No immediate cat bond impact expected from Japan earthquake: Plenum

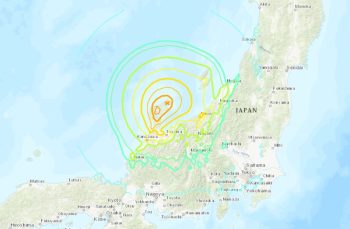

2nd January 2024The magnitude 7.5 earthquake that struck in Ishikawa prefecture on the west coast of the Japanese main island of Honshu yesterday, is not expected to have an immediate catastrophe bond market impact, Plenum Investments has said.

Read the full article