Florida’s property insurer of last resort, Citizens Property Insurance Corporation, could increase its purchase of reinsurance and catastrophe bond backed risk transfer in 2024, with its new layer structure following the merging of its accounts suggesting as much as $5.5 billion could be purchased next year.

Notable, for 2024, is the fact that Florida Citizens will have far less in multi-year cover from its cat bonds, as it heads into its reinsurance renewals.

In fact, the majority of its catastrophe bonds are set to mature, with one to be redeemed, meaning Citizens will only have $500 million of cat bond cover still in-effect from prior years, meaning $5 billion of the total will need buying from reinsurance and capital markets in 2024. That’s more risk transfer than we’ve ever seen Citizens need to procure in a single year.

To recap, Florida Citizens secured just over $5.38 billion of reinsurance protection, from traditional and ILS markets, for 2023.

This consisted of $2.4 billion of outstanding catastrophe bonds, at the time of the renewal, and a fresh placement of $2.98 billion of traditional and collateralized reinsurance at the June 1st renewal in 2023.

Florida Citizens still has the $2.425 billion of outstanding catastrophe bonds in-force, our cat bond sponsor leaderboard shows, a significant proportion of which will mature before the 2024 Atlantic hurricane season begins.

In fact, Artemis data shows that there are $1.7 billion of scheduled catastrophe bond maturities prior to the start of the 2024 wind season.

Meanwhile Florida Citizens is also planning to redeem its Everglades Re 2022-1 cat bond early after April 30th 2024, as it will no longer fit the newly proposed single reinsurance tower structure. Board approval for this early call is being sought.

Which means $1.9 billion of the Citizens cat bond program is expected to mature before June 1st 2024.

Before its next reinsurance renewal, Citizens will merge its three so-called accounts (Coastal Account, Personal Lines Account and Commercial Lines Account) into a single Citizens Account, effectively transitioning its reinsurance structure from three towers into a single one.

With the significant catastrophe bond maturities also coming, on top of this restructure of the reinsurance tower, purchasing fresh risk transfer is going to be critical for Florida Citizens in 2024.

In fact, Citizens will only have the $500 million Lightning Re Ltd. (Series 2023-1) industry loss trigger cat bond left in-force, due to the early redemption and the maturities that were already scheduled.

So we can likely expect Florida Citizens to visit the cat bond market at least once in 2024, in order to replenish some of the cat bonds that are maturing and being redeemed.

