Private insurance-linked securities (ILS) funds, that invest in collateralised reinsurance and retrocession, took the biggest hits from hurricane Ida in August and as the event happened so close to the end of the month significant uncertainty remains over valuations, with further declines possible when September returns are reported.

For the month of August 2021, the average ILS fund was down -0.47% which was largely thanks to hurricane Ida, according to the Eurekahedge ILS Advisers Index.

For the month of August 2021, the average ILS fund was down -0.47% which was largely thanks to hurricane Ida, according to the Eurekahedge ILS Advisers Index.

Hurricane Ida made landfall as a major Category 4 storm on August 29th and as a result some ILS funds have been struggling with their valuations.

Greater clarity has emerged in the eventual loss quantum of this catastrophe event, but that has involved upwards movement as the expectation rose from hurricane Ida being a roughly $20-25bn industry event, to $25-30bn, to $30-35bn, or perhaps even higher, once all losses are counted and the impacts of northeastern floods factored in.

The northeastern states flooding layered on additional uncertainty, as there have been hours clause conversations to be had as well, as we understand some in the industry would prefer Ida was classified as one event for its landfall and southern state impacts and a second event for the largely flood related impacts in the northeast and Mid-Atlantic states.

All of which has complicated things considerably and as a result, while ILS Advisers and Eurekahedge are reporting the Index today, it is based on around 83% of ILS managers having reported to them, with a number of private ILS fund strategies still to report August returns.

ILS Advisers explained, “The impact on the ILS market is still uncertain. It will depend on several factors, including whether the storm will be considered as one or two separate events, how much of the loss was caused by wind and storm surge vs inland flooding (the latter being often excluded from policies), and the mix of residential vs commercial losses related to business interruption.”

Because of this, reported Index figures are likely to change as the remaining ILS fund returns are submitted.

Pure catastrophe bond funds did much better in August, despite some impacts from hurricane Ida to particular positions in the market that were exposed.

Pure cat bonds funds as a group returned 0.14% for the month of August 2021, but we should likely expects some additional attrition for September as well, as some cat bonds exposed to hurricane Ida saw steeper market-to-market declines during the month.

On the private ILS side as a group, these ILS funds declined -0.96% for August 2021. With a number still to report, there is a chance that worsens.

“Considering the complexity of Ida and its occurrence in the last days of the month, August valuations remain uncertain and may con- tinue to evolve over the next few months as effective losses materialize,” ILS Advisers also cautioned.

11 of the ILS funds included in the Eurekahedge ILS Advisers Index reported positive returns for the month of August, but 14 were negative.

The performance gap was significant for the month, ranging from the worst performing ILS fund which was down -4.3%, to the best performing ILS fund that was up +3.0 in August.

Once again, this demonstrates the range of strategies, but also possibly valuation strategies as well, as the fund up 3% is likely a private ILS fund and so would the one down -4.3% have been.

So there’s likely some more pain and adjustments to come, particularly for private ILS funds focused on collateralised reinsurance or retro, as the loss picture related to hurricane Ida becomes clearer.

Just the latest of the more challenging catastrophe losses, hurricane Ida promises to be another driver of trapped collateral for some ILS funds as we move towards the end of the year.

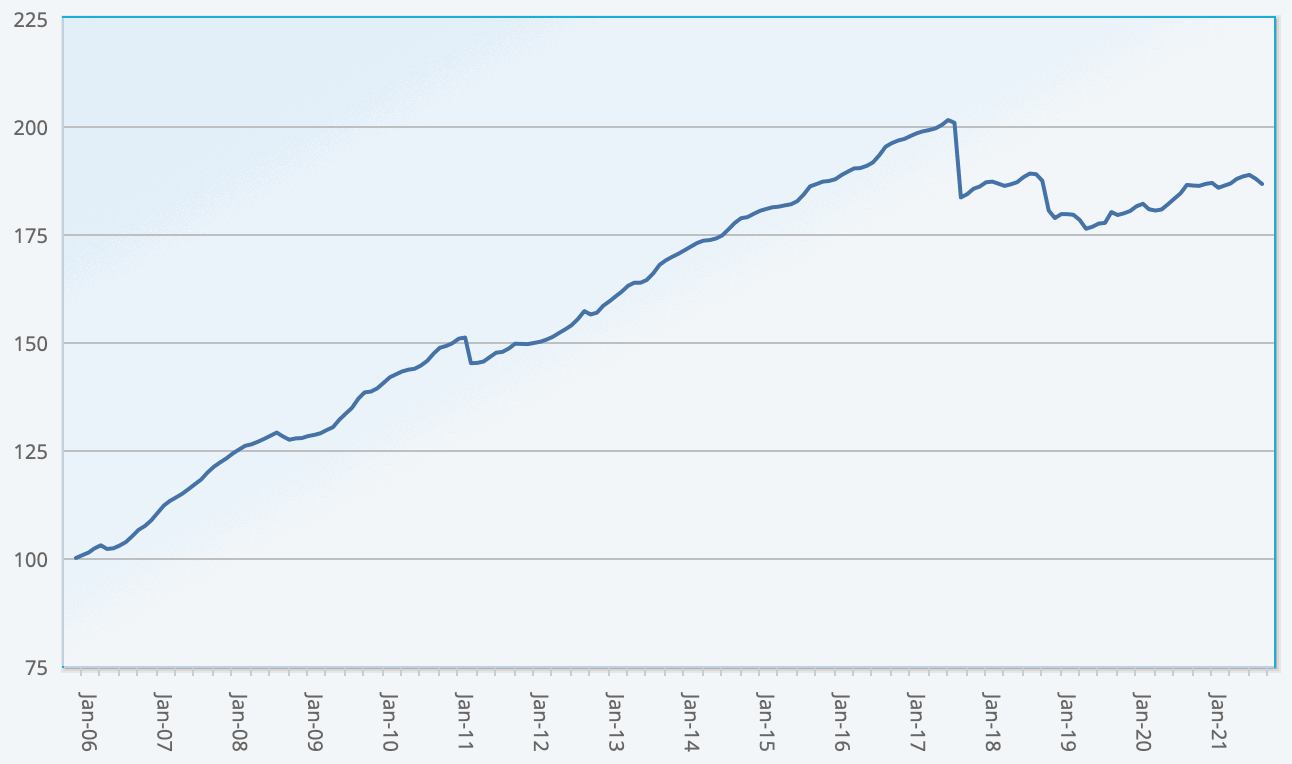

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 28 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.