Morocco’s government received a $275 million payout from its parametric earthquake insurance policy after the devastating earthquake that occurred in 2023 and the parametric policy is being renewed again, to provide a similar level of cover for 2024, we understand.

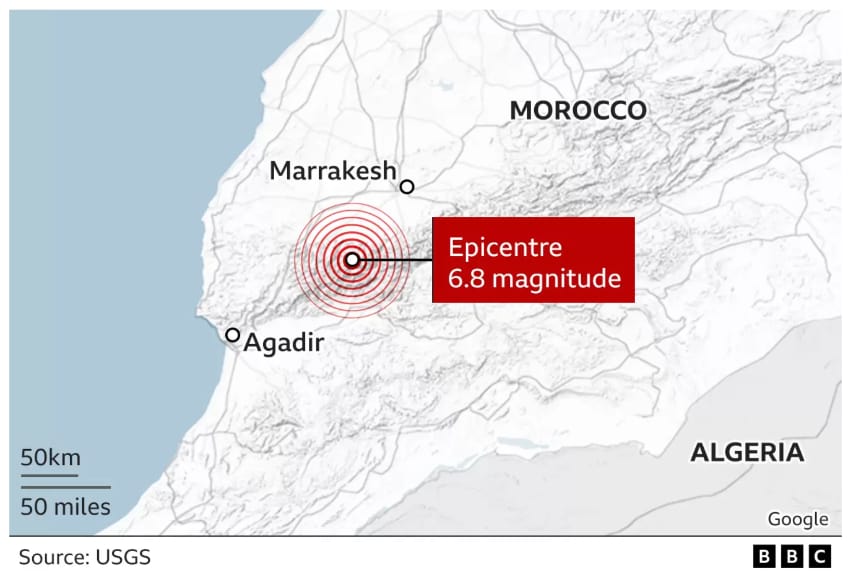

The North African country of Morocco was struck by a magnitude 6.8 earthquake in September, that had an epicentre to the south of Marrakesh and caused around 3,000 deaths.

The North African country of Morocco was struck by a magnitude 6.8 earthquake in September, that had an epicentre to the south of Marrakesh and caused around 3,000 deaths.

As we reported at the time, the earthquake caused economic losses that were estimated as up to 8% of the country’s GDP, but with insurance and reinsurance penetration limited, the protection gap from this quake in Morocco was wide.

The government of Morocco made a full recovery under its parametric earthquake insurance arrangement, which had been in-force since 2019.

This catastrophe risk insurance arrangement supported the financing needs of the Solidarity Fund against Catastrophic Events (FSEC) that was established in Morocco at the same time.

The insurance component of Morocco’s disaster risk financing system was also backed by global reinsurance capital and being parametric in nature, it was able to payout relatively quickly after the earthquake, much quicker than most aid sources would have been available.

The Solidarity Fund is designed to provide liquidity to the local insurance industry after a disaster event, drawing on global reinsurance market resources through the $275 million parametric policy.

A full payout was received, which helped ensure money got to the affected regions as quickly as possible, including to the uninsured population that the Solidarity Fund was designed to cover.

We now understand that the parametric earthquake policy has been renewed, to support the needs of the Solidarity Fund should future damaging earthquakes occur.

Update: We’ve now learned from the Moroccan Solidarity Fund for Catastrophic Events that the renewal is in progress, still in negotiation and so has not yet been confirmed, although is expected to be in due cours.

Morocco’s Solidarity Fund has been structured so that it can draw on private market resources for its reinsurance needs and we understand a catastrophe bond has been under discussion for some years, with work ongoing to try and provide more capacity to underpin the Fund from the capital markets.

We’re also told that the World Bank has been working on a flood insurance solution for Morocco as well, with a parametric trigger also having been explored, while the Global Risk Financing Facility (GRiF) is also involved in efforts to extend Morocco’s risk protection.

The way Morocco has embedded insurance risk financing into its disaster financing needs shows how private sector resources can be mobilised to assist a government in making insurance-type financial protection more widely available, even in a country where insurance penetration rates are in the low single-digits.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.