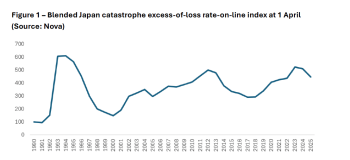

Cat bonds strategic for Japanese sponsors, AM Best says. But M&A could influence issuance

18th September 2025Japanese reinsurance cedents continue to access the insurance-linked securities (ILS) market for capacity with the catastrophe bond the preferred structure, underscoring the strategic role of cat bonds, AM Best has said. But changes coming to the Japanese insurance market through M&A could influence the amount of risk flowing to the ILS market, at least for […]

Read the full article