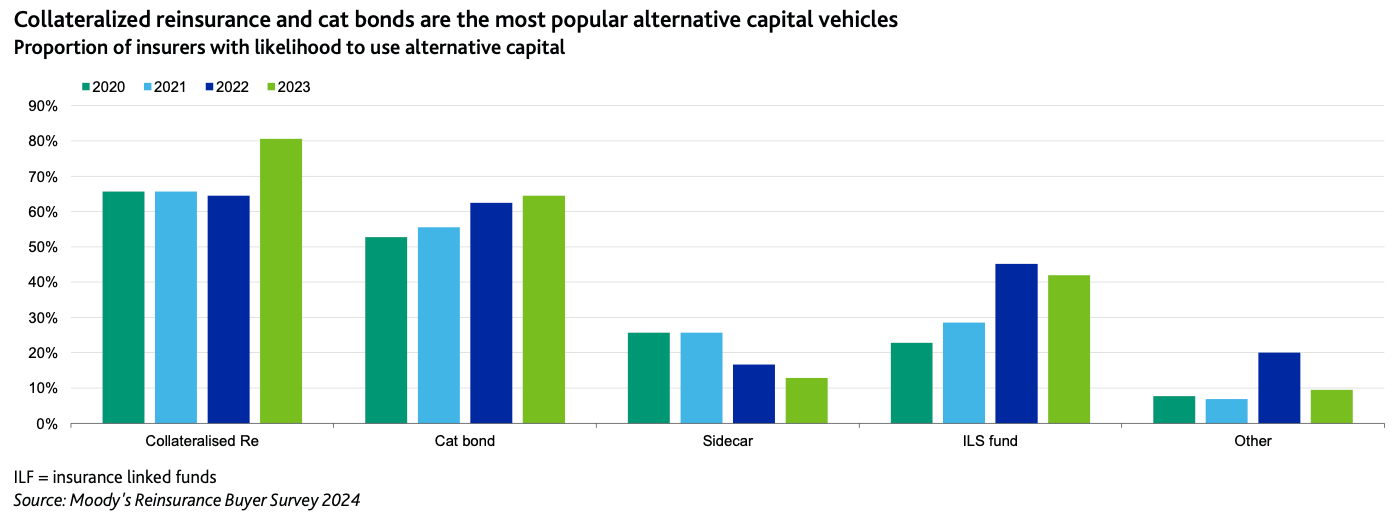

As a form of protection, collateralized reinsurance looks like it could be set for a return to favour, as more primary carrier reinsurance buyers cited it as a preferred alternative capital structure, data from a survey by Moody’s Investors Service suggests.

Collateralized reinsurance had been seen to fall somewhat out of favour in recent years, with lower available capacity in the market segment due to trapped collateral and previous catastrophe losses.

That dented investor appetite for some collateralized reinsurance funds and especially retrocession strategies, which had the effect of reducing availability as well.

But, it looks like with investor sentiment gradually returning to be more favourable, while reinsurance pricing and therefore returns are now much higher, the cedent or reinsurance buy-side are also looking more favourably on collateralized reinsurance as well.

Moody’s noted in its recent reinsurance buyers survey report, that growth in alternative reinsurance capacity has been limited in recent years.

The rating agency said that, “While the catastrophe bond market is expected to achieve record growth in 2023, the broader alternative capital market is not anticipated to expand meaningfully until investors have observed sustained improvements in performance.”

Adding that, for alternative capital as a whole, “We do not foresee a rebound in 2024.”

At the same time, some 78% of surveyed primary insurance groups “do not anticipate increasing their use of alternative capital protection over the coming 12-18 months,” Moody’s said.

But, while the cat bond market is flying and overall growth of the alternative capital segment may not be significant, it does appear interest in using collateralized reinsurance is set for a resurgence, which is positive for growth further down the line.

Moody’s explained, “There has been an increase in the number of primary groups interested in using collateralized reinsurance.”

Going on to say that, “We believe this trend has emerged as traditional reinsurers prices have increased meaningfully.”

Also helping to lift the profile of collateralized reinsurance and bring it back into favour, has been the gradual unlocking of trapped collateral, the realisation and settling of prior year losses, and the fact that, because of this, many vehicles and ILS funds actually have more deployable capital now than they have for the last couple of years.

It’s interesting that Moody’s separates out ILS funds from collateralized reinsurance and catastrophe bonds, when ILS funds are the main capital providers to support both of those instruments.

Taking that into consideration, it seems there could be a strong shift in demand towards ILS funds in 2024, as cedants look more favourably on collateralized reinsurance and catastrophe bonds as reinsurance structures for the sourcing of protection.

It looks particularly positive for collateralized reinsurance, as we also expect to see rising investor interest for this segment as well, given the new and higher levels of return available and the fact that ILS funds are now demonstrating the benefits of sitting higher in the reinsurance tower, as we’ve seen with a number of recent catastrophe events.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.