The development of sophisticated catastrophe risk models has been integral to the growth of the insurance-linked securities (ILS) market, making it easier to understand and visualise risk exposures, roll up portfolios and identify insurance and reinsurance linked investment opportunities.

In a recent report that looked at the use of catastrophe risk models and found that they are challenged when it comes to estimating losses from complex hurricane events, reinsurance broker JLT Re highlighted that without risk models it would perhaps have been hard to see the ILS market developing as it did.

Importantly, as the main risk modelling vendors technology advanced in the 1990’s their products became the accepted third-party view of risk for many and this provided a valuable way for the earliest of ILS fund managers to communicate their portfolio and fund risk metrics to investors.

This helped the catastrophe bond market to emerge, as a third-party and relied upon source of risk analytics was a requirement for broadly marketed 144A securities.

Some of the first ILS transactions were completed without a third-party model vendor’s involvement as a contracted service provider, instead the ceding companies provided their own modelling data. That is now akin to how private deals are transacted, where as every 144A catastrophe bond features one of the leading catastrophe risk modellers.

Catastrophe risk modelling began in the early 1990’s, following the impacts of hurricane Andrew which was at the time the largest insurance and reinsurance market loss in history.

After that, the ILS market began to develop and grow, but it wasn’t really until roughly 2005 that general acceptance of catastrophe risk models helped to increase the confidence of third-party investors in the pricing of catastrophe risk, JLT Re explained.

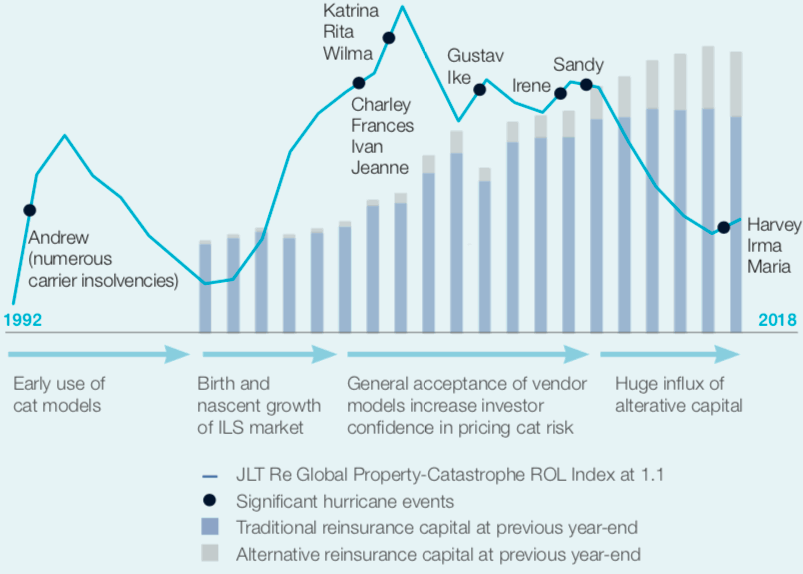

The graphic below from JLT Re shows the development of the catastrophe risk modelling industry alongside reinsurance and alternative or ILS capital growth.

Key Developments in the Property-Catastrophe Market (Source: JLT Re)

After catastrophe risk models became embedded in the day-to-day underwriting and risk management practices of insurance and reinsurance firms, their use enabled the more rapid development of the ILS market.

JLT Re explained, “Catastrophe models facilitated the rapid expansion of the insurance-linked securities (ILS) market as institutional investors utilised recalibrated models (post-Katrina and Ike) to price catastrophe risks.

“It is no exaggeration to say that the ILS market in its current form would not exist today without catastrophe modelling.”

So catastrophe models and the ability to better understand and analyse catastrophe risk has been responsible for part of the growth of ILS and alternative capital, so to they are then responsible for the “structural change in how capital is provided to the market and in how much capital can enter (and exit) the sector,” JLT Re said.

As a result, catastrophe models have enabled ILS capacity to grow rapidly and the reinsurance broker is not overstating the facts when it says, “Investor confidence in the current suite of catastrophe modelling applications has underpinned this growth.”

But the catastrophe models do remain imperfect, providing useful directional assistance in understanding and pricing risk, but not being the holy grail when it comes to deriving the potential impacts of major catastrophe events, as JLT Re’s full study explains.

But they have clearly been an enabler for ILS market growth, without them it is hard to imagine an asset class of more than $100 billion of capital investing directly into insurance and reinsurance risks, or $36 billion of outstanding catastrophe bond deals.

With technology advancing all the time, the next generations of catastrophe risk models may be able to provide even more granular and accurate insights about risk and exposure, which could facilitate even more rapid growth of alternative capital and ILS.

A copy of the full study on catastrophe risk models can be downloaded over at the JLT Re website.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.