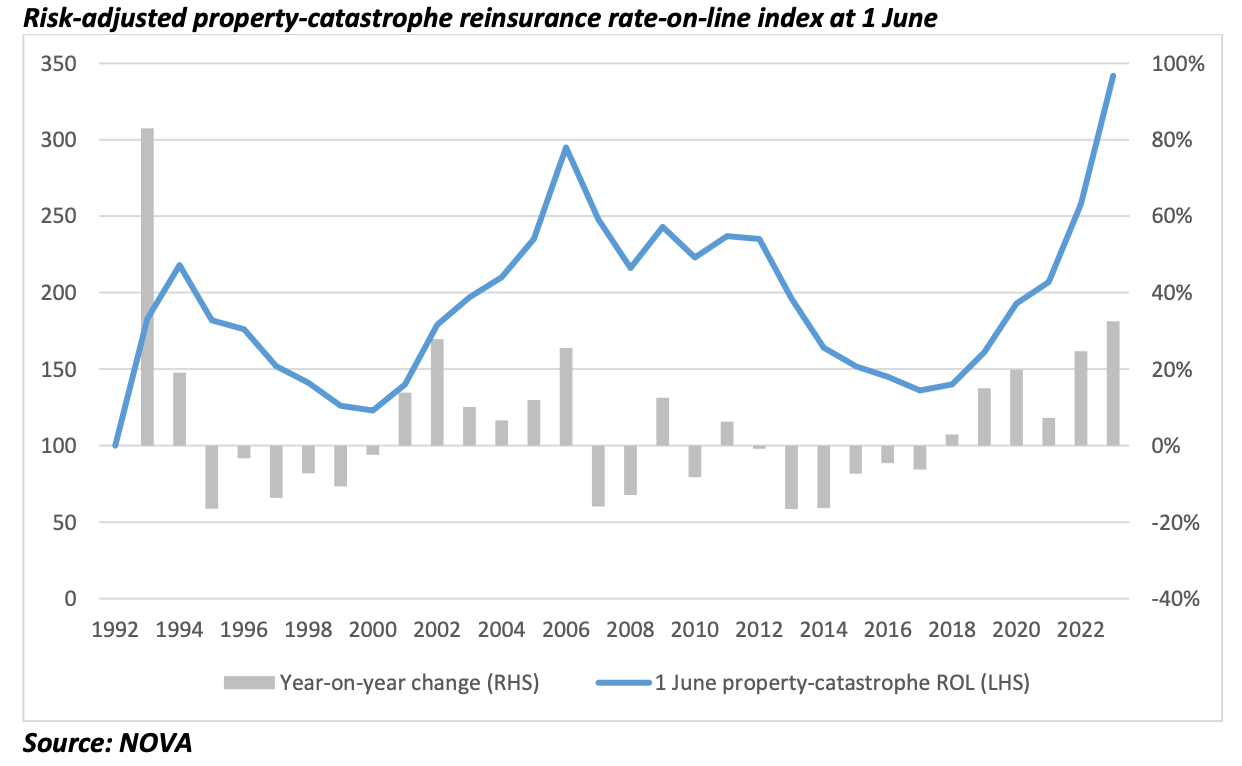

With the Florida reinsurance renewal now all but completed, broker Howden Tiger has said that risk-adjusted property- catastrophe reinsurance was pricing up by 33% on average at the 1 June renewals.

This continued rate hardening in the reinsurance market has helped to take Howden Tiger’s property catastrophe reinsurance pricing Index to its highest level since inception, the broker explained.

Property cat rates rose by a typical range of 25% to 40%, with variations by layer, Howden Tiger estimates, which follows the 25% rise in 2022, helping to drive the Index at 1 June to its highest level since inception.

“In this once-in-a-generation market, it is critical to ensure clients can secure the coverage they need,” Wade Gulbransen, Head of North America, Howden Tiger explained.

“Given strong rate hardening, the need for strategic planning and dynamic placement strategies has become paramount. This isn’t just about finding capacity, it’s about finding the right capacity that fits our clients’ risk profiles and financial objectives while adapting to an industry in transformation.”

Citing “enduring, low levels of capital to risk” Howden Tiger says that while this remains a factor, it is now starting to shift.

The broker said that loss-affected programmes saw increases exceeding 40% in some cases, depending on loss quantum and effect.

At the same time some higher layers of reinsurance towers also saw increases in excess of 40% year-on-year, as reinsurance markets sought to enforce new minimum rate-on-line thresholds and this was seen for both earthquake and wind covers, Howden Tiger said.

Early engagement was a critical factor in delivering successful renewals, with private placements a play for early capacity, and early strategic placements setting the tone as early as March, Howden Tiger further explained.

Around March, “Noticeable appetite for higher layer risks from both traditional and ILS capacity providers emerged,” the broker said.

Lower layer dynamics remained challenging at the renewals, with higher attachments and increased retentions, alongside higher pricing and additional reinstatement premiums.

Higher layers, meanwhile, were oversubscribed in some cases, but capacity was available for most, with the right terms, structures and pricing.

Read all of our reinsurance renewals news and analysis.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.