The latest catastrophe bond from U.S. primary insurer Safepoint Insurance Company has had its settlement date pushed back into the second-quarter, we’re told, but still the catastrophe bond market is set to reach a new first-quarter issuance record, with the total likely to be $3.84 billion or greater.

We understand that Safepoint’s $165 million multi-peril Manatee Re II Ltd. (Series 2018-1) catastrophe bond, that had been expected to complete before the end of March, has now been pushed back into April after new information about the insurers reinsurance program and the expected reduction in its FHCF participation was distributed to potential investors.

Had the Manatee Re II transaction settled this month then first-quarter 2018 cat bond issuance would have reached $4 billion for the first time.

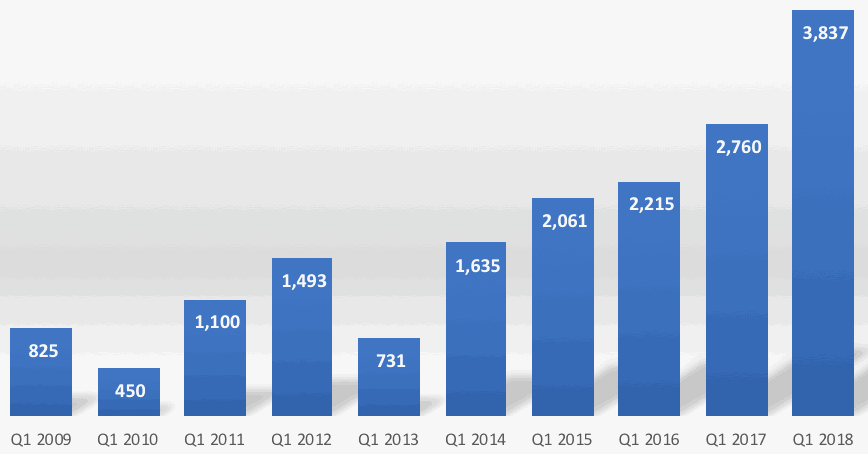

But as it is, there is still sufficient cat bond issuance this in Q1 2018 to set a new record by over $1 billion. If all the currently marketing deals remain at their latest sizing then cat bond market issuance this quarter will reach a new record of $3.84 billion, perhaps greater if any more upsizing occurs.

First-quarter cat bond issuance trends reflect the growth of the insurance-linked securities (ILS) market, as re/insurers look to the capital markets for reinsurance protection, with steady increases seen in each of the last five years, according to data from Artemis’ cat bond transaction directory.

The fact that 2018 catastrophe bond issuance is set to break more records is testament to the resilience of the cat bond market against the backdrop of the major hurricane, earthquake and wildfire losses of 2017, as well as the continued strong interest in the ILS asset class from institutional investors.

There are still four transactions set to complete before the end of this month, the now $320 million Akibare Re Ltd. (Series 2018-1), the $200 million Kizuna Re II Ltd. (Series 2018-1), the $424.4 million Radnor Re 2018-1 Ltd. and the $400 million Sanders Re Ltd. (Series 2018-1).

Of those, the Sanders Re 2018-1 cat bond from sponsor Allstate could still increase in size before pricing, which could take the Q1 2018 cat bond total ever closer to $4 billion.

But even at $3.84 billion this Q1 will be the strongest on record and set up 2018 catastrophe bond issuance for another very strong year.

At the beginning of the year brokers were largely forecasting around $8 billion of issuance for 2018. But with the pipeline currently looking strong and cat bond pricing looking extremely competitive with traditional reinsurance, it’s possible we could see double-digit billions of issuance for the second year on the run.

Track catastrophe bond market issuance and developments using the Artemis Deal Directory, Cat Bond Market Dashboard, our data room which breaks down the outstanding market for you and our free to download quarterly Cat Bond Market Reports.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.