Tremor Technologies, the insurtech operator of a programmatic risk transfer marketplace, is targeting the catastrophe bond issuance process with a new product launch, believing Tremor Issuer™ can make the primary cat bond issuance process more streamlined.

The goal is to put its already successful reinsurance and risk transfer placement technology to work in delivering best execution for catastrophe bond issues.

Powered by Tremor’s existing Panorama marketplace technology, Tremor Issuer™ is an online application specifically tailored for the catastrophe bond market and can be accessed online by investors, issuers, bankers and brokers.

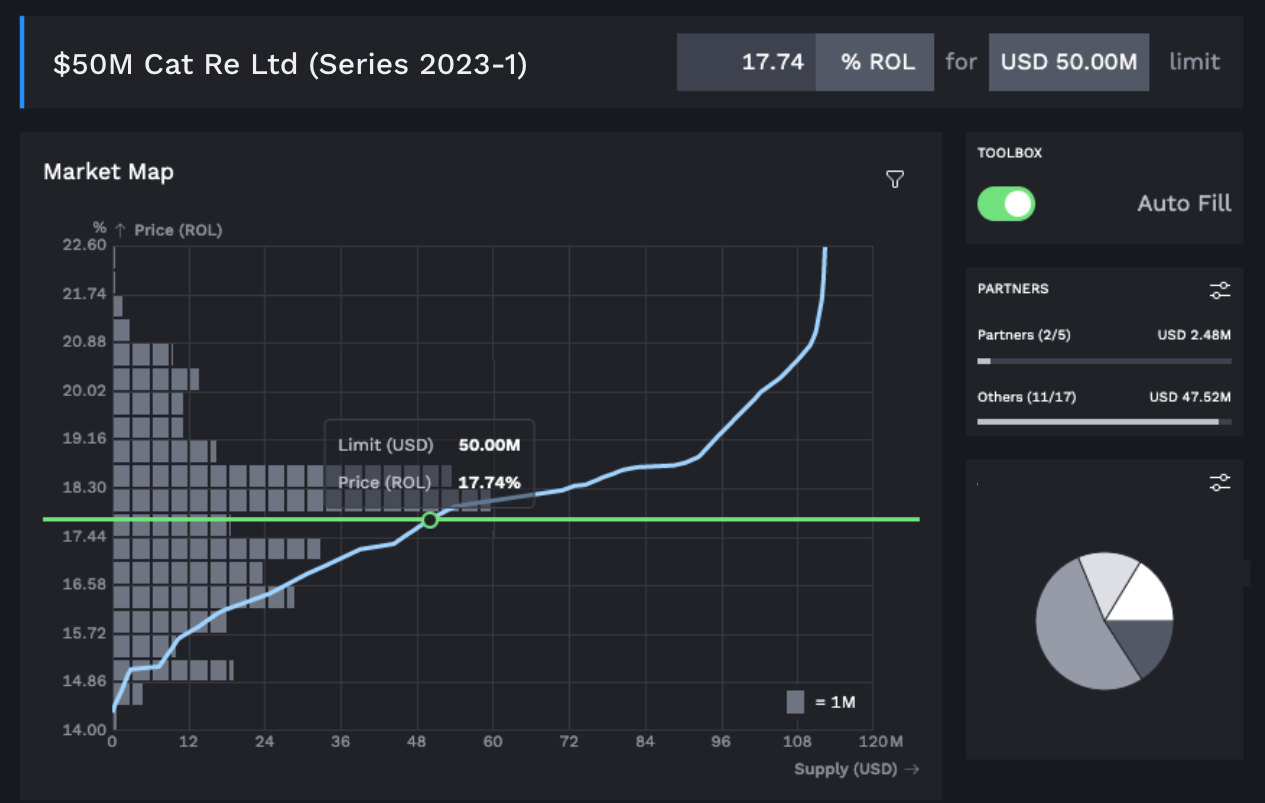

Sean Bourgeois, Tremor’s CEO explained the rationale behind the new cat bond focused product launch, “In the last two weeks alone, we have seen four cat bonds price 15% or more below initial guidance. While this signals more capital coming back into the market which is great to see after last year’s market challenges, it also confirms that the original guidance for these bonds was extremely poor. Could prices have been even more competitive? A traditional issuer will never know because the process is negotiated rather than powered by competitive market forces.

“The clearing price of a bond issued today is determined when the phone gets put down, not by economics. Tremor Issuer™ will vastly improve price discovery and allocation for the issuance of cat bonds as we work with all sides of the industry to modernize the cat bond market.”

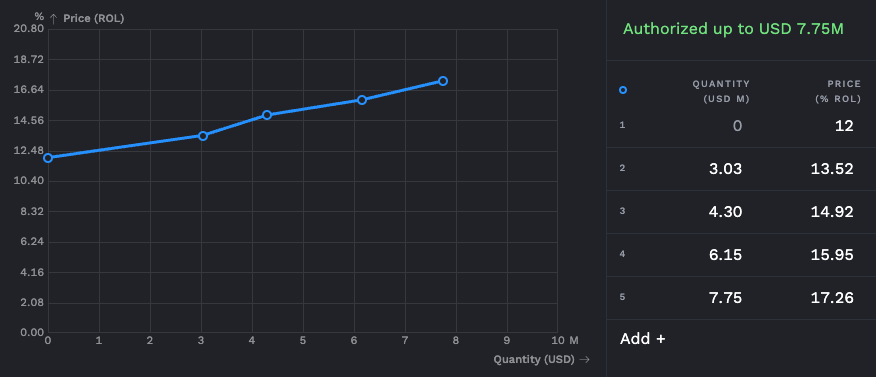

Using the new cat bond platform, investors can bid on bonds that are being offered by banks and brokers by expressing rich preferences for their desired quantities, prices and important contingencies confidentially, Tremor explained.

After receiving all the investor bid and preference information, Tremor’s new technology offering compiles all of this and brings together the aggregate supply.

“The issuer gets to see the entire, most competitive version of the market for their bond powered by competitive market forces, whereby optimal price is competed for and true equilibrium is revealed vs. guessed at and negotiated,” Tremor explained.

Tremor believes that its Panorama platform can provide best execution for catastrophe bonds.

The company said that as the issuance process can take many weeks, while the negotiation process to establish down terms and allocation can be laborious, its technology can help to dramatically shorten this process, while coming to the optimal solution based on true and expressed investor appetite.

“The Tremor Issuer™ process takes hours and all participants can be confident that they will receive what they have requested – no guesswork required. The net result is vastly improved price and cost efficiency for the entire market,” the company said.

Tremor has set up a new new regulated subsidiary, Tremor Capital Markets, LLC, to offer this new cat bond issuance platform through as an introducing broker.

Using digital technology to derive best execution in pricing and allocation for catastrophe bond issues is an interesting concept.

As our readers will know, cat bonds tend to be marketed with a price range, which can often end up being raised, lowered, narrowed, or expanded, based on investor feedback, resulting in the need for second sets of bids to be received and aggregated.

Using technology to solve for the best price and allocation, while allowing issuers to define what is most important to a sponsor, could make this process faster and simpler, enabling investors to express much richer preferences, for their desired quantities at a specified range of price points.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.