There is a distinction between reinsurance firms that purely rely on retrocession, often from alternative capital, to support their gross underwriting, and those that target earning fee income by managing it for third-party investors, rating agency Moody’s says.

Moody’s Investors Service warns the former to be careful against becoming overly reliant on capital markets backed sources of retrocession, in case market forces cause a squeeze, or price hikes, as has been seen since the major catastrophes of 2017 and 2018.

In its latest report on the global reinsurance sector, Moody’s warns that reliance on retrocession capital is growing but that it considers increased reliance on retrocession to sustain a normal reinsurance underwriting business to be risky and weaken the capital quality of those dependent on it for support.

Moody’s explains, “We consider retrocession to be a weaker form of capital than balance sheet equity. This is primarily because most retrocession is annually renewable, and therefore less permanent than on-balance sheet capital. Our view also reflects the increased susceptibility to dislocation in price and availability, and operating risk, that dependence on retrocession brings.”

The rating agency believes that over reliance on retrocession by some reinsurers has, “increased their exposure to supply and demand dynamics in the alternative capital market.”

With capital markets backed retrocession having been relatively cheap in recent years, some reinsurers have become particularly reliant on it for managing their gross exposures and enabling them to underwrite more gross premiums.

Some segments of the market, such as catastrophe focused Lloyd’s syndicates became so reliant on certain retro providers that they’ve struggled to replace capacity that has now left the market in 2019, we have heard.

As a result, some reinsurers could even be going relatively bare, given the evaporation of pillared retro capacity this year, something Moody’s has noted and believes some reinsurance firms need to be careful about.

It’s not just the pure retro users as well, Moody’s also says some of the reinsurers managing third-party capital are putting themselves increasingly at-risk of supply issues from the capital markets.

“A number of reinsurers have engaged proactively with alternative capital to retrocede some of their own risk and/or to offer risk transfer to clients. This has boosted their gross capacity, limited their exposure to peak risks, and generated additional fee income,” the rating agency explained.

“There is an important distinction between reinsurers that simply rely on retrocession and alternative capital to support their gross underwriting capacity, and those that earn fee income by managing significant amounts of alternative capital for third-party investors. We believe that increased reliance on retrocession weakens capital quality of those reinsurers overly dependent on it to support capacity. It also poses a potential threat to their franchise and market position, particularly in the event of (i) capacity constraints in the retrocession/ reinsurance markets, and (ii) faster increases in retrocession prices than in reinsurance prices,” Moody’s continued.

Those too reliant on retro risk price and availability dislocation, as well as operating risks, given it is less permanent than on-balance sheet arrangements, the rating agency believes.

Full-collateralisation of retro does offset some of the risks somewhat, given it limits counter-party credit exposures. However, that’s still no guarantee of its availability.

Moody’s also notes that sidecar vehicles can have greater permanence as well, given it is generally longer duration as reinsurers have more control.

Hence while the retro dependent model can boost capacity, provide flexibility and access to efficient capital, it also puts reinsurers at risk of market forces.

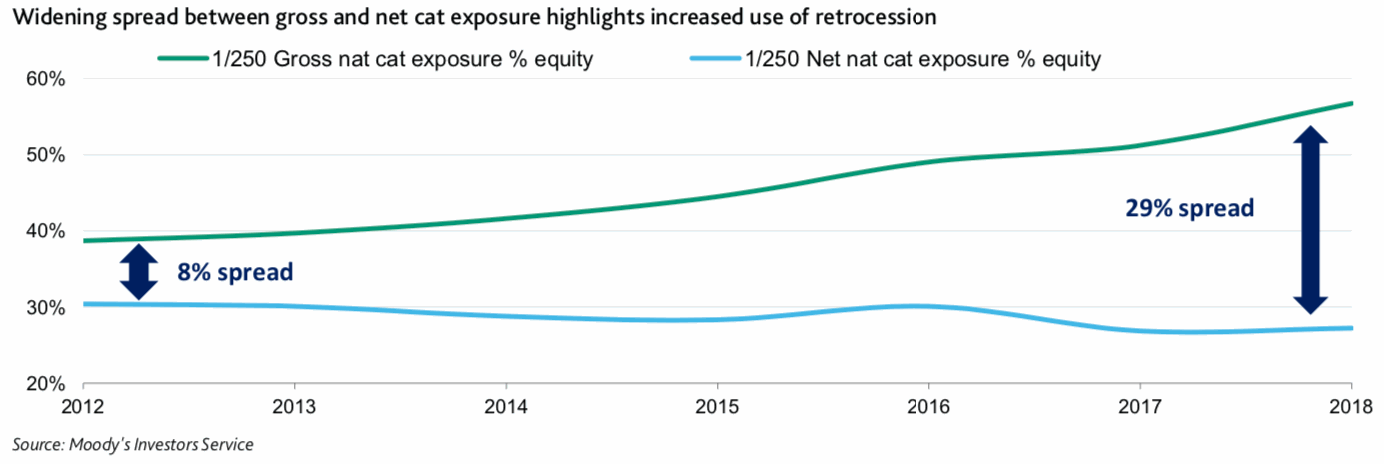

Moody’s notes the widening spread between gross and net catastrophe exposures of reinsurers, which it says also highlights the increasing reliance on alternative capital retro to reduce net exposure, while maintaining gross underwriting volumes.

But for stronger reinsurers, using alternative capital as retrocession, or managing it for fee income to allow for expansion, carefully alongside their own core capital can be beneficial.

“Ultimately, we believe reinsurers with strong underwriting track-records, that can offer risk transfer solutions to clients across their own balance sheets and more flexible alternative capital platforms will have a competitive advantage in the years ahead,” Moody’s states.

Adding that the flexibility it offers to careful users means it can, “Enhance their market presence to access the most attractive reinsurance contracts, reduce earnings and balance sheet volatility and earn relatively stable fee income”

This was evidenced at the beginning of 2019, when retro capacity crunched and prices rose.

At the January 2019 renewals Moody’s notes, “While the stronger reinsurers were able to secure sufficient capacity to meet their requirements, others had to reduce gross capacity going into 2019.”

The price corrections in retrocession meant that the gap between reinsurance and retro pricing narrowed, which squeezed retro dependent reinsurer margins.

It’s made for a divergence in retro strategy beginning to become evident, although others are ploughing ahead with managing more third-party capital alongside their own balance-sheets instead.

In addition to the warnings from Moody’s it’s important to remember that, over the longer-term the model of reinsurers managing increasing amounts of third-party capital to grow into catastrophe risk zones where their own balance-sheet may not support it is still being proven out.

While some seem to have nailed the fine balance, between own capital and others, still more are attempting to emulate the success of companies such as RenaissanceRe here (who’ve been managing third-party capital for more than a decade), but as yet without the proof that margins earned from underwriting risk on investors capital can sustain them in the same way as putting risk on their own balance-sheet.

This strategy will play out over time and it really is a balancing act to get it right. Not to mention the importance of demonstrating true alignment with investors, who will not tolerate being used simply as retro when they were originally told they were going to be “managed” capital.

For those who fail to get this balance right, or become overly exposed to market forces of supply-and-demand through their reliance on capital markets backed retro, there could be nasty surprises to come further down the line.

Of course, the real story here should perhaps be that relying too much on retro of any kind, not just from the capital markets, may be less than desirable in the eyes of a rating agency.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.