Insurance-linked securities (ILS) strategies focused on peak peril exposures deliver capital to the locations “where it is needed the most” in the insurance and reinsurance industry, so providing enhanced returns and supporting the traditional re/insurance market, ILS fund manager Twelve Capital has said.

A peak perils focused ILS strategy, be that in catastrophe bond or collateralised reinsurance form, delivers the capital directly to the locations and exposures where the traditional market experiences the highest capital requirements, so aligning the investors with the needs of traditional companies.

In a report, ILS and reinsurance focused investment manager Twelve Capital explained why peak peril exposures can deliver better risk-adjusted returns for ILS investments.

Peak perils typically describe the risks and regions where re/insurers have high concentrations of insured values that are exposed to major catastrophe events.

U.S. hurricane risk, which is the dominant risk in the ILS and catastrophe bond market, often poses the greatest contributor to tail risk for re/insurers, the ILS fund manager notes.

It is these tail risks that can drive high capital requirements for re/insurers, so as a result peak perils ILS or reinsurance focused on the major tail risk contributors can also command increased risk premiums as they help re/insurers meet their capital costs.

“In Twelve’s view, peak peril exposures tend to offer improved risk-adjusted returns within ILS and are typically better modelled and understood than other risks in the industry,” the investment manager said.

Twelve Capital notes that peak peril ILS strategies mean attempting to align capital markets investors with re/insurers exposure and so capital needs in the most effective manner.

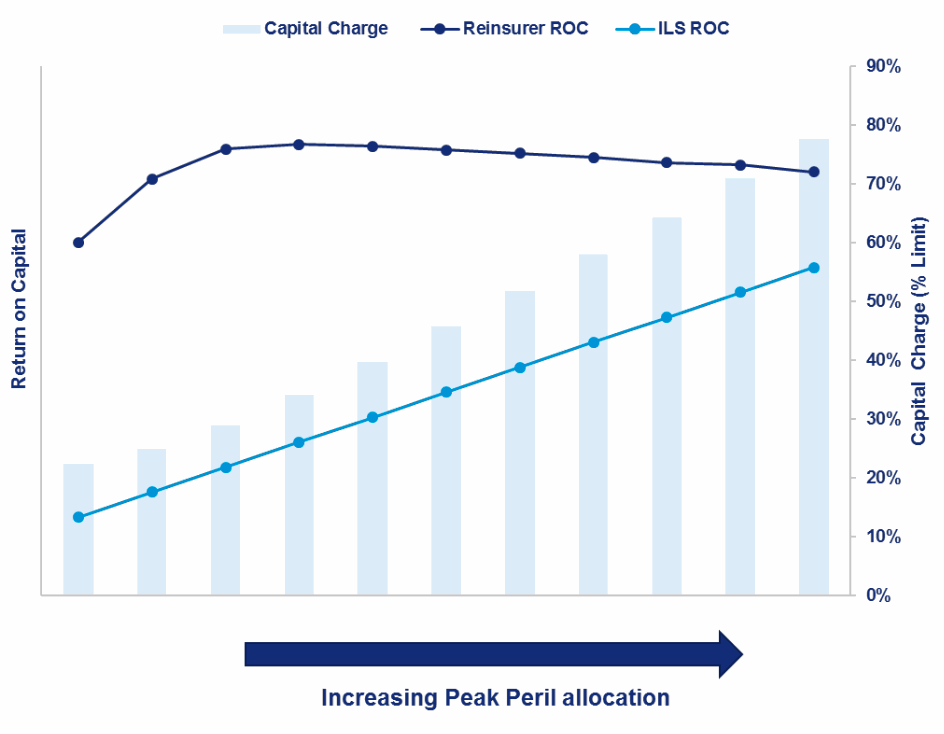

The ILS manager shared the below graphic which displays how reinsurers’ returns on capital decline as peak peril exposure increases, where as ILS return on capital continues to rise.

The diagram above shows: Comparison of return on capital (ROC) and capital charge for a theoretical property catastrophe reinsurance portfolio1 versus the ROC for a collateralised ILS portfolio both investing in the same underlying risk with an increasing allocation to peak peril exposure. Source – Twelve Capital.

When you consider the lower-cost of capital associated with ILS capacity from major global institutional investors, the above chart demonstrates why it becomes attractive for traditional insurance and reinsurance companies to leverage the ILS market to help them to underwrite more business in a peak peril zone.

It would be really interesting to take this chart further, using a capital model of a re/insurer, to show how bringing third-party capital from the ILS market into its underwriting can enable it to write more peak peril risk while benefiting from the elastic and shock-absorbing nature of peak peril ILS capacity.

This is one way that peak peril ILS strategies can align themselves with the re/insurers they protect, by acting as supportive capital for operations in these peak peril zones.

Twelve Capital explains that, “From a theoretical perspective, a pure property catastrophe focused reinsurer will start to experience reduced returns on equity when capital charges become too punitive as allocation to peak peril exposure increases. In contrast, the higher reinsurance cost of capital of peak peril regions drives attractive dollar-for-dollar risk-adjusted returns for collateralised ILS investors, who do not benefit from levered (re-) insurance balance sheets.

“An allocation to peak peril (re-)insurance exposure therefore delivers attractive low correlated risk-adjusted target returns close to the cost of (re-)insurance equity (see chart above) and, consequently, should form a core strategic allocation within an ILS portfolio.”

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.