In Q4 2023, the catastrophe bond investor base pushed for higher risk-adjusted returns amid favourable market conditions, with the average price change of spreads over the issuance process swinging to positive for the first time in the year. However, looking at Q1 2024 data so far, a very different picture is emerging.

The Artemis Q4 and full-year 2023 catastrophe bond and related insurance-linked securities (ILS) report, available to download for free, examines the spread of the tranches of notes issued.

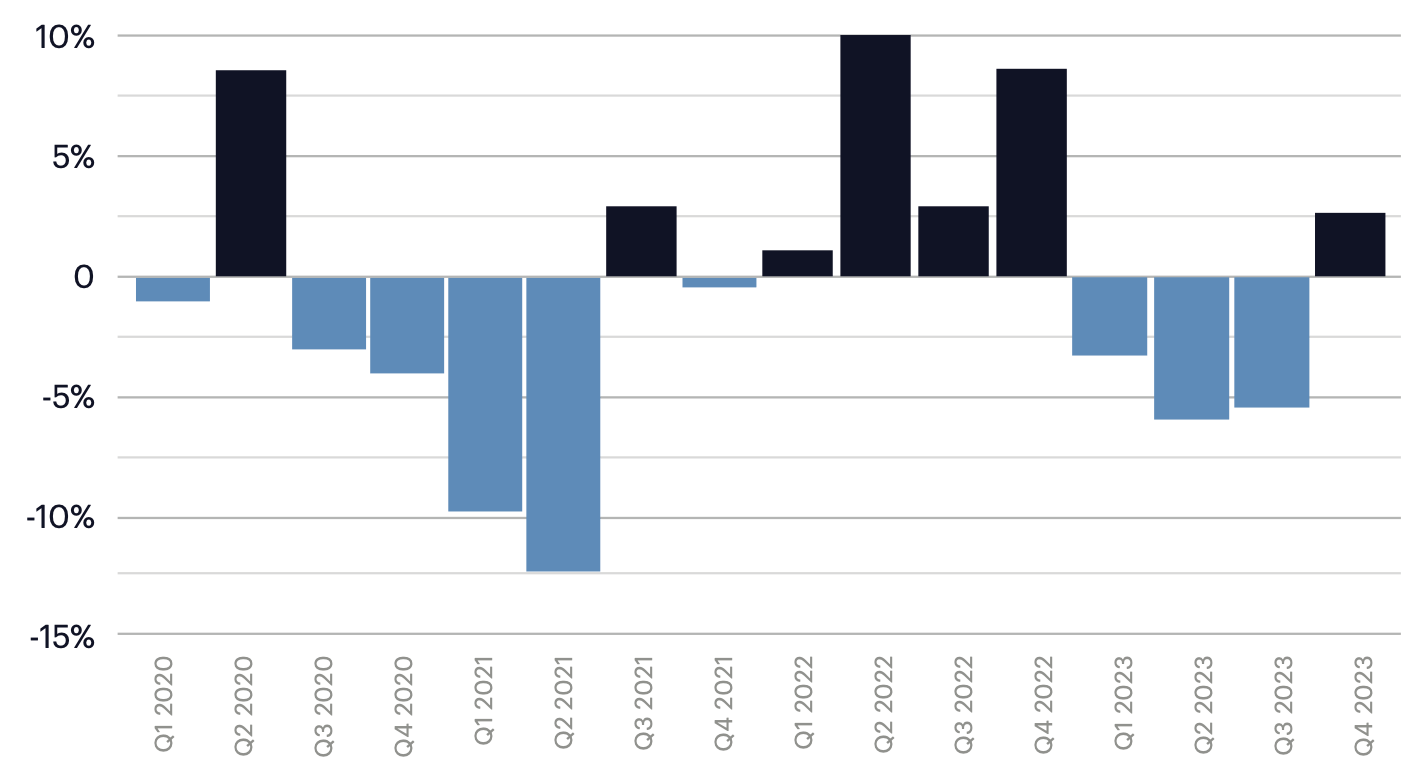

We also record how spread pricing evolves through the issuance process, so whether prices rose above the initial mid-points of spread guidance, or fell.

For the 32 tranches of notes issued in the fourth quarter that we have full pricing data for, the average spread change was positive 2.7%.

It’s the first time a positive average occurred sine Q4 2022, with a -3.2% change seen in Q1 2023, -6.3% in Q2 2023, and -5.8% in Q3 2023.

Artemis’ data shows that of the 32 tranches of notes issued in Q4, 22 priced above the mid-point of initial guidance, nine priced below, and just one deal priced at the mid-point.

As the chart below shows, since the start of 2020, the quarter with the highest average spread change was Q2 2022 at 10.6%, with 2022 being the only year to witness a positive average change in each quarter of the year. In contrast, a negative average spread change of 12.5% in Q2 2021 is the steepest decline, and was actually the fourth consecutive quarter to witness a negative average change across tranches of notes issued.

An overall positive shift in spreads for the majority of notes while marketing suggests that investors pushed for higher returns in the hard market environment, and for the most part achieved this.

As highlighted by Artemis in recent weeks, catastrophe bond yields and subsequently returns have narrowed since the highs of early 2023, but do remain historically attractive.

However, with many of the recent 2024 catastrophe bonds pricing well-below their initial spread guidance mid-points, we suspected this chart once extended out to incorporate Q1 2024 in our next report (due at the start of April) will likely show a relatively significant negative change for the period.

In fact, based on the catastrophe bonds that have settled so far in the first-quarter of 2024 that are listed in our Deal Directory, the average price change from the guidance mid-point is already -9.9% for the quarter.

That’s based solely on the cat bond deals that are settled now, not those waiting to settle or still in the market, so the price change figure has the potential to dip further into negative territory.

It’s a function of supply and demand, as ever, with excess cash and capital, as well as burgeoning investor interest, helping cat bond sponsors secure very strong execution so far this year.

We will keep you updated on all catastrophe bond and related ILS transaction issuance as 2024 progresses, and we’ll report on the evolving trends in the cat bond, insurance-linked securities (ILS) and collateralised reinsurance market.

Our end of first-quarter 2024 report will be published at the start of April and looks set to detail record activity levels in the cat bond market, again.

For full details of fourth-quarter 2023 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of fourth-quarter 2023 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q4 2023 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.