Florida’s Citizens Property Insurance Corporation is targeting a $2.6 billion reinsurance and risk transfer program in advance of the 2021 hurricane season beginning and within the renewed towers could be $850 million of new catastrophe bonds.

Florida Citizens has been growing at an unsustainable rate, which its Chairman previously said makes it “the insurer of first resort,” rather than the last resort, not for profit insurer for property owners that cannot find coverage in the private market, it was always supposed to be.

Issues in the Florida property insurance market have driven this growth and the result has been policies being driven back to Citizens, increasing its need for reinsurance capacity and opening up more potential for the catastrophe bond market to support its risk transfer needs as a result.

Right now, Florida Citizens has two chunks of catastrophe bond coverage in-force, $110 million of reinsurance from the Everglades Re II Ltd. (Series 2020-2) transaction that provides some aggregate reinsurance protection for Florida Citizens personal lines account tower.

As well as the $250 million Everglades Re II Ltd. (Series 2018-1), that provides aggregate reinsurance protection to the Citizens coastal account.

But this 2018 vintage cat bond matures before the wind season, in April, which means without fresh catastrophe bond issues Florida Citizens would enter the 2021 Atlantic hurricane season with only a $110 million contribution to its reinsurance arrangements from the catastrophe bond market.

So it’s no surprise the capital markets are set to feature again.

Citizens is targeting having around $2.6 billion in reinsurance coverage in place for the 2021 hurricane season, as it looks to protect surplus while its policy count continues to grow and protect against having to leverage assessments.

Chief Financial Officer Jennifer Montero updated the Citizens board on a proposed 2021 risk transfer program yesterday, march 3rd and with her team are beginning the renewal negotiations with reinsurance providers and capital market investors.

The goal is to have a firm proposal ready for the Citizens Board to take action on in early May, well in advance of the 2021 hurricane season.

The proposal calls for risk transfer limit of up to $1.72 billion for the Coastal Account and another $926 million for the Personal Lines Account (PLA), which typically covers properties farther inland from the coastal areas.

Together, these towers should enable Citizens to weather a 1-in-100 year storm, the proposal states, with no risk of levying assessments, at the same time protecting 60% of its coastal account reserves, and 32% of PLA reserves.

Citizens policy count has continued to escalate in the last year, from 443,444 in March 2020 to 551,613 today, an increase of 26.4% and with over 3,000 new customers per week being added.

