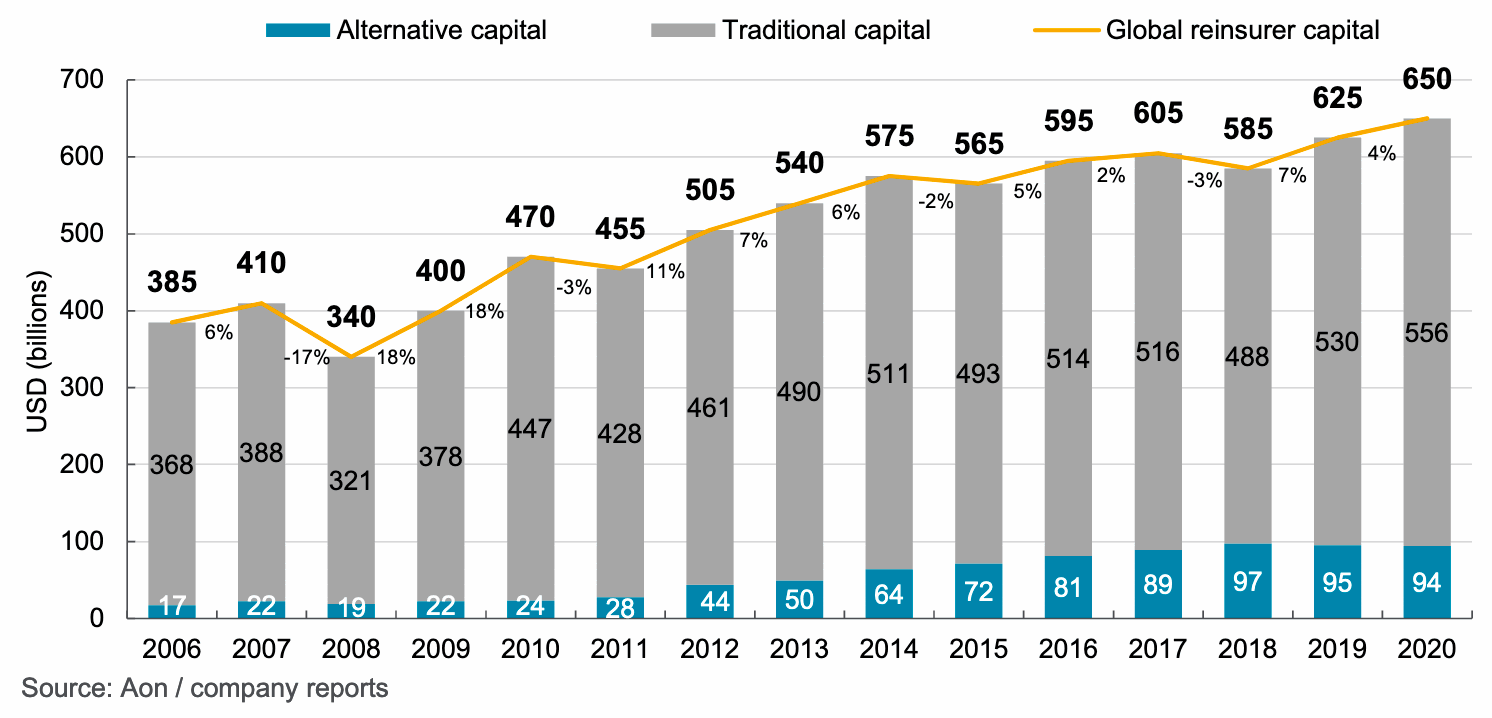

Alternative reinsurance capital levels, largely from insurance-linked securities (ILS), continued to rebound in the fourth-quarter of 2020, adding $2 billion to end the year at $94 billion, according to the latest data from broker Aon.

When Aon last reported on global reinsurance capital levels, the broker’s analysis showed that alternative capital, so the capital supplied by insurance-linked securities (ILS) funds and structures, as well as in instruments such as catastrophe bonds, collateralized reinsurance vehicles and sidecars, had begun to recover and added $1 billion in the third-quarter to reach $92 billion.

Now, updated data from Aon shows that alternative reinsurance capital grew further towards the end of last year, adding another $2 billion to reach $94 billion just in the fourth-quarter of 2020.

Overall, global reinsurance capital reached a new high at the end of 2020, rising by 4% to $650 billion, all of which growth was in the fourth-quarter according to Aon’s data.

Traditional reinsurance capital led the way, rising by 5% to $556 billion across the full-year 2020, the majority of which was in Q4.

Alternative capital, or ILS capital, is actually down year-on-year, having fallen from $95 billion at the end of 2019, to $94 billion at the end of 2020.

But that doesn’t portray the recovery seen in the second-half of 2020, as alternative reinsurance capital actually grew by $1 billion during the third-quarter to reach $92 billion and then by another $2 billion, or 2%, to $94 billion by the end of the year.

Which means ILS capital in the global reinsurance market has increased by 3% since the mid-year of 2020.

Aon noted that the funds actually available for deployment in the ILS fund and alternative capital sector remains somewhat below the headline figure, as trapped collateral issues remain after recent years of catastrophe losses.

A lot of the growth in alternative capital seen in late 2020 will have seen catastrophe bond fund managers the beneficiaries, as investors looked to absorb the high levels of issuance seen.

In 2021 we suspect the headline figure may have risen a little further, given continued strong demand for cat bond investments, as well as some small capital raises at private ILS funds.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.