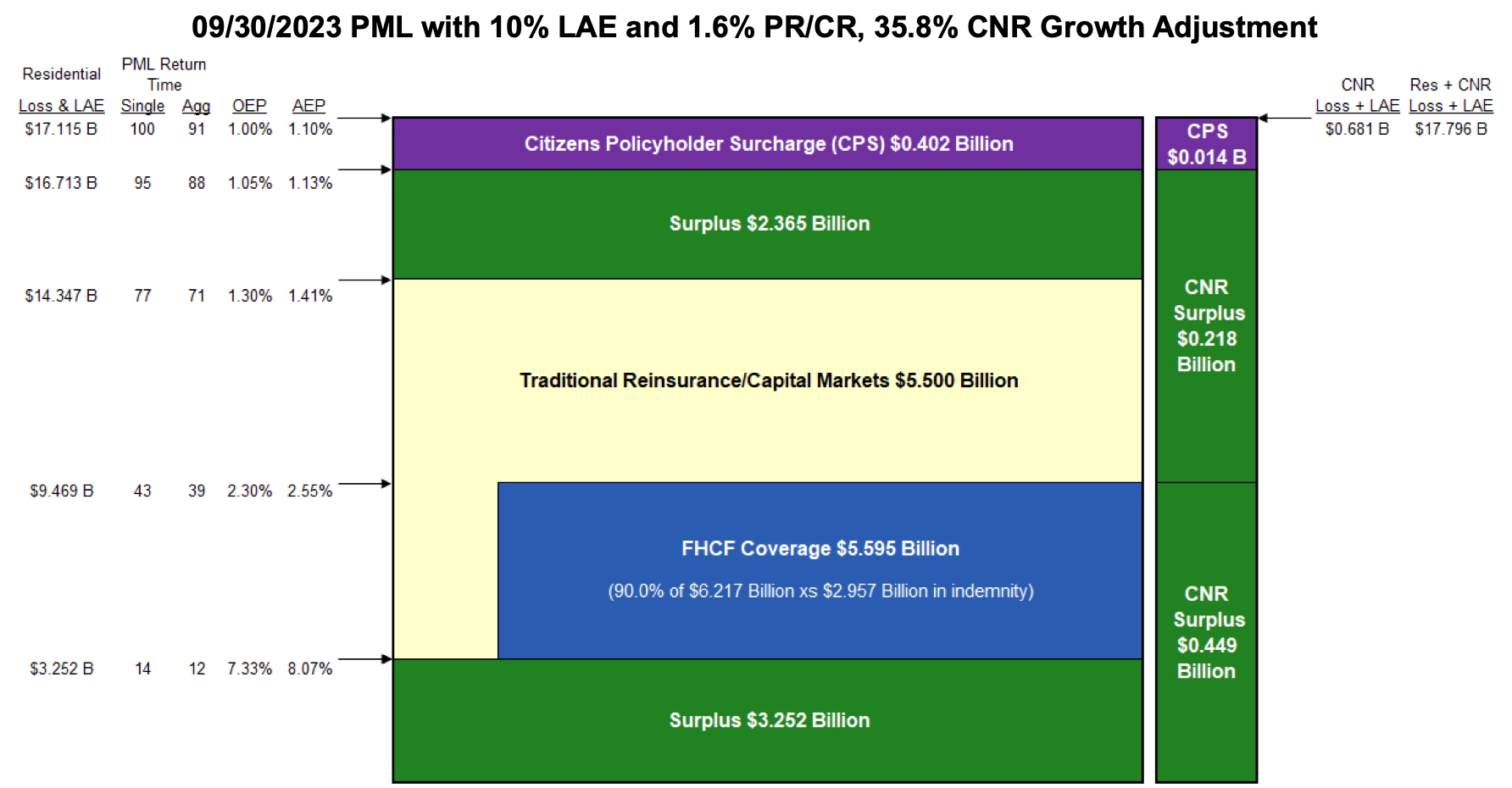

Overall, Citizens is projecting it will need approximately $5.5 billion of reinsurance and capital markets risk transfer in 2024, some of which is expected to sit in a sliver next to its FHCF coverage, the rest in a layer spanning above that. You can see a diagram of the new projected layer chart for the Citizens 2024 budgeting process below.

Moving to the new, single reinsurance tower structure is going to require significant work this year, not least because of cat bond maturities needing replenishing, but overall the way reinsurance is purchased is changing quite significantly for Citizens in 2024.

But, once the change to the new structure is completed, it should make for more straightforward renewals in future and also an easier structure to fit multi-year coverage and catastrophe bonds into.

Florida Citizens staff have acknowledged that global reinsurance markets are moving into 2024 with a positive outlook and with expectations that the market will be more orderly than in 2023.

Marginal rate increases are still seen as possible though, dependent on the cedent as well as market supply of capital.

Florida Citizens itself is anticipating rate increases of around 5%, budget documents show.

Positively for Citizens and the state of Florida, the depopulation efforts are beginning to have an effect.

As we reported recently, there is now evidence that Florida Citizens is going to start shrinking, in policy count terms and the insurer of last resort acknowledges this.

Citizens projects it will now end 2023 insuring around 1.2 million policyholders and writing more than $5.2 billion in premium volume.

However, it had previously estimated that the portfolio could contain as much as 1.7 million policies at the end of this year, so clearly depopulation and takeouts from private market insurance carriers are now having a significant effect.

The insurer of last resort explained, “Legislative reform together with corporate initiatives targeted at reducing Citizens’ overall exposure have promoted a resurgence in depopulation during the third and fourth quarters of 2023, contributing to the reduction in policyholders insured by roughly 280,000. Further, the volume of premium removed through depopulation in 2023 was initially estimated at $32 million, corresponding to a $6 billion reduction in exposure, but has since been revised to $606 million by the end of 2023, corresponding to $110 billion more exposure removed.”

That reduction in exposure is also going to make a significant difference when it comes to reinsurance buying for 2024 and the layer chart proposed above may not be the final program design, we would suspect.

However, inflation and insured values are expected to inflate premiums going-forwards anyway.

Citizens said, “While the insured policy count in 2024 is expected to stay roughly flat, an increase in the average premium per policy as well as growth in commercial risks will drive an increase in premium volume in 2024, increasing 36% to $7.1 billion.”

Finally, of note to reinsurance and cat bond backers, Citizens is forecasting that the legislative changes in Flroida will have an effect in 2024.

Explaining that, “Statutory changes impacting litigation are also expected to produce favorable results in 2024. This will contribute to the non-catastrophe loss and LAE ratio decreasing by 5 percentage points, from 43% in 2023 to 38% in 2024.”

All of which means that, in ceded premium terms, only a slight increase is expected in 2024 for the private reinsurance program, with $700 million set to be budgeted for next year, compared to a projection of over $695.2 million for the current year.

Still, the design of the reinsurance tower is being considered in such a way that a 1-in-100 year hurricane event would drive a full recovery of the entire reinsurance and cat bond program, or $5.5 billion.

It’s going to be an interesting year for Florida Citizens in 2024, with the change to a single layer chart and reinsurance tower, alongside the significant maturities in its catastrophe bond program.

All of which should present a significant opportunity for the cat bond and broader ILS market to help Florida Citizens replenish its coverage needs for 2024.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.