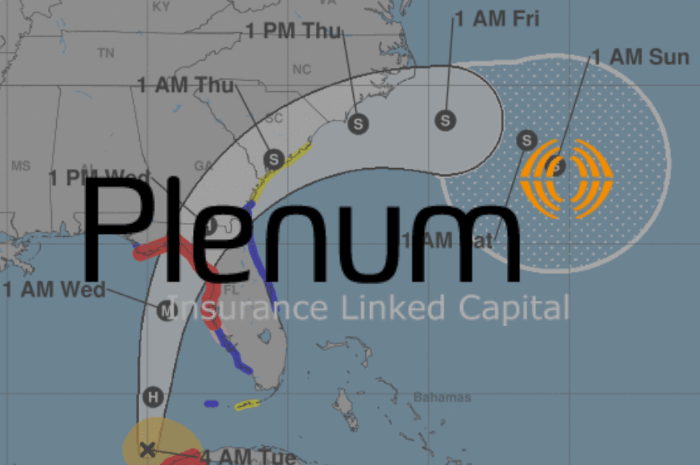

Hurricane Idalia is not expected to significantly impact catastrophe bonds, with a shift in its forecast track north and further away from Tampa having lowered the modelled expected loss outcome for the storm, according to specialist asset manager Plenum Investments.

Plenum Investments did say that expected losses look to be marginal and that as of yesterday the suggestion was for a 0.4% impact to its catastrophe bond funds, but today, as the forecast track for hurricane Idalia has moved further towards Florida’s Big Bend, the expected impact to the Plenum cat bond funds looks even lower.

Plenum Investments did say that expected losses look to be marginal and that as of yesterday the suggestion was for a 0.4% impact to its catastrophe bond funds, but today, as the forecast track for hurricane Idalia has moved further towards Florida’s Big Bend, the expected impact to the Plenum cat bond funds looks even lower.

The investment manager explained, “Florida’s Big Bend area is only lightly populated, and the track forecast momentarily places the densely populated Tampa Bay area and Tallahassee outside of the cone of uncertainty. Idalia is forecast to move over Jacksonville but will have traversed Florida and hence weakened before reaching Jacksonville.

“It is worthwhile comparing Idalia to hurricane Ian, which devastated parts of western Florida last year and caused severe price reactions of exposed cat bonds around landfall. In comparison, Idalia is a smaller, weaker storm and is likely to affect a less densely populated area of Florida.

“Initial modelling indicates that expected losses should be marginal. Based on yesterday’s forecasts that placed the track closer to Tampa, expected losses on our funds are less than 0.4%.

“As the track forecast has moved the storm now slightly further north, less interaction with densely populated areas is likely.

“We therefore anticipate only moderate market reactions for the storm and marginal if any losses to a limited number of cat bonds.”

Catastrophe bond market transactions, like contracts in reinsurance and also other insurance-linked securities (ILS), have moved up the risk tower over the last couple of years, with higher attachment points making them a little more risk remote and better protected from smaller industry losses.

Even hurricane Ian, from September 2022, with its near $50 billion industry insured losses, did not cause particularly significant cat bond actual losses, although it did drive a significant market correction immediately after its landfall of roughly 10%.

Hurricane Idalia, given the location of the Florida Gulf Coast it is heading for, is not expected to have as much of an effect on secondary market pricing of catastrophe bonds, it seems.

While the actual and realised loss potential, to cat bonds, appears relatively small, as confirmed by Plenum Investments.

Plenum does caution that aggregate catastrophe bonds do need watching.

Saying, “As usual, also smaller events may lead to a further erosion of annual aggregate structures which have been eroded from previous events. We are significantly underweight such aggregate CAT Bonds.”

Plenum also notes that there is still some uncertainty surrounding the forecasts for hurricane Idalia, adding, “There is still uncertainty in the track and intensity forecast and we will follow up with updated information if warranted.”

Also read: Idalia forecast to be “extremely dangerous major hurricane” for Florida.

Track storm or hurricane Idalia and the entire 2023 Atlantic tropical storm and hurricane season on our dedicated page and we’ll update you as new information emerges.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.