The longevity swap market could see a record volume of transactions in 2020 as market conditions look set to make hedging longevity risk particularly conducive, while insurance and reinsurance capital abundant and appetite for large longevity risk transfer deals high.

So says insurance and reinsurance broker Willis Towers Watson (WTW), who believes that pension schemes may be in a rush to lock in longevity swaps and other risk transfer or reinsurance transactions while life expectancy assumptions are at a low.

So says insurance and reinsurance broker Willis Towers Watson (WTW), who believes that pension schemes may be in a rush to lock in longevity swaps and other risk transfer or reinsurance transactions while life expectancy assumptions are at a low.

In 2019 longevity swap activity has been a little slower than was anticipated, but a few larger and landmark deals have helped volumes reach around the UK £10 billion mark, which is where WTW had anticipated them being.

This was an uptick on recent years, 2017 saw £6.4 billion and 2018 £4.7 billion, but some had forecast 2019 would have seen more activity.

However, a number of transactions that could have been longevity swaps ended up being reinsurance transactions, we understand, which resulted in a slightly lower level of activity than expected.

The HSBC Bank UK Pension Scheme transaction, which was transacted with Prudential using a Bermuda captive and reinsurance market backing, contributed £7 billion of the 2019 total longevity swap volume.

Longevity hedging remains attractive for pension schemes looking to hedge out the risk of their members living longer than forecast and while insurance and reinsurance capital remains abundant and competitively priced, there is a good chance we see a greater volume of issuance in the coming year.

Bulk annuity activity reached around £40 billion for 2019, but in 2020 this is expected to fall slightly to around £30 billion.

The reason being a more balanced market, which WTW believe will mean fewer mega-deals and more opportunity for smaller pensions to transfer their scheme risks.

The start of the year is expected to be particularly busy, as pensions that failed to get to market in 2019 look to lock down their risk transfer requirements early on, WTW said.

Ian Aley, Head of Willis Towers Watson’s Transactions team, commented, “This year has seen a remarkable number of mega deals, so although we expect a reduction in the number of large deals through 2020, there is certainly lots of ‘pent up’ demand in both the longevity swap and bulk annuity markets.

“Larger schemes should consider partnering with insurers to find optimal assets to match their liabilities. There is great opportunity for smaller schemes to find more traction in the market if they can focus on streamlining processes, with good preparation, governance and pre-agreed legal terms.”

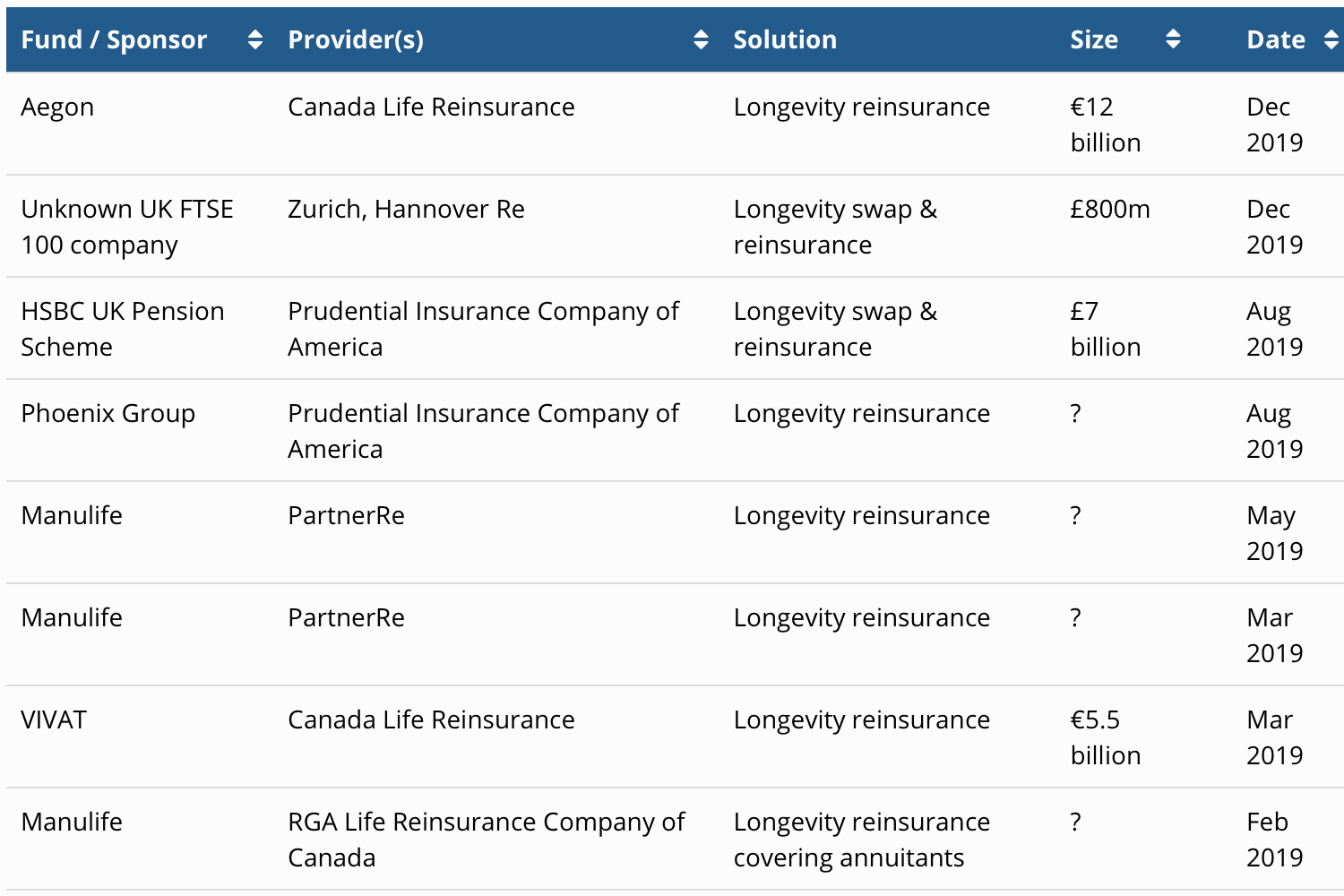

Details of the longevity risk transfer, reinsurance and longevity swap arrangements recorded by Artemis in 2019 can be seen below. Click the image for more details on every transactions.

Read details of many longevity hedging transactions in our longevity swap, reinsurance and risk transfer deal directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.