Despite an overall slower level of issuance of non-life catastrophe bonds in the first-quarter of this year, broker Willis Re notes that yields are on the rise as investors and ILS funds demand higher returns after recent losses.

There was only just slightly over $1.1 billion of 144a non-life catastrophe bond issues during the quarter, a lot slower than the average of $1.8 billion over the most recent six first quarters, the reinsurance broker notes.

However, Willis Re’s ILS market report only really looks at these 144a cat bond deals, which are the most broadly syndicated and invested in, so does not count the significant activity in private cat bonds, less broadly syndicated deals, specialty lines and other types of reinsurance linked securitization.

Commenting on the level of market activity seen, William Dubinsky, Managing Director & Head of ILS at Willis Towers Watson Securities, said, “We don’t believe the slowdown in issues we saw in the final quarter of 2018 and again in Q1 reflects any long term change in appetite for ILS risk from the capital markets, but understandably some investors are looking harder at the mechanics.”

While catastrophe bond market activity slowed for the second consecutive quarter in Q1 2019, there were positive signs for investors in reinsurance linked assets as yields jumped higher and signalled better returns for ILS fund investors going forwards.

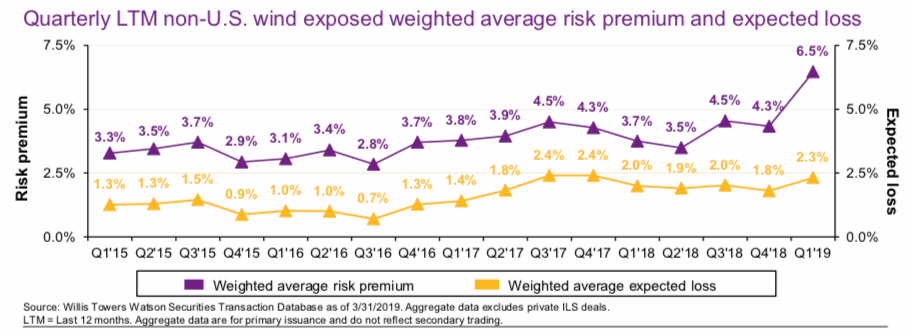

According to Willis Re, the transaction data from primary 144a catastrophe bond issuance shows that the weighted average last-12-month risk premium for non-US wind-exposed bonds jumped by a significant 2.2 points to 6.5% in Q1 2019 (see below).

Interestingly, for US wind-exposed catastrophe bonds yields were only recorded as rising by 0.3 points to 6.1%, Willis Re explained.

We suspect this is a function of the time of year and mix of cat bond issuance in Q1, rather than anything else and it may be more telling to look at this second chart from the reinsurance broker at the end of the second-quarter.

Willis Re also noted that seasonality has contributed to secondary market heaviness during the quarter, whilst loss-affected bonds continued to be marked lower as expected impacts increased for those still threatened by hurricane Irma, typhoon Jebi and the California wildfires, in particular.

These higher primary issuance yields bode well for catastrophe bond funds and their investors over the coming years, as those investors with access to new issuance have clearly benefitted from higher premiums on offer across reinsurance that have flowed through to securitised issuance as well.

It’s going to be interesting to see how recent cat bonds and any more than come to market in the coming weeks price.

View details on every catastrophe bond and many other related ILS transactions in the Artemis Deal Directory.

———–

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

Register today to attend our next ILS conference in Singapore, ILS Asia 2019.

We’re returning to Singapore for our fourth annual ILS market conference for the Asia region. Please register today to secure the best prices. Early bird tickets are still on sale.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.