Having analysed data from the secondary market for insurance-linked securities (ILS), consultancy Lane Financial LLC concludes that the market for catastrophe bonds and ILS will remain in “hard market” territory in 2024, but perhaps only “half as hard” as might have been forecast at the start of this year.

The latest analysis by Lane Financial’s President Morton Lane and Vice President Roger Beckwith, compares the forward-looking forecast derived from the pricing in the secondary market from earlier in 2023 to a more recent view, finding that the view has softened over that period.

Back in January 2023, the catastrophe bond and ILS market was implying a significant hard market, as we saw through the first-half, albeit perhaps not the hardest ever seen (but very close to).

However, by September the forward-looking view had softened considerably and Lane Financial’s analysis finds it softened some more by October 2023, albeit remaining firmly within “hard market” territory.

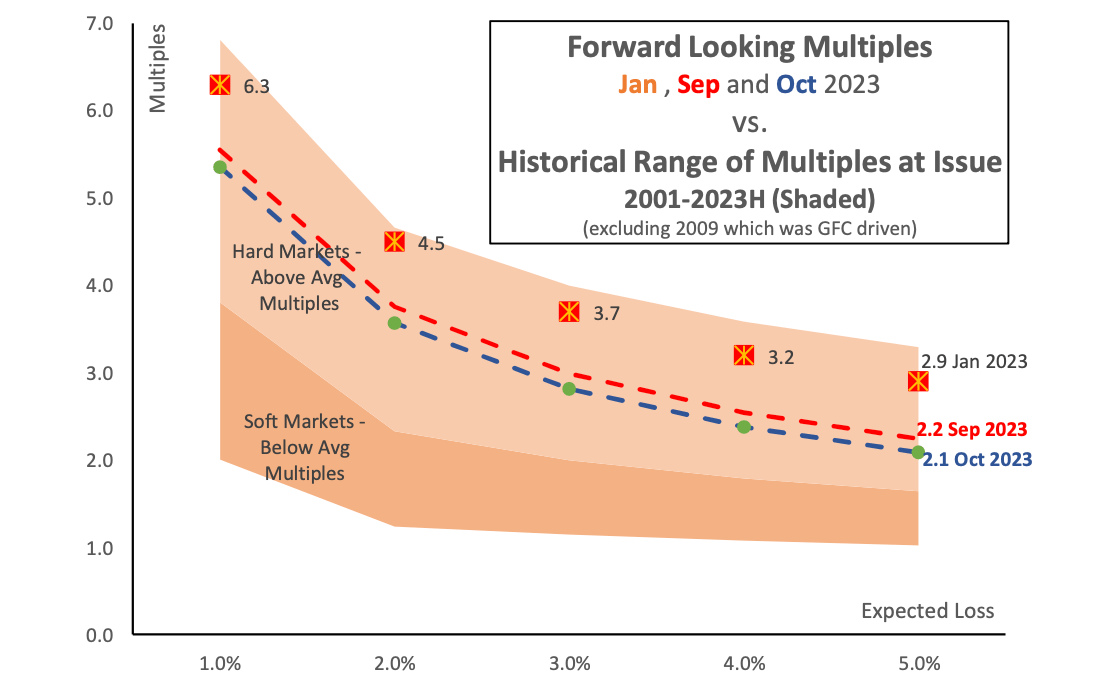

The chart above, taken from the latest Lane Financial paper which you’ll be able to access via its website later today, shows the forward looking multiples for January, September and October 2023, showing how the market implied status has softened throughout this year.

But, encouragingly, the analysis also plots the range of hard and soft markets in catastrophe bonds and ILS, as the shaded areas, clearly showing that as of October 2023 the forward-looking multiple of issuance is expected to remain firmly in hard market territory.

As of the September 2023 line on the chart, Lane Financial states, “Next year’s market is still “hard” but only half as hard as the early January forecast.”

It softens further with the October 2023 view and with issuance continuing apace in November it will be interesting to see whether that view softens any further, or the market holds its line.

Building to a conclusion, Lane Financial states, “Should you invest in next year’s ILS market? – yes. Will you get the same returns as this year? – probably not.”

Adding, “In 2023 the rewards for taking cat risk were better than 20 out of 22 years. The rewards for 2024 are likely better than 15 of 22 years.

“Including the 5% floating rate, 2024 returns will likely be double digit to the low teens compared to the mid or high teens of 2023.”

On a constant expected loss basis, as of the October 2023 view, Lane Financial’s analysis found that catastrophe bond and ILS market multiples remain at their historical highest for the higher EL’s, but for lower-EL (1%) cat bonds have slipped back somewhat, but still multiples sit at around their highest since about 2013.

Of course, a lot could change over the next few months as the insurance-linked securities (ILS) market moves into 2024, from capital entry and inflows, to catastrophe losses, as well as broader capital market or even geopolitical volatility, that could affect the investor view of cost-of-capital and demand for returns.

Lane Financial’s analysis should provide some confidence to investors that are wondering whether the cat bond and ILS market will return to a soft market state.

At the moment, the market data implies it remaining firmly within the historical hard market range, which should prove encouraging.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.