Our sister publication Reinsurance News surveyed a segment of its industry readership as to how high they anticipate the insurance and reinsurance market loss from the recent severe storm and tornado outbreak will rise, with the largest percentage opting for between $2.5 billion and $5 billion.

Official industry loss estimates are still lacking, aside from Karen Clark & Company’s around $3 billion from earlier this week.

But analysts and other commentators have said the industry loss may reach higher, with some suggesting it could even prove as costly as the 2020 Midwest state Derecho event, that resulted in industry losses of around $7 billion.

So, our team decided polling the reinsurance focused readership of Reinsurance News would provide a reasonable representation for what the broader industry practitioner base is anticipating.

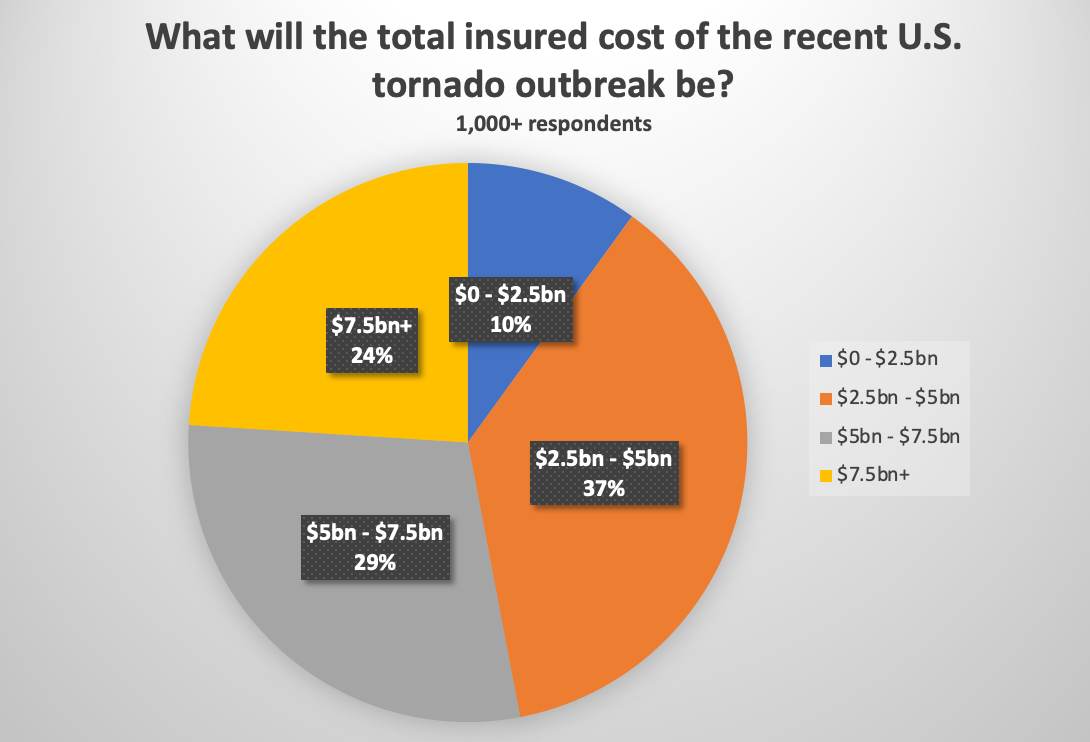

More than 1,000 people responded to the survey, that asked how high the tornado industry loss may rise, giving options in increments of, up to $2.5bn, from $2.5bn to $5bn, $5bn to $7.5bn, or over $7.5bn.

Interestingly, while the largest percentage opted for the insurance and reinsurance market loss to fall between $2.5 billion and $5 billion, which seems a reasonable banding to put it in, the majority actually opted for a loss of greater than $5 billion.

Just 10% of the more than 1,000 respondents opted for the eventual industry loss from the tornadoes settling at below $2.5 billion.

The largest proportion, or 37%, opted for an industry loss of between $2.5 billion and $5 billion.

But, 29% opted for between $5 billion and $7.5 billion, while another 24% opted for the industry loss to rise above $7.5 billion.

So what to make from that?

The $2.5 billion to $5 billion mark seems to be where we’re hearing brokers and other industry facilitators are telling their clients to prepare loss reserves for, at this stage.

But there is a large number in the reinsurance industry that feel the eventual toll, once all of the damage from across the very wide area affected has been counted, could rise into the upper-end of the single-digit billions, it seems.

Interestingly, reinsurance broker Guy Carpenter has said that insured losses are estimated as high as the mid-single digit billions, which aligns with our survey majority response.

But the broker also cautioned on looking too much higher, saying that commentaries suggesting a loss as high as the 2020 Derecho, of around $7 billion, “are likely aggressive with the early knowledge of the event.”

It is still very early for a clear picture of a catastrophe loss with such a wide foot-print and with some set to bundle losses from severe weather on days either side with the tornado outbreak as well, it could be some time before the industry has an accurate picture of its exposure.

Also read:

– Significant tornado outbreak damages multiple U.S. states.

– Weekend tornado & storm losses to run into billions of dollars.

– Tornadoes to affect some aggregate cat bonds: Plenum.

– Tornado impact to ILS investors cannot be ruled out: Twelve Capital.

– US tornado toll likened to $7bn industry loss from 2020 Derecho.

– Tornadoes a multi-billion loss, a “limited portion” for reinsurance: Aon.

– US tornado & storm outbreak estimated a $3bn insured loss by KCC.

– Properties with reconstruction value of $3.7bn exposed to tornadoes: CoreLogic.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.