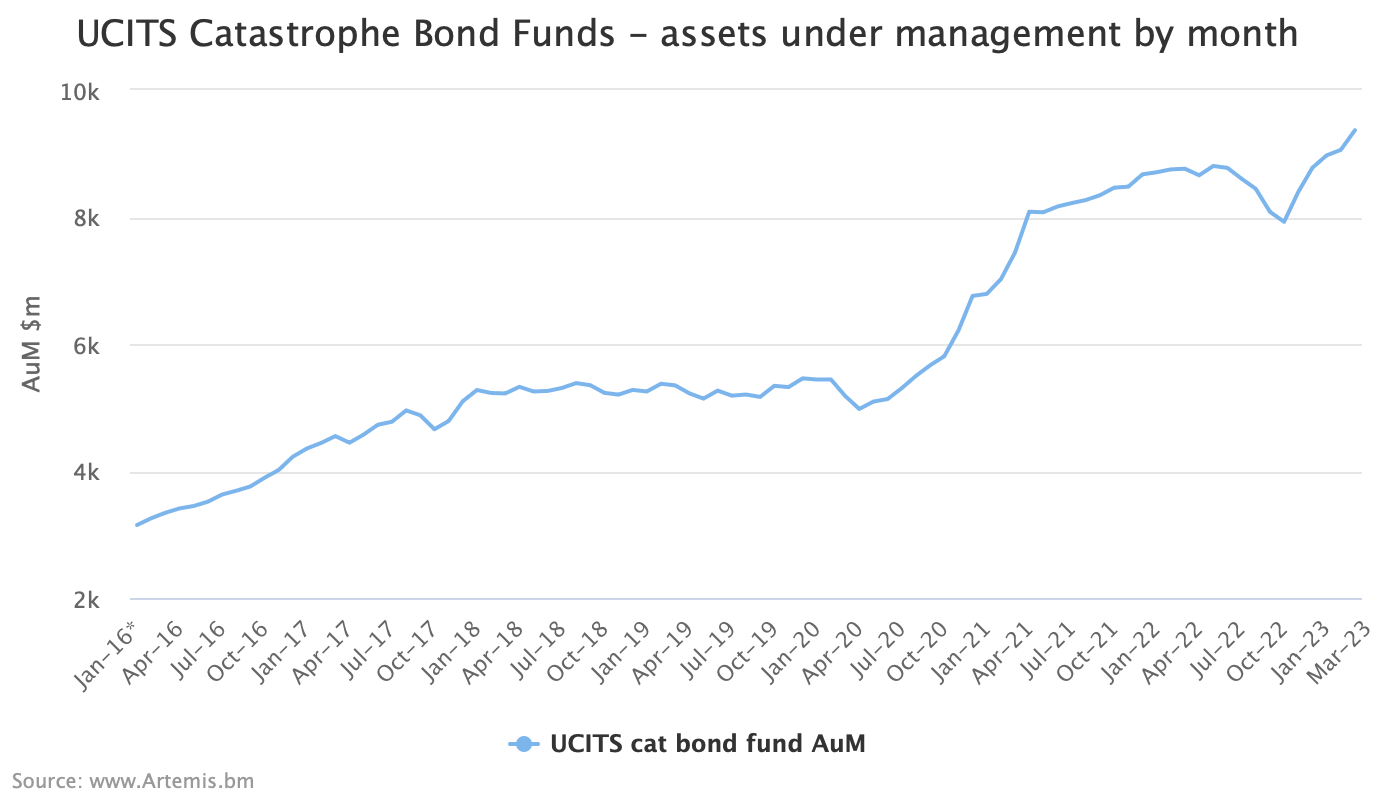

This figure has been rising now since October 2022, after a combination of spread widening and the effects and impacts of hurricane Ian drove the UCITS cat bond fund AUM figure down to just $7.92 billion.

Recovering valuations of cat bond positions that had been severely marked down in the wake of hurricane Ian, plus recovering values of many other cat bonds affected by spread widening, as well as new cat bond investor inflows, have together now added over $1.44 billion back to the UCITS cat bond fund assets total in just five months.

The chart below shows UCITS cat bond fund AUM to the end of Q1 2023. Click on the chart to view an interactive version.

In March 2023 alone, these UCITS cat bond funds added an impressive $309 million in new reported AUM.

That is the largest increase in some months, that doesn’t appear to be solely driven by recoveries after Ian (much of that coming before), so this what looks like fresh cat bond capital injection to the market goes a long way to explaining why the execution, in terms of pricing, has been very strong for many of the sponsors visiting the cat bond market in Q1 2023.

Read our new cat bond market report for more details on quarterly issuance.

This second chart, below, shows UCITS catastrophe bond fund assets under management by month and here you can clearly see the strong recovery in values post-hurricane Ian, as well as the accelerated growth now being seen in 2023 with new inflows also contributing to the total. Click on the chart to view an interactive version.

This UCITS cat bond fund AUM data shows that assets grew by almost $606 million over the 12-month period to the end of March 2023, only slightly more than was seen in just the last quarter.

But, if we look a little further back we can see that the group of UCITS cat bond funds increased their assets under management by over $1.92 billion in the last two years.

As ever, growth in assets under management of these cat bond funds is not even.

Twelve Capital’s UCITS cat bond strategy, the Twelve Cat Bond Fund has grown its AUM by almost 12% just in the first-quarter of 2023, rising from $2.14 billion at the end of 2022 to $2.39 billion at March 31st 2023.

However, the fastest growing cat bond funds, in percentage terms, were the Plenum Investments managed Plenum CAT Bond Dynamic Fund which added over 23% in AUM and the Solidum CAT Bond Fund which added an impressive 26% in AUM.

The largest UCITS cat bond fund at the end of Q1 2023 was the Fermat Capital Management portfolio managed GAM Star CAT Bond Fund at $2.67 billion, followed by the Schroder GAIA Cat Bond Fund at almost $2.43 billion, then the Twelve Capital Cat Bond Fund at $2.39 billion.

As a group, the three largest UCITS cat bond funds now hold a combined AUM of $7.49 billion, making up some 80% of the total across the 15 cat bond funds tracked in this data.

With catastrophe bond issuance set to be particularly brisk over the coming months, but scheduled maturities also set to be high, it’s going to be fascinating to see how the assets under management of this group develop through the second-quarter of the year.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.