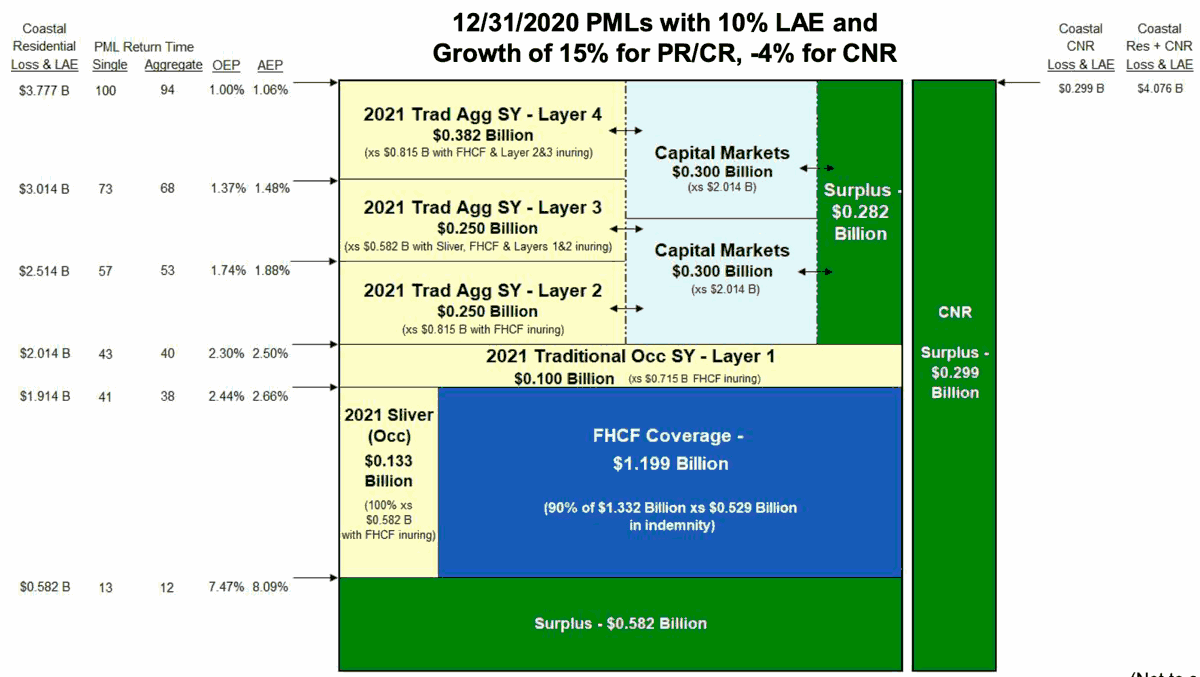

For the Coastal Account tower, two new capital markets layers are proposed to sit alongside traditional reinsurance sources.

Each of these capital market layers, which presumably would be catastrophe bonds, although they could be structured as collateralized reinsurance we suppose as well, will be $300 million in size, for combined reinsurance protection of $600 million, providing multi-year coverage on an annual aggregate basis for personal residential and commercial residential losses, attaching at $2.014 billion of losses.

The proposed Coastal Account reinsurance tower, including the proposed location of the $600 million of cat bonds, can be seen below.

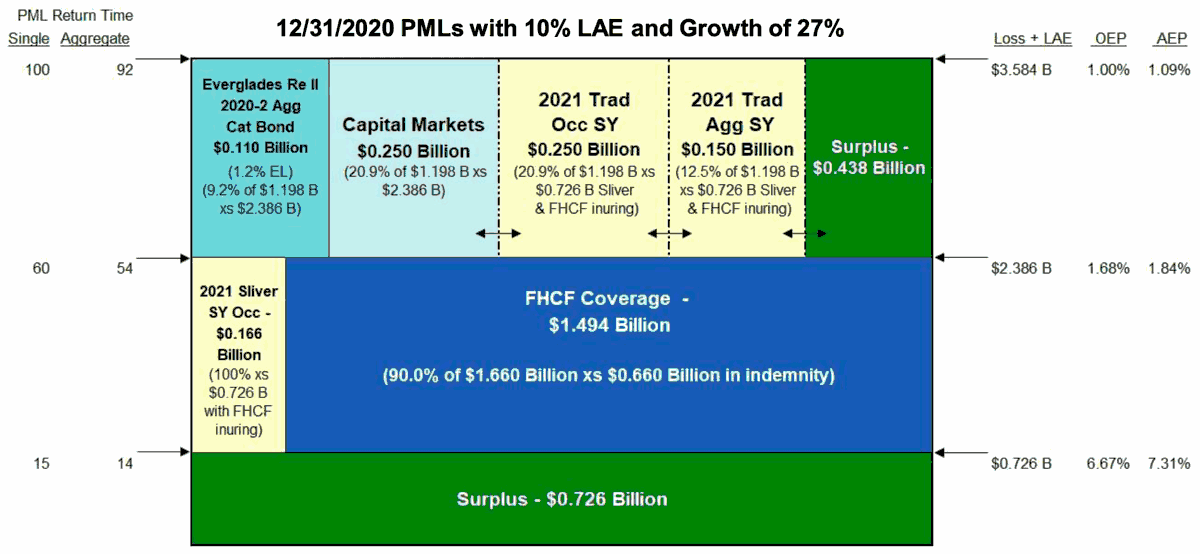

For the Citizens Personal Lines Account (PLA), the in-force $110 million 2020 Everglades Re II catastrophe bond remains, but another $250 million of capital markets backed reinsurance is also being sought for 2021.

This new capital markets reinsurance structure, so presumably a catastrophe bond as well, will provide $250 million of multi-year, annual aggregate reinsurance coverage against certain personal residential losses, attaching at $1.198 billion of losses.

The proposed Personal Lines Account reinsurance tower, including the proposed location of the $250 million of new cat bonds, can be seen below.

The Citizens team led by Montero will now work with its broker and financial advisers, while engaging with reinsurance and insurance-linked securities (ILS) markets, to try and source the optimal solution to secure these coverage towers at the best terms and pricing available.

The appetite is certainly there, in the catastrophe bond market, to support an $850 million issuance from Florida Citizens in 2021, so it seems likely the insurer can secure that target, or at least get very close to it.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.