In finalising the insurance and reinsurance industry loss estimate for Japanese typhoon Nanmadol, which struck the country in September 2022, catastrophe loss data aggregator PERILS AG has lowered the total to JPY 125.9 billion, while also saying that its data is increasingly being used in Japanese ILW loss triggers.

The finalised estimate for typhoon Nanmadol is down from the JPY 129.6 billion estimate from March 2023, which was the last PERILS update.

The finalised estimate for typhoon Nanmadol is down from the JPY 129.6 billion estimate from March 2023, which was the last PERILS update.

At today’s currency rates, the finalised typhoon Nanmadol industry loss estimate of JPY 125.9 billion works out at roughly US $850 million. It would have been nearer US $885 million at the time the storm struck.

PERILS estimate includes property losses falling to Japanese non-life insurers only and does not include losses sustained by the cooperatives insurance industry (Kyosai).

The estimate does not include losses from motor physical damage, despite this being a factor that is covered in many reinsurance and catastrophe bond arrangements, or goods covered by transportation-related policies.

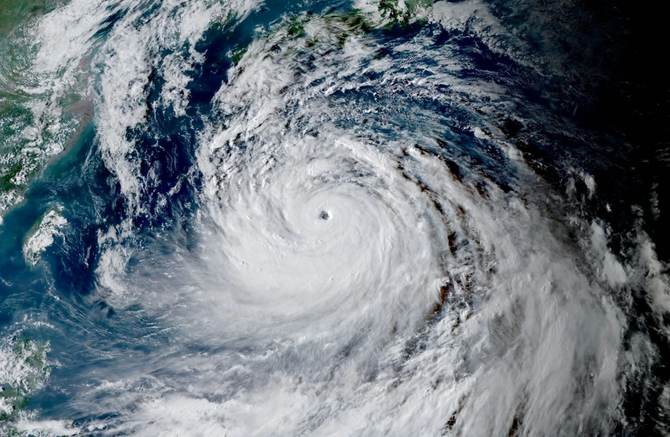

Typhoon Nanmadol, known as Typhoon No. 14 in Japan, impacted the islands of Kyushu and Shikoku in southern Japan and the western and central regions of Japan’s main island of Honshu from 18th to 20th September 2022.

Most of the losses from typhoon Nanmadol impacted the island of Kyushu, with 75% of the total industry loss falling to that region of Japan.

PERILS noted that the overall size of the industry loss was not exceptional for the Japanese non-life insurance industry, despite very strong wind gusts of up to 183km/h and rainfall of up to 904mm within a 72-hour period with Nanmadol.

As we reported at the time Nanmadol struck, insurance-linked asset manager Twelve Capital warned that losses from typhoon Nanmadol would likely be sufficient to attach some higher-risk reinsurance layers, while fellow ILS manager Plenum Investments said the typhoon wasn’t severe enough to trouble catastrophe bonds.

Rating agency AM Best had also said that reinsurance would buffer Japanese insurance carriers against losses from typhoon Nanmadol.

Takashi Goda, Senior Advisor for PERILS in Japan, commented, “We are very pleased to be able to present our fourth and final loss report for Typhoon Nanmadol. It is again based on data directly collected from insurance companies representing the vast majority of the Japan general insurance industry. We are deeply grateful for their support and remain committed to providing value in return through our high-quality and systematic exposure and loss data for Japan.”

Dalida Bachmann, Head of Client Relationship at PERILS, added, “In addition to PERILS data being used for R&D purposes, our industry loss figures serve as triggers for risk transfer products. We are therefore particularly happy to report that since our last communication on Typhoon Nanmadol in March, there have been several new ILW contracts using PERILS Japan as the source for the industry loss trigger. It is confirmation that our data can facilitate the increased flow of risk capital into the Japan Cat market, similar to many other markets covered by PERILS.”

Lukas Wissler, Product Manager at PERILS, also said, “One value in providing both exposure and loss data lies in the fact that losses can be put in relation to sums insured and damage degrees can be calculated. The correlation of these damage degrees with gust or rainfall metrics provides new insights into the vulnerability of insured assets which ultimately enhances market understanding of Japan typhoon risk.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.