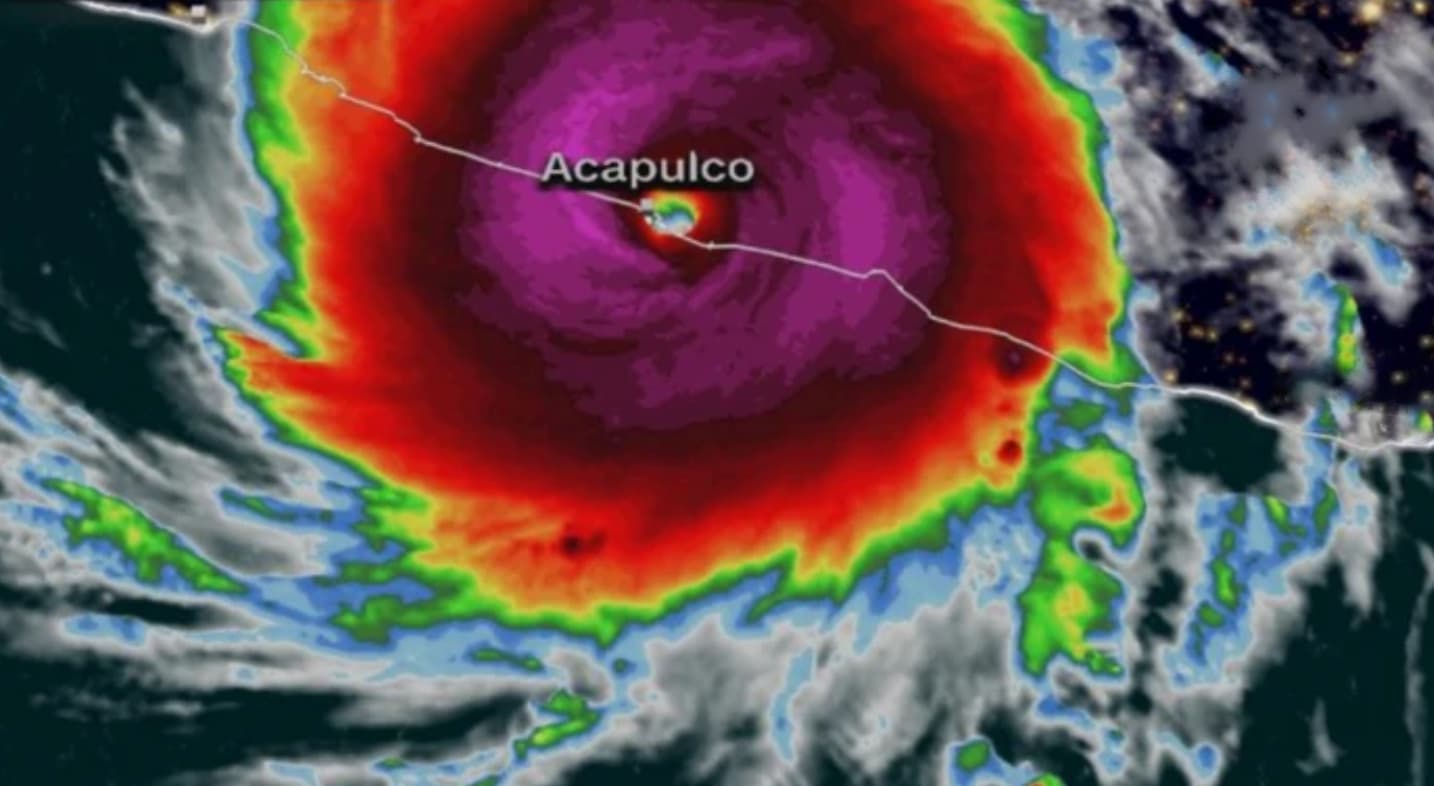

Risk analytics and modelling firm CoreLogic has estimated that the “insurable” loss from hurricane Otis’ category 5 winds onslaught in the Acapulco and surrounding region of Mexico is in the range of $10 billion to as much as $15 billion.

It’s important to note this is an estimate of the ground-up loss from hurricane Otis’s winds that could be insurable, not an actual insurance industry loss estimate for the storm.

It’s important to note this is an estimate of the ground-up loss from hurricane Otis’s winds that could be insurable, not an actual insurance industry loss estimate for the storm.

CoreLogic explained that the insurable (ground up) losses from wind damages in Mexico are between $10 and $15 billion, including damage to buildings and contents only, but not business interruptions or costs associated with additional living expenses.

This estimate is based on residential, commercial, industrial, and agricultural structures, while government property, infrastructure, crops, and livestock are not included, CoreLogic said.

The risk analytics and modelling specialist said that the financial impact to private insurance markets is likely to be lower than the total insurable modeled loss.

The company noted that coverage is most likely limited to hotels and resorts in the region, while property insurance penetration is much lower across other sectors.

Acapulco, which received the full onslaught of hurricane Otis’ winds this week, had a gross domestic product of MXN 107 billion (US $54.9 billion) in 2021.

CoreLogic noted that the majority of its modeled insurable loss estimate is derived from exposure to resorts, hotels, commercial-residential properties (i.e., condominiums), and luxury residential properties.

The damage reports being seen show significant impact to those hotels and resorts, as you can see from this post on X (formerly Twitter) from a Mexican journalist below showing damage to structures on the Diamond Zone resort strip of Acapulco:

La Zona Diamante de Acapulco, completamente devastada por el azote de Otispic.twitter.com/RUyG8k5c5X

— Joaquín López-Dóriga (@lopezdoriga) October 27, 2023

Here’s another aerial view of the damage to the high-value coastline:

NEW: Just awful! View of Acapulco from the air. Utter destruction 💔

Via: @PedroMrquez_#HurricaneOtis #HurracanOtis #Otis #Acapulco #Méxicopic.twitter.com/Dul9n7dEQS

— Volcaholic 🌋 (@volcaholic1) October 26, 2023

There is the potential for some parametric insurance contracts to be exposed and triggered, via the damage suffered by high-value resorts in the Acapulco region, as we understand some hotels there had purchased an element of coverage on a parametric trigger basis.

As we reported earlier this week, hurricane Otis is set to trigger the Mexican government’s Fonden catastrophe bond that was issued with the support of the World Bank.

Also read:

– Hurricane Otis a “monumental” weather model miss: RMS.

– High probability Mexico cat bond loss will be 50% ($62.5m) from Otis: Plenum.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.