Having peaked with a market yield of around 16% back in January 2023, the catastrophe bond market has moderated, but remains very attractive, with the cat bond market yield now stabilising at around the 12% level (in USD), Plenum Investments believes.

The catastrophe bond fund manager notes that, “The total yield in the CAT bond market is still very attractive and varies between 12% and 8.5% depending on the currency.”

Hedging costs remain a factor for some investors depending on their location.

Such as those investing in Swiss Francs, where the cost of currency hedging against the typically USD denominated catastrophe bonds remains a consideration.

Plenum Investments noted that, “On a CHF basis, the insurance risk compensation is 4.2 times higher than the collateral yield minus hedging costs, in EUR 1.8 times and in USD 1.3 times.”

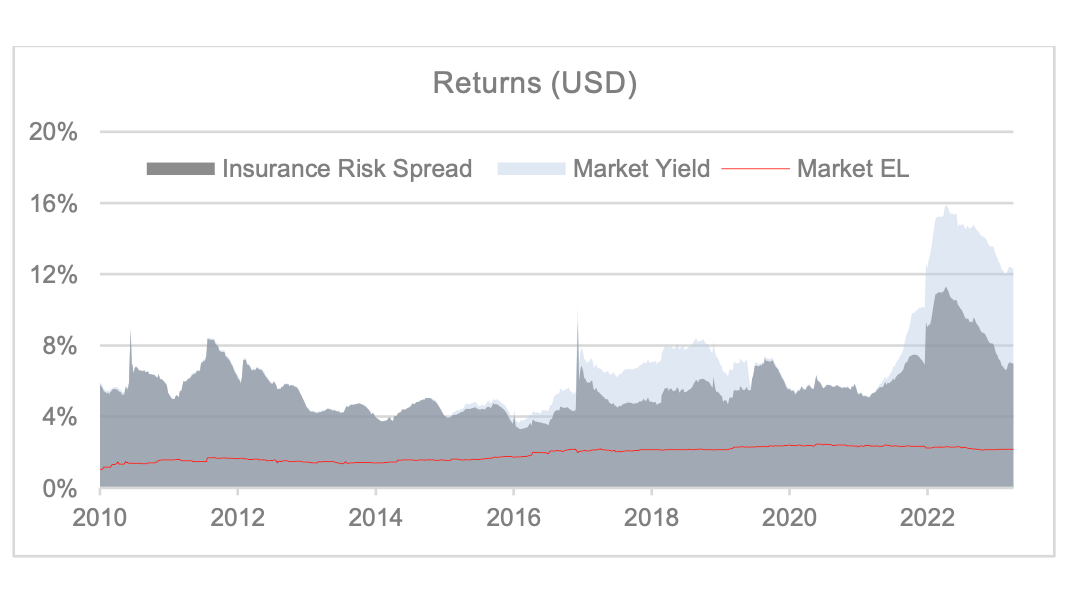

While yields and therefore returns may have slipped down since the market high at the beginning of last year, the current catastrophe bond market yield at around 12% in USD remains historically attractive, as you can see in the chart below.

In fact, the chart above also shows that the insurance risk spread remains historically attractive and higher than almost all of the last decade.

Plenum Investments said, “Even though the USD-yield in the CAT Bond market has decreased somewhat since its January 2023 all time high of 16%, it now appears to be stabilizing at around 12%.

“We do not see any further decline in the short term due to the balanced supply/demand ratio.”

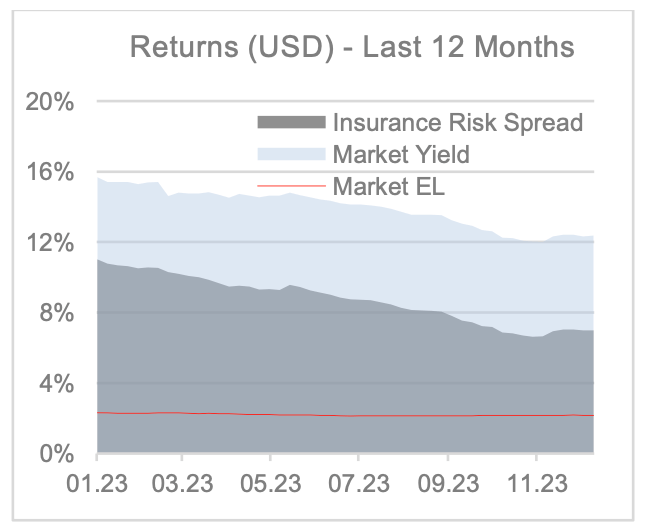

The stabilisation of catastrophe bond market yields can be better visualised in this chart, to the right, that shows how risk spreads, market yield and expected losses have developed over a shorter period of time.

The stabilisation of catastrophe bond market yields can be better visualised in this chart, to the right, that shows how risk spreads, market yield and expected losses have developed over a shorter period of time.

You can see that there does appear to be a stabilisation in recent months, which has been evidenced in the latest quarter of catastrophe bond issuance, where the average change in spread guidance for newly issued cat bonds, from marketing to issuance, was positive in Q4, the first quarter of the year where that occurred.

How primary cat bond issue price changes (while marketing) evolved over 2023 mirrors the market yield chart, having slid through the first three-quarters of the year, but then stabilised and ticked up at the end of last year, as investors demanded their minimum return requirements.

It remains to be seen whether this stabilisation at around the 12% mark will be a lasting feature of the market, or whether yields may slide further once issuance picks back up as the year progresses, and naturally more capital flows in to the catastrophe bond market.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.