The reinsurance market is not in a hard market and in fact rate increases seen at the January 2021 renewal season are only seen as adequate by Moody’s, who believe that reinsurance prices must keep rising for adequate risk-adjusted returns to be achievable.

The rating agency said that the January 2021 reinsurance renewals were “favorable for reinsurers, but not a hard market.”

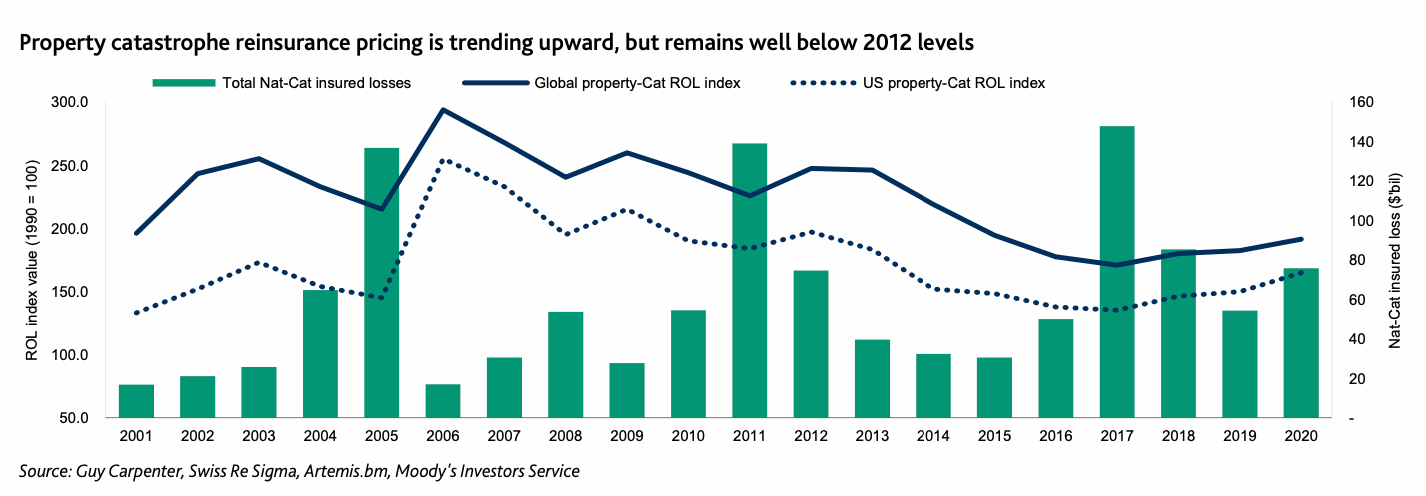

While the price of reinsurance, including property catastrophe cover, has been rising since 2018, it still is not at levels were reinsurers and of course insurance-linked securities (ILS) funds can be certain of delivering sustainable risk-adjusted returns, Moody’s says.

Of course, business model efficiency, cost-of-capital and leverage, among other factors, all make a difference here.

As some business models at the more efficient ends of the industry (often the alternative and ILS market end) may well find current rates and pricing more than adequate, in a risk-adjusted basis, while others at the more traditional end where expenses remain stubbornly high, may find risk-adjusted reinsurance pricing unsustainable across the cycle.

Part of the issue is that reinsurers are struggling to increase prices in areas of the market where losses haven’t been prevalent.

Moody’s says that, “Because the current upward pricing cycle is driven by risk perception and not capacity constraints, insurers have been more resistant to price increases on loss-free accounts where risk is perceived to be lower.”

When you look at regions like Europe, reinsurance rates remain barely at levels that can cover loss costs, let alone costs of capital and expenses plus a margin.

Of course, a key driver here is the big four European reinsurers, who underwrite their home region at low return levels and dominate Europe as a result.

Another factor that has prevented reinsurers and ILS funds from always getting the price rises they need, is the ability of both insurers and reinsurers to retain more risk.

Given the industry remains well-capitalised and new capital flowed in towards the end of 2020, many insurance and reinsurance carriers opted to retain more risk than cede it at higher pricing.

Of course this can raise earnings volatility Moody’s warns, so may not be a long-lived trend.

Overall, Moody’s believes rates need to continue rising in reinsurance, to provide sustainable returns.

“While the pricing trend is positive for reinsurers, prices still remain significantly below 2012 levels and will need to increase further to provide adequate risk-adjusted returns, particularly as risks for the sector have risen,” Moody’s warns.

As we’ve said many times, pricing needs to enable reinsurers and ILS funds to earn back their cost-of-capital, cover their loss costs, expenses and a margin, over the market cycle.

As a result of all of this, Moody’s is anticipating “broad-based price increases in April and July, the key renewal dates for Japanese and US reinsurance contracts, respectively.”

However, the rating agency cautions that, “the extent of price increases will be dependent on the balance between the supply of capacity and the demand for reinsurance coverage.”

Read all of our reinsurance renewals focused coverage here